[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  DeFi Mago [@defi_mago](/creator/twitter/defi_mago) on x 43.7K followers Created: 2025-07-16 00:22:33 UTC Farming USDC in a short period on @useteller is currently giving me the best experiences and yield! I'm getting XXXXX% APY just for supplying USDC, no leverage. → The best part is its time-based loans, just X month, and my earnings are locked in right when the loan gets taken. → No APY change halfway through. →UI even shows me the numbers super clearly. ─────── For example: If you drop 1000 USDC into the USDC-MASA pool, you’re getting: → XXXXX% Base APY → XXXX% Reward APY = XXXXX% total, fixed So over a 1-month term, that’s $XXXXX in yield. Easy math. ─────── And if you wanna borrow? It works the same way. Say you borrow $1K worth of MASA, it straight up tells you you'll pay: → $XXXXX interest → $XXXXX in fees No surprise APR changes. ─────── Why this setup is so nice: 👉 I don’t have to touch anything. After X month, it auto-settles. No need to time exits or micro-manage positions. When to use this strat: > Got some spare stables and want to park them short-term (<1 month) with solid, fixed yield > Wanna borrow ETH/BTC to farm points or airdrops short-term and know exactly your cost upfront > Or even short tokens that are borrowable on Teller ─────── Bonus alpha: Teller raised like $8M from legit funds. They’ve got a points system + rankings, so there’s a chance you get extra rewards down the line, not just only APY.  XXXXXX engagements  **Related Topics** [ui](/topic/ui) [usdc](/topic/usdc) [coins made in usa](/topic/coins-made-in-usa) [coins bsc](/topic/coins-bsc) [coins stablecoin](/topic/coins-stablecoin) [coins solana ecosystem](/topic/coins-solana-ecosystem) [coins inj](/topic/coins-inj) [coins base ecosystem](/topic/coins-base-ecosystem) [Post Link](https://x.com/defi_mago/status/1945277840116867435)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

DeFi Mago @defi_mago on x 43.7K followers

Created: 2025-07-16 00:22:33 UTC

DeFi Mago @defi_mago on x 43.7K followers

Created: 2025-07-16 00:22:33 UTC

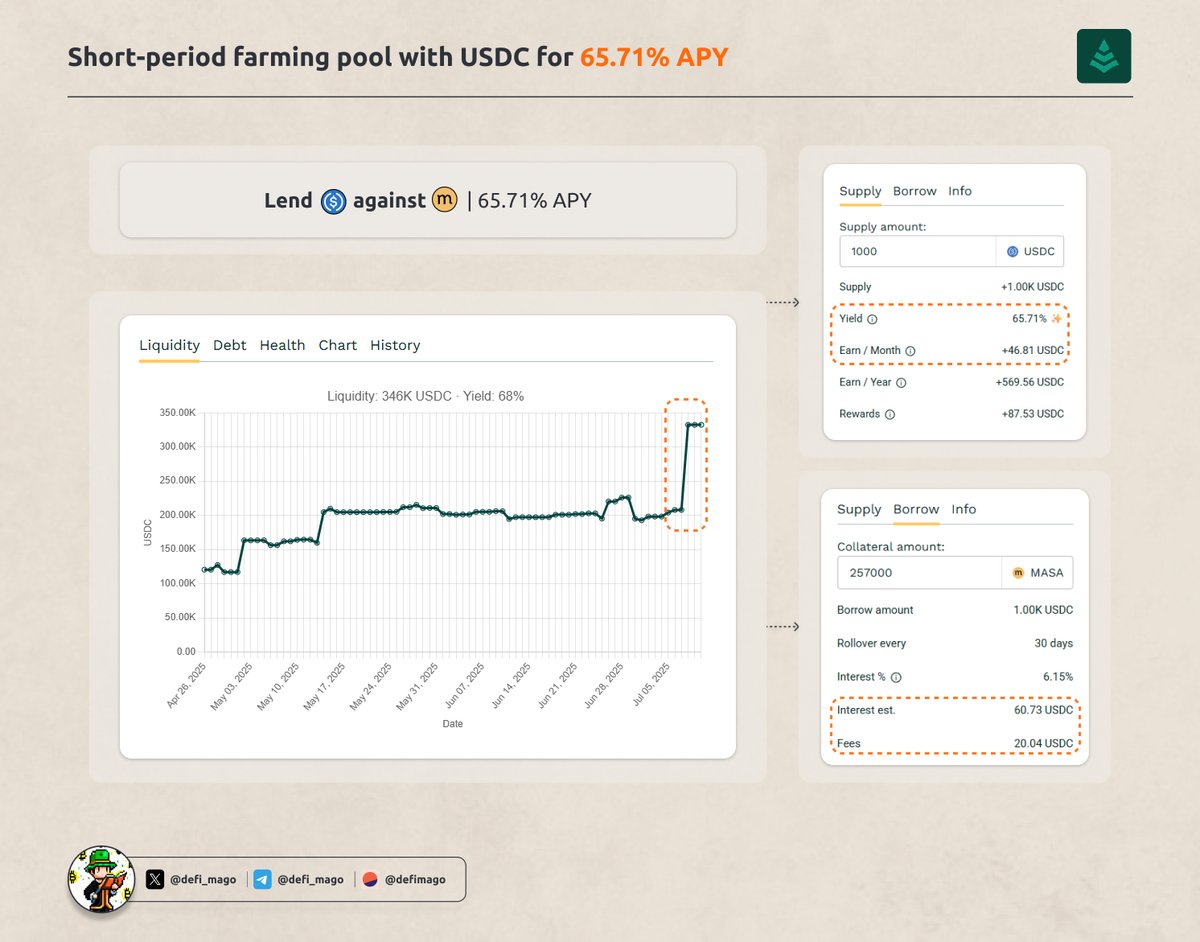

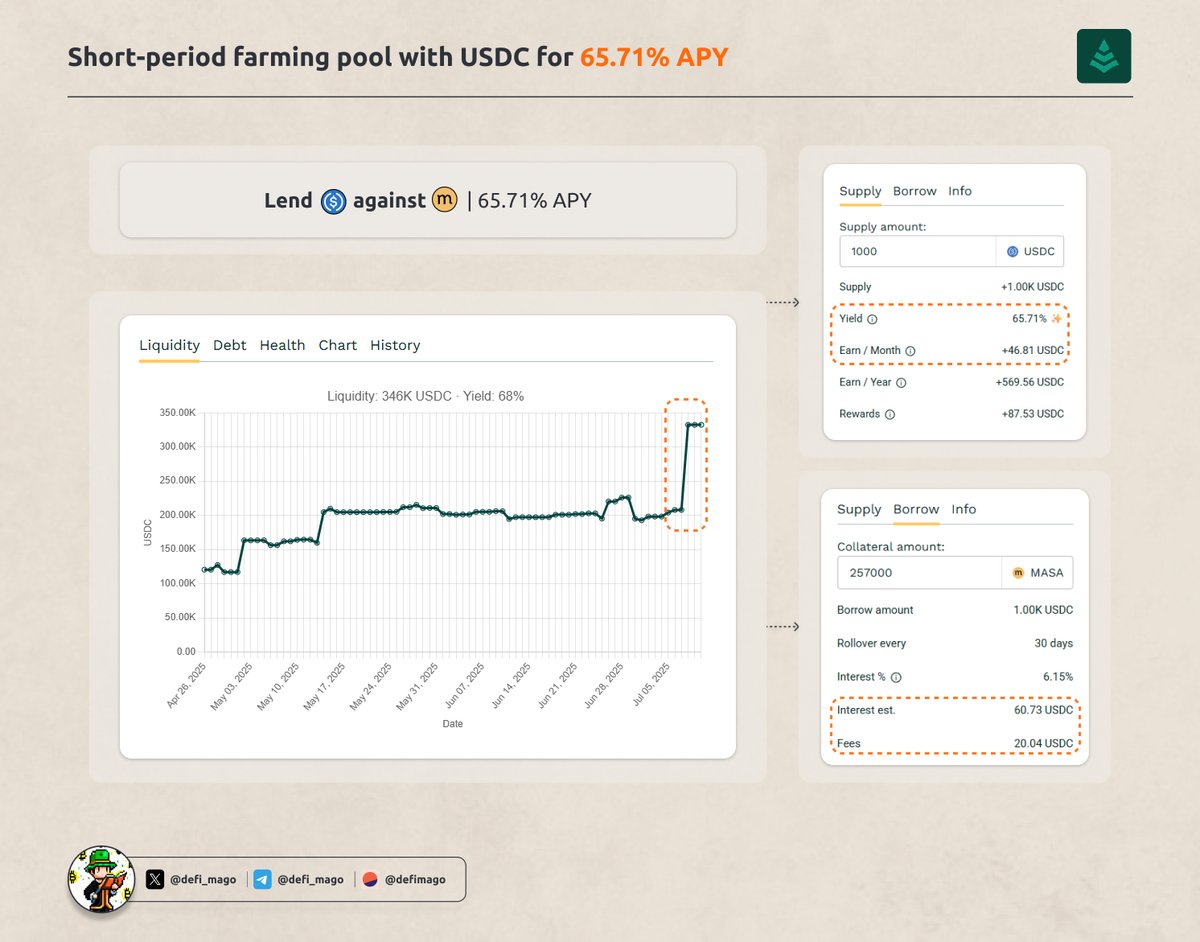

Farming USDC in a short period on @useteller is currently giving me the best experiences and yield!

I'm getting XXXXX% APY just for supplying USDC, no leverage.

→ The best part is its time-based loans, just X month, and my earnings are locked in right when the loan gets taken.

→ No APY change halfway through.

→UI even shows me the numbers super clearly.

───────

For example:

If you drop 1000 USDC into the USDC-MASA pool, you’re getting:

→ XXXXX% Base APY → XXXX% Reward APY = XXXXX% total, fixed

So over a 1-month term, that’s $XXXXX in yield. Easy math.

───────

And if you wanna borrow? It works the same way. Say you borrow $1K worth of MASA, it straight up tells you you'll pay:

→ $XXXXX interest → $XXXXX in fees

No surprise APR changes.

───────

Why this setup is so nice:

👉 I don’t have to touch anything. After X month, it auto-settles. No need to time exits or micro-manage positions.

When to use this strat:

Got some spare stables and want to park them short-term (<1 month) with solid, fixed yield

Wanna borrow ETH/BTC to farm points or airdrops short-term and know exactly your cost upfront

Or even short tokens that are borrowable on Teller

───────

Bonus alpha: Teller raised like $8M from legit funds. They’ve got a points system + rankings, so there’s a chance you get extra rewards down the line, not just only APY.

XXXXXX engagements

Related Topics ui usdc coins made in usa coins bsc coins stablecoin coins solana ecosystem coins inj coins base ecosystem