[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Gami 🌐 IMF [@gamiwtf](/creator/twitter/gamiwtf) on x 15.2K followers Created: 2025-07-15 23:59:27 UTC thanks for sharing cousin, will address your points one by one :-) 2/X: Our team doesn't provide the USDS liquidity, instead we manage a vault that lenders lend to, and adaptive curve interest rate model from Morpho reacts to supply/demand dynamics. 3/X: Borrow rate at target for Mog is currently XX% which on $15.28M of outstanding loans, would be about $19k/day. the liquidity doesn't get taken by other markets, as they're isolated and allocated to individually by the vault. 4/X: What you're not taking into consideration is supply caps, which are set based on onchain sell-side liquidity, for safety in the event of mass liquidations. Pepe has a much larger supply cap which hasn't been met as demand is not as high yet. Mog and Joe have hit their supply caps, and raising them would introduce unnecessary risk. Morpho's dynamic interest rate model spikes up when utilisation is over XX% and falls sharply when under XX% to compel repayments. Mog and Joe repayments are highly advised atm due to many borrowers being in profit etc. These high spikes are temporary and Morpho's IR model is designed to adapt to supply and demand dynamics. I've linked to relevant part of their docs below.[1] 5/X: New liquidity isn't the issue. We have more than we can allocate right now, and since supply caps are our primary constraint, we need to list more assets in order to have safe allocations we can make. As per screenshot, you can see that our "idle" market has $28.96M and there's another $22M is not yet borrowed across active markets. 6/6: These thoughts are much appreciated and will be put to good use as with all feedback. You're no more a retard than I and your thread is much appreciated cousin. 1:  XXXXX engagements  **Related Topics** [$19kday](/topic/$19kday) [$1528m](/topic/$1528m) [fed rate](/topic/fed-rate) [Post Link](https://x.com/gamiwtf/status/1945272026324984211)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Gami 🌐 IMF @gamiwtf on x 15.2K followers

Created: 2025-07-15 23:59:27 UTC

Gami 🌐 IMF @gamiwtf on x 15.2K followers

Created: 2025-07-15 23:59:27 UTC

thanks for sharing cousin, will address your points one by one :-)

2/X:

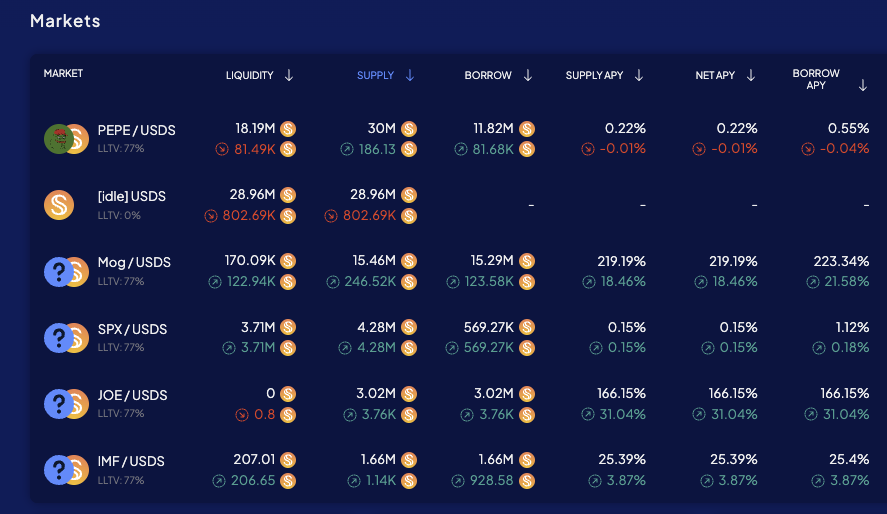

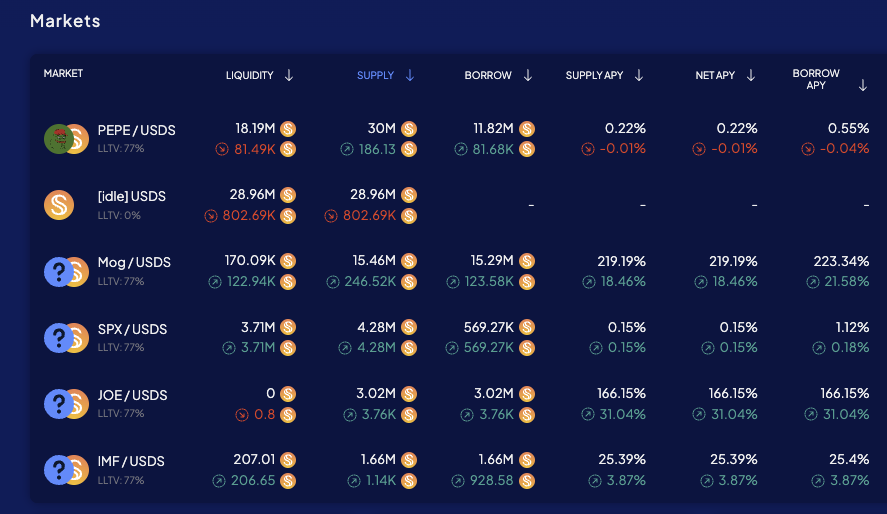

Our team doesn't provide the USDS liquidity, instead we manage a vault that lenders lend to, and adaptive curve interest rate model from Morpho reacts to supply/demand dynamics.

3/X:

Borrow rate at target for Mog is currently XX% which on $15.28M of outstanding loans, would be about $19k/day. the liquidity doesn't get taken by other markets, as they're isolated and allocated to individually by the vault.

4/X:

What you're not taking into consideration is supply caps, which are set based on onchain sell-side liquidity, for safety in the event of mass liquidations. Pepe has a much larger supply cap which hasn't been met as demand is not as high yet.

Mog and Joe have hit their supply caps, and raising them would introduce unnecessary risk. Morpho's dynamic interest rate model spikes up when utilisation is over XX% and falls sharply when under XX% to compel repayments.

Mog and Joe repayments are highly advised atm due to many borrowers being in profit etc. These high spikes are temporary and Morpho's IR model is designed to adapt to supply and demand dynamics. I've linked to relevant part of their docs below.[1]

5/X:

New liquidity isn't the issue. We have more than we can allocate right now, and since supply caps are our primary constraint, we need to list more assets in order to have safe allocations we can make.

As per screenshot, you can see that our "idle" market has $28.96M and there's another $22M is not yet borrowed across active markets.

6/6:

These thoughts are much appreciated and will be put to good use as with all feedback. You're no more a retard than I and your thread is much appreciated cousin.

1:

XXXXX engagements