[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Cryptovicci 🌐 [@cryptovicci](/creator/twitter/cryptovicci) on x 2491 followers Created: 2025-07-15 21:51:21 UTC $MARA is building a shadow bank powered by Bitcoin. In Q1 2025, they had ~47,531 BTC on the balance sheet. Instead of selling into the market, they lent out ~14,269 BTC to institutions, up XXXX% QoQ. That’s already XX% of their treasury, generating a 5–9% yield, similar to private credit or secured bank loans. At $XXXXXXX per BTC, the loan book is valued at $1.65B, and yields $83M–$149M annually. #MARA is monetizing their treasury without liquidating it, creating a recurring revenue stream that mirrors Net Interest Margin (NIM) in banking. Using conservative bank-style valuation models: 🔹 A 10× earnings multiple on $83M–$149M gives this segment a $830M–$1.49B standalone value. But let’s look ahead. If lending continues to grow, full deployment is possible by Q1 2026. At XXXXXX BTC lent, and BTC at $200K, MARA’s loan book would be worth $11B. A 5–9% yield on that generates $550M–$990M/year, PURE YIELD, with no BTC sold. Valuing that future loan book at just 50–90% of asset value gives a potential segment worth of $5.5B–$9.9B. MARA’s Bitcoin stack doesn’t just grow in value when BTC appreciates, it now doubles in utility: 1.📈 Asset appreciates 2.💰 Same assets generates interest from institutional borrowers. It’s not just a miner. It’s not just a HODLer. It’s becoming a Bitcoin-native bank with a loan book and balance sheet directly tied to BTC upside. Viewed through that lens, MARA’s “BTC banking arm” could soon become its most valuable business line. — 🧠 Analysis by @Cryptovicci #Bitcoin #BitcoinBank #Miner #Banking  XXXXXX engagements  **Related Topics** [$149m](/topic/$149m) [$83m](/topic/$83m) [$165b](/topic/$165b) [balance sheet](/topic/balance-sheet) [$mara](/topic/$mara) [stocks financial services](/topic/stocks-financial-services) [stocks bitcoin treasuries](/topic/stocks-bitcoin-treasuries) [bitcoin](/topic/bitcoin) [Post Link](https://x.com/cryptovicci/status/1945239790804459789)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Cryptovicci 🌐 @cryptovicci on x 2491 followers

Created: 2025-07-15 21:51:21 UTC

Cryptovicci 🌐 @cryptovicci on x 2491 followers

Created: 2025-07-15 21:51:21 UTC

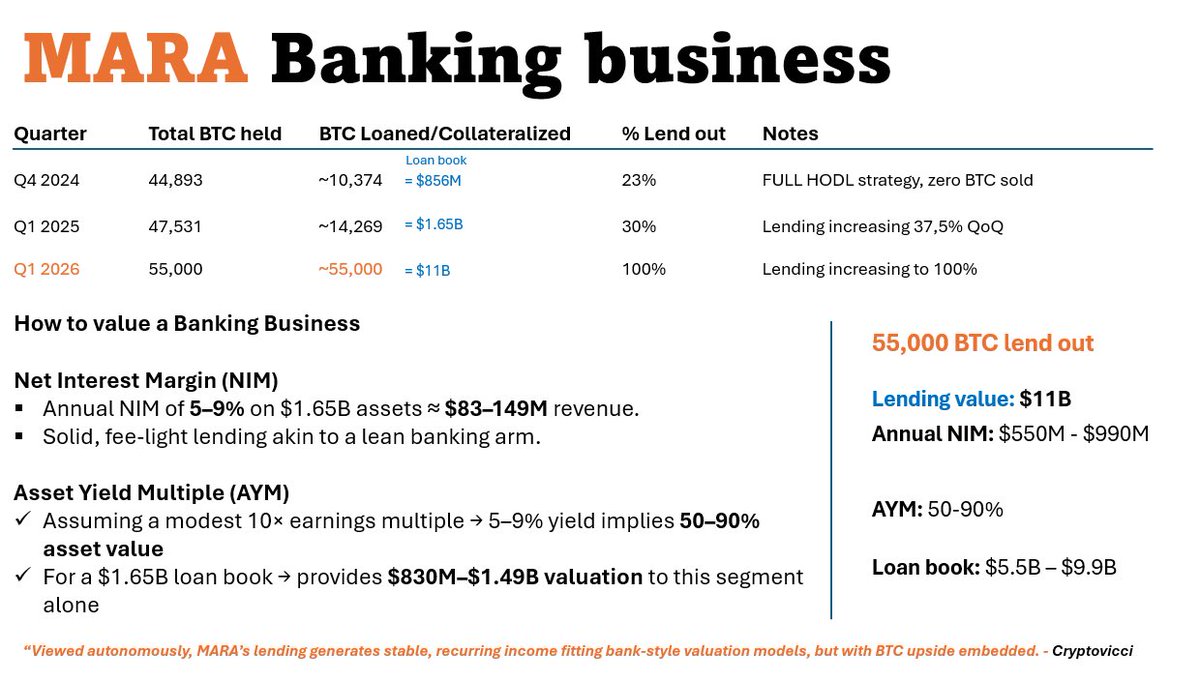

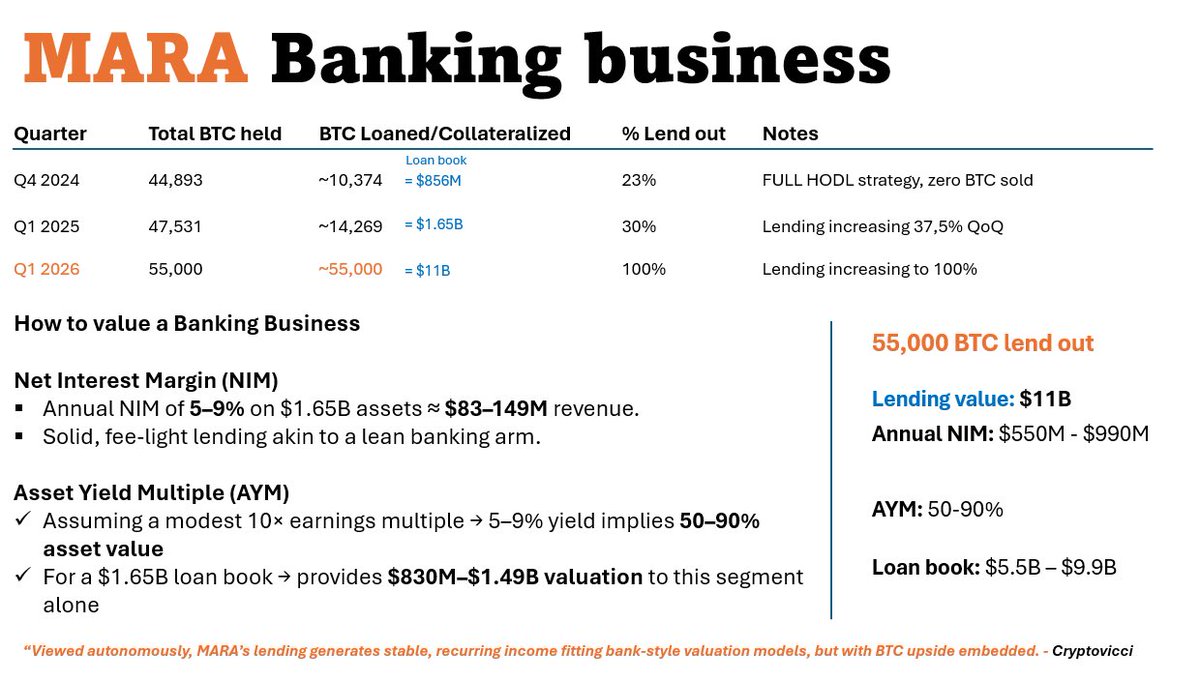

$MARA is building a shadow bank powered by Bitcoin.

In Q1 2025, they had ~47,531 BTC on the balance sheet. Instead of selling into the market, they lent out ~14,269 BTC to institutions, up XXXX% QoQ.

That’s already XX% of their treasury, generating a 5–9% yield, similar to private credit or secured bank loans.

At $XXXXXXX per BTC, the loan book is valued at $1.65B, and yields $83M–$149M annually.

#MARA is monetizing their treasury without liquidating it, creating a recurring revenue stream that mirrors Net Interest Margin (NIM) in banking.

Using conservative bank-style valuation models: 🔹 A 10× earnings multiple on $83M–$149M gives this segment a $830M–$1.49B standalone value.

But let’s look ahead. If lending continues to grow, full deployment is possible by Q1 2026. At XXXXXX BTC lent, and BTC at $200K, MARA’s loan book would be worth $11B.

A 5–9% yield on that generates $550M–$990M/year, PURE YIELD, with no BTC sold.

Valuing that future loan book at just 50–90% of asset value gives a potential segment worth of $5.5B–$9.9B.

MARA’s Bitcoin stack doesn’t just grow in value when BTC appreciates, it now doubles in utility: 1.📈 Asset appreciates 2.💰 Same assets generates interest from institutional borrowers.

It’s not just a miner. It’s not just a HODLer. It’s becoming a Bitcoin-native bank with a loan book and balance sheet directly tied to BTC upside. Viewed through that lens, MARA’s “BTC banking arm” could soon become its most valuable business line. — 🧠 Analysis by @Cryptovicci #Bitcoin #BitcoinBank #Miner #Banking

XXXXXX engagements

Related Topics $149m $83m $165b balance sheet $mara stocks financial services stocks bitcoin treasuries bitcoin