[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  DarwinKnows [@Darwin_Knows](/creator/twitter/Darwin_Knows) on x XXX followers Created: 2025-07-15 20:32:20 UTC Robinhood Markets Inc (Overall - Unfavourable) US Large Caps: Robinhood Markets Inc has a total score of +34 and there are XX alerts. The overall rating for Robinhood Markets Inc is unfavourable. The combination of an "unhealthy" health rating, a "very expensive" valuation rating, and mixed sentiment from price and model analyses creates a concerning investment case. The upcoming earnings report scheduled for July 30, 2025, could serve as a catalyst for price movement, but the current financial metrics suggest that the company is struggling to regain profitability. The high forward P/E ratio and negative profit margins indicate that the stock may be overvalued, while the mixed indicators suggest potential volatility in the near future. Investors should exercise caution and consider waiting for more favorable conditions before entering a position in this asset. #DarwinKnows #RobinhoodMarkets #HOOD $HOOD  XX engagements  **Related Topics** [caps](/topic/caps) [investment](/topic/investment) [Sentiment](/topic/sentiment) [$hood](/topic/$hood) [stocks technology](/topic/stocks-technology) [Post Link](https://x.com/Darwin_Knows/status/1945219903340077404)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

DarwinKnows @Darwin_Knows on x XXX followers

Created: 2025-07-15 20:32:20 UTC

DarwinKnows @Darwin_Knows on x XXX followers

Created: 2025-07-15 20:32:20 UTC

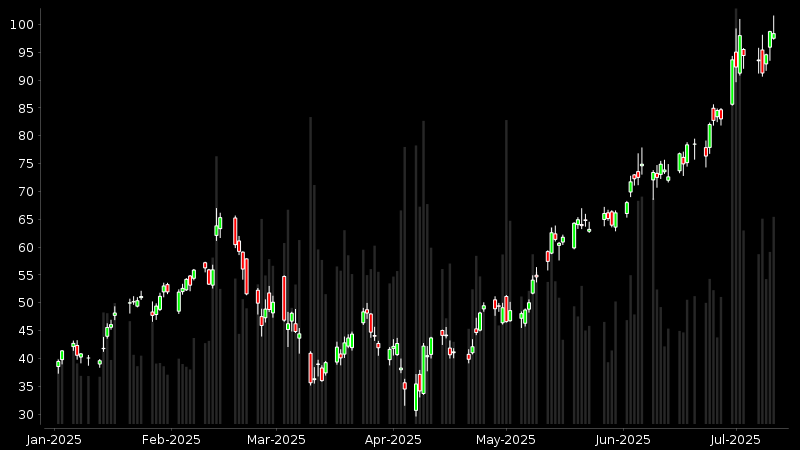

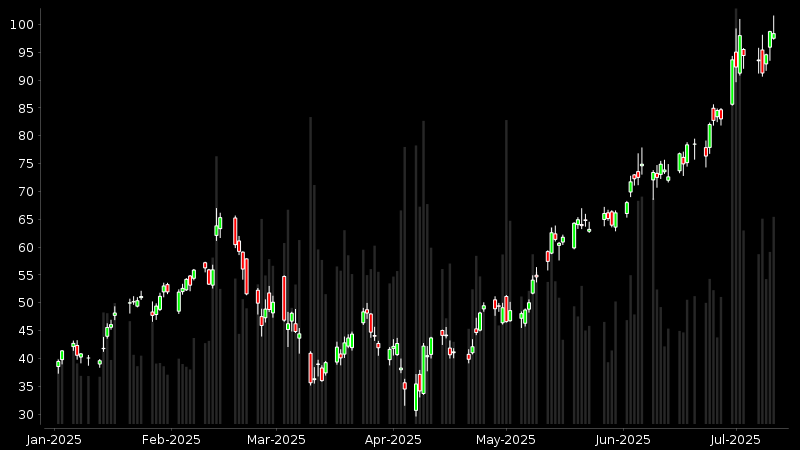

Robinhood Markets Inc (Overall - Unfavourable)

US Large Caps: Robinhood Markets Inc has a total score of +34 and there are XX alerts.

The overall rating for Robinhood Markets Inc is unfavourable. The combination of an "unhealthy" health rating, a "very expensive" valuation rating, and mixed sentiment from price and model analyses creates a concerning investment case. The upcoming earnings report scheduled for July 30, 2025, could serve as a catalyst for price movement, but the current financial metrics suggest that the company is struggling to regain profitability. The high forward P/E ratio and negative profit margins indicate that the stock may be overvalued, while the mixed indicators suggest potential volatility in the near future. Investors should exercise caution and consider waiting for more favorable conditions before entering a position in this asset.

#DarwinKnows #RobinhoodMarkets #HOOD $HOOD

XX engagements

Related Topics caps investment Sentiment $hood stocks technology