[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Cryptoguy49 [@Cryptoguy49](/creator/twitter/Cryptoguy49) on x XXX followers Created: 2025-07-15 15:38:59 UTC You’ve seen posts hyping BTCFi. But here’s why Lombard might be the most important piece of it and what happens when you run the actual numbers. Here’s what happens when you do the math .🧵👇 Start with Ethereum. Market cap: $361B Around XXXX% of ETH is staked That’s 35.8M ETH, worth over $106B actively deployed Ethereum staking didn’t explode overnight. It evolved with LSTs, vaults, and modular DeFi enabling participation at scale. That XX% staked figure is what happens when the right infrastructure meets real incentives. Now turn to Bitcoin. Market cap: $2.33T Still under X% of that capital is actively deployed in DeFi And yet, Lombard alone holds $1.66B in TVL already leading the charge To be clear: Lombard didn’t wait for BTCFi to trend. It’s building the rails now and early adoption is already measurable. Now imagine this: If even X% of currently idle BTC capital sitting cold in wallets, not earning, not flowing got deployed through Lombard… That would be $23.3B coming into the system. Lombard today: $1.66B. You’re looking at a 14x increase in TVL from just a single-digit shift. At X% idle BTC flow? That’s $46.6B nearly 28x current levels. Why Lombard matters in this picture: Because it’s not another passive vault. It’s a Bitcoin-native execution stack: Babylon enables BTC staking Katana routes capital across vaults, restaking, liquidity layers $LBTC is becoming composable collateral plugged into modular DeFi It’s not about chasing hype. It’s about building a secure, scalable base layer for Bitcoin’s onchain economy. The takeaway: Ethereum staking captured $100B+ through XX% participation. Bitcoin is sitting on $2.3T and less than X% of it is activated. If Lombard captures even 1–2% of that idle supply, TVL isn’t just going up it’s multiplying by an order of magnitude. This is not a theoretical future. The architecture is live. The capital is waiting. Lombard is the unlock. @Lombard_Finance @JacobPPhillips  XXX engagements  **Related Topics** [staking](/topic/staking) [$106b](/topic/$106b) [$361b](/topic/$361b) [market cap](/topic/market-cap) [coins btcfi](/topic/coins-btcfi) [ethereum](/topic/ethereum) [coins layer 1](/topic/coins-layer-1) [Post Link](https://x.com/Cryptoguy49/status/1945146081337336070)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Cryptoguy49 @Cryptoguy49 on x XXX followers

Created: 2025-07-15 15:38:59 UTC

Cryptoguy49 @Cryptoguy49 on x XXX followers

Created: 2025-07-15 15:38:59 UTC

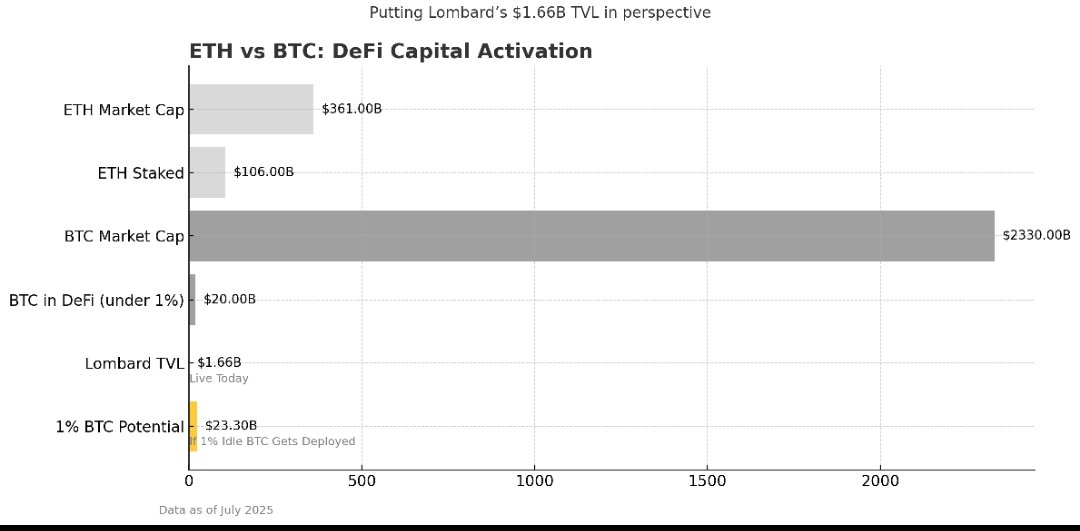

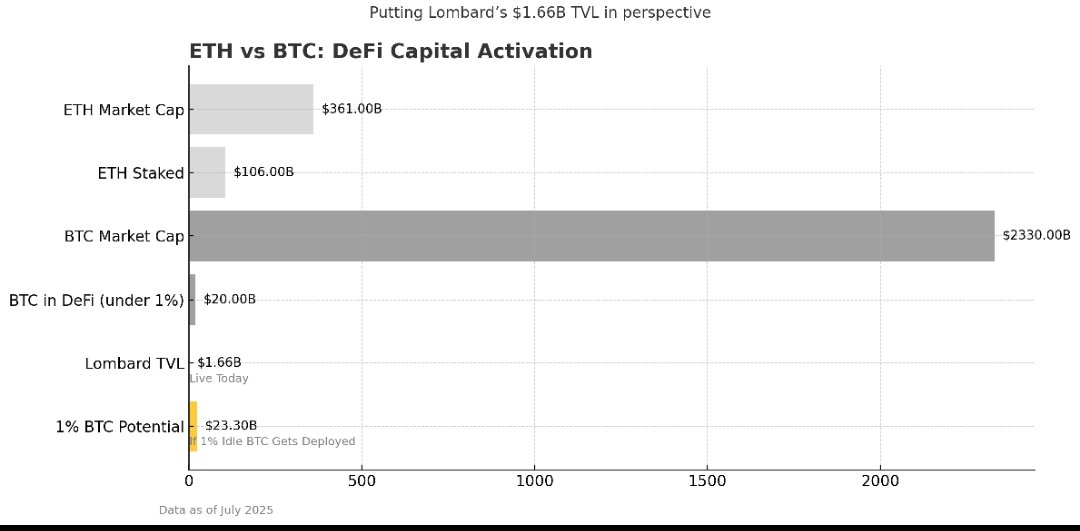

You’ve seen posts hyping BTCFi. But here’s why Lombard might be the most important piece of it and what happens when you run the actual numbers.

Here’s what happens when you do the math .🧵👇

Start with Ethereum.

Market cap: $361B

Around XXXX% of ETH is staked

That’s 35.8M ETH, worth over $106B actively deployed

Ethereum staking didn’t explode overnight. It evolved with LSTs, vaults, and modular DeFi enabling participation at scale.

That XX% staked figure is what happens when the right infrastructure meets real incentives.

Now turn to Bitcoin.

Market cap: $2.33T

Still under X% of that capital is actively deployed in DeFi

And yet, Lombard alone holds $1.66B in TVL already leading the charge

To be clear: Lombard didn’t wait for BTCFi to trend. It’s building the rails now and early adoption is already measurable.

Now imagine this:

If even X% of currently idle BTC capital sitting cold in wallets, not earning, not flowing got deployed through Lombard…

That would be $23.3B coming into the system. Lombard today: $1.66B.

You’re looking at a 14x increase in TVL from just a single-digit shift. At X% idle BTC flow? That’s $46.6B nearly 28x current levels.

Why Lombard matters in this picture:

Because it’s not another passive vault. It’s a Bitcoin-native execution stack:

Babylon enables BTC staking

Katana routes capital across vaults, restaking, liquidity layers

$LBTC is becoming composable collateral plugged into modular DeFi

It’s not about chasing hype. It’s about building a secure, scalable base layer for Bitcoin’s onchain economy.

The takeaway:

Ethereum staking captured $100B+ through XX% participation. Bitcoin is sitting on $2.3T and less than X% of it is activated.

If Lombard captures even 1–2% of that idle supply, TVL isn’t just going up it’s multiplying by an order of magnitude.

This is not a theoretical future. The architecture is live. The capital is waiting. Lombard is the unlock. @Lombard_Finance @JacobPPhillips

XXX engagements

Related Topics staking $106b $361b market cap coins btcfi ethereum coins layer 1