[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  BL [@BL_in_SV](/creator/twitter/BL_in_SV) on x XXX followers Created: 2025-07-15 14:13:26 UTC This is the game I'm playing. It doesn't happen all the time but when it does, wow. It's a XX% borrow/stake spread! If you're long-term bullish on ADA and think that 2025 might be the last time you'll see it below $1, don't sell it, deposit it in a CDP on Indigo protocol and borrow iSOL at the collateral ratio you're comfortable with. You'll continue to receive your ADA staking rewards. You'll get XX% staking rewards for all the iSOL you borrowed and deposited into the iSOL stability pool, while only paying XXX% to borrow it. If the price of SOL goes up relative to the price of ADA, you might have to increase the amount of ADA collateral, which is fine if you're long-term bullish on ADA. If the value of SOL decreases relative to the value of ADA, your relative collateral will increase and you'll be able to increase the amount of iSOL you're borrowing and get even more returns for no additional investment. Also, if SOL declines relative to ADA, there will likely be some liquidations of accounts that weren't maintaining enough collateral, and iSOL stability pool accounts will receive a pro rata share of that liquidated ADA. With a spread like this, a strategy like this seems like a very good one. The rewards are paid out in the INDY token, which can itself be staked in Indigo for at present an almost XX% return or converted to whatever you want on any exchange. The only downside is that opportunities like this don't usually last very long and when the spread is reduced to a few percent, it's not really worth it to maintain the position and there are all sorts of transaction costs associated with closing the position and opening another one or converting the tokens to something else to be used somewhere else. Fees and transaction costs are silent killers, so I always recommend that people do research up front, understand what they've getting into, and go in heavy so the fees don't matter so much.  XXX engagements  **Related Topics** [indigo protocol](/topic/indigo-protocol) [protocol](/topic/protocol) [longterm](/topic/longterm) [all the](/topic/all-the) [playing](/topic/playing) [Post Link](https://x.com/BL_in_SV/status/1945124551576445415)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

BL @BL_in_SV on x XXX followers

Created: 2025-07-15 14:13:26 UTC

BL @BL_in_SV on x XXX followers

Created: 2025-07-15 14:13:26 UTC

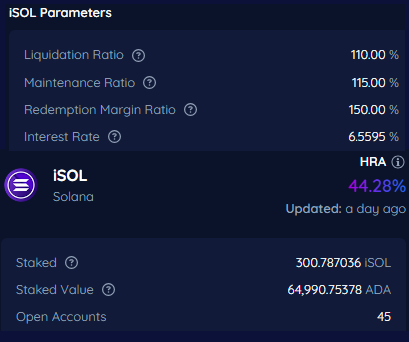

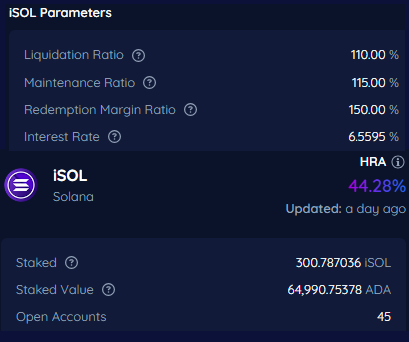

This is the game I'm playing. It doesn't happen all the time but when it does, wow. It's a XX% borrow/stake spread! If you're long-term bullish on ADA and think that 2025 might be the last time you'll see it below $1, don't sell it, deposit it in a CDP on Indigo protocol and borrow iSOL at the collateral ratio you're comfortable with. You'll continue to receive your ADA staking rewards. You'll get XX% staking rewards for all the iSOL you borrowed and deposited into the iSOL stability pool, while only paying XXX% to borrow it. If the price of SOL goes up relative to the price of ADA, you might have to increase the amount of ADA collateral, which is fine if you're long-term bullish on ADA. If the value of SOL decreases relative to the value of ADA, your relative collateral will increase and you'll be able to increase the amount of iSOL you're borrowing and get even more returns for no additional investment. Also, if SOL declines relative to ADA, there will likely be some liquidations of accounts that weren't maintaining enough collateral, and iSOL stability pool accounts will receive a pro rata share of that liquidated ADA. With a spread like this, a strategy like this seems like a very good one. The rewards are paid out in the INDY token, which can itself be staked in Indigo for at present an almost XX% return or converted to whatever you want on any exchange. The only downside is that opportunities like this don't usually last very long and when the spread is reduced to a few percent, it's not really worth it to maintain the position and there are all sorts of transaction costs associated with closing the position and opening another one or converting the tokens to something else to be used somewhere else. Fees and transaction costs are silent killers, so I always recommend that people do research up front, understand what they've getting into, and go in heavy so the fees don't matter so much.

XXX engagements

Related Topics indigo protocol protocol longterm all the playing