[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Yiannis Zourmpanos [@yianisz](/creator/twitter/yianisz) on x 2490 followers Created: 2025-07-15 14:00:34 UTC Here’s how the game actually works: Big downgrades come after the real risk is already in the price. Banks time these calls to protect their credibility, they pile on after a sector scare (like $CNC's blow-up) to look “prudent,” not because they suddenly discovered new facts. $OSCR was hyped at $XX when everyone agreed; now at $14, they say “too risky”, after the Q1 guide held, SG&A hit record lows, and the moat is proving itself with quota share reinsurance and AI risk tuning. What you’re seeing: a classic cycle. The downgrades drip out until weak hands capitulate. Once the last holdouts flip max bearish, the “optimism pessimism point” hits, that’s when the stock re-rates because fundamentals stayed intact while sentiment cratered. Smart money: buys before the downgrade cycle ends, rides the asymmetry when the same analysts raise targets back up later pretending it was a “new pivot.”  XXXXX engagements  **Related Topics** [oscr](/topic/oscr) [$cncs](/topic/$cncs) [$oscr](/topic/$oscr) [Post Link](https://x.com/yianisz/status/1945121313720254910)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Yiannis Zourmpanos @yianisz on x 2490 followers

Created: 2025-07-15 14:00:34 UTC

Yiannis Zourmpanos @yianisz on x 2490 followers

Created: 2025-07-15 14:00:34 UTC

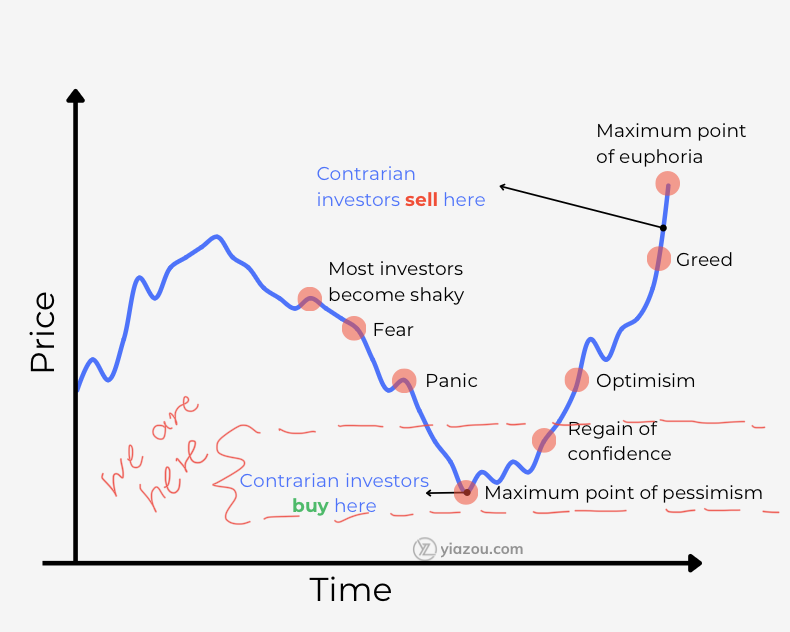

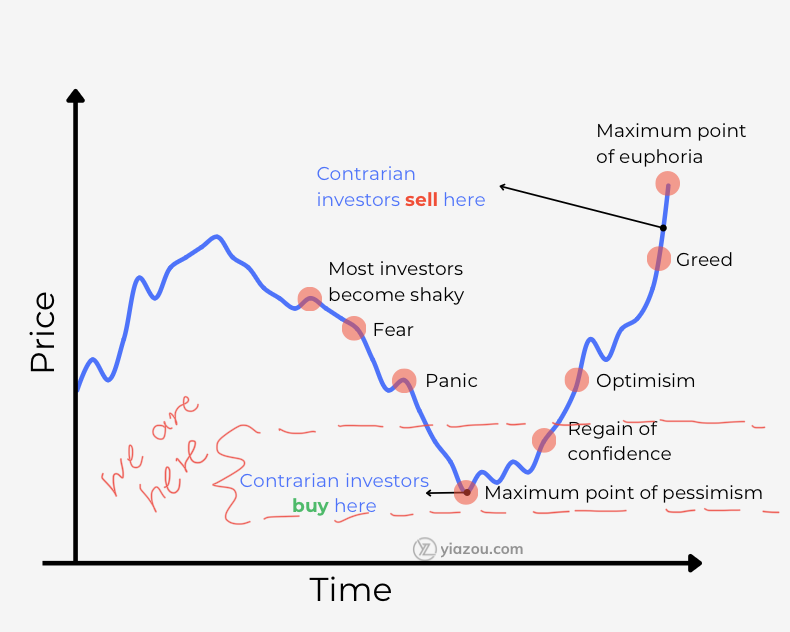

Here’s how the game actually works:

Big downgrades come after the real risk is already in the price.

Banks time these calls to protect their credibility, they pile on after a sector scare (like $CNC's blow-up) to look “prudent,” not because they suddenly discovered new facts.

$OSCR was hyped at $XX when everyone agreed; now at $14, they say “too risky”, after the Q1 guide held, SG&A hit record lows, and the moat is proving itself with quota share reinsurance and AI risk tuning.

What you’re seeing: a classic cycle.

The downgrades drip out until weak hands capitulate.

Once the last holdouts flip max bearish, the “optimism pessimism point” hits, that’s when the stock re-rates because fundamentals stayed intact while sentiment cratered.

Smart money: buys before the downgrade cycle ends, rides the asymmetry when the same analysts raise targets back up later pretending it was a “new pivot.”

XXXXX engagements