[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Trex [@Trextxxy](/creator/twitter/Trextxxy) on x 1722 followers Created: 2025-07-15 12:53:32 UTC Loyalty is very important to me. I will always remember those that engage me when it is not a giveaway post. But let us talk about $KAIA for a bit. @KaiaChain price dropped XXXX% in 24h due to pre-hard fork exchange suspensions and broader market weakness. X. Network upgrade uncertainty: Binance halted KAIA deposits/withdrawals ahead of July XX hard fork. X. Technical breakdown: Price fell below key support at $XXXXX pivot point. X. Market-wide dip: Crypto market cap dropped XXXX% in 24h. Deep Dive X. Primary Catalyst: Hard Fork Preparations Binance and ProBit Global paused KAIA deposits/withdrawals on July 15-16 ahead of the network’s hard fork at block height XXXXXXXXXXX While trading remains active, liquidity constraints and investor caution around protocol changes likely triggered selling pressure. Historical data shows similar pre-upgrade volatility in mid-cap tokens. X. Technical Context - Key levels breached: KAIA fell below its 7-day SMA ($0.154) and the pivot point ($0.156), activating stop-loss orders. -Momentum shift: MACD histogram (-0.00165) and RSI X (43.08) signal bearish dominance. - Volume: 24h spot volume dropped XXX% to $33.3M, reflecting weaker buying interest. X. Market Dynamics -BTC correlation: Bitcoin dominance rose to 63.4%, pressuring altcoins like KAIA. - Derivatives cooling: Open interest for altcoins dipped XXXX% weekly as traders reduced risk exposure. -Fear & Greed Index: At XX (“Greed”), markets were primed for profit-taking. Conclusion $KAIA’s decline combines protocol uncertainty, technical breakdowns, and sector-wide risk aversion. Traders are likely repositioning ahead of the hard fork’s outcome and monitoring whether $XXXXX (June swing low) holds as support. What to watch: Will KAIA’s post-upgrade tokenomics (e.g., gas abstraction) reignite demand if the network upgrade succeeds?  XXX engagements  **Related Topics** [goat](/topic/goat) [anoma](/topic/anoma) [binance](/topic/binance) [kaiachain](/topic/kaiachain) [$trex](/topic/$trex) [$kaia](/topic/$kaia) [coins layer 1](/topic/coins-layer-1) [Post Link](https://x.com/Trextxxy/status/1945104442509939087)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Trex @Trextxxy on x 1722 followers

Created: 2025-07-15 12:53:32 UTC

Trex @Trextxxy on x 1722 followers

Created: 2025-07-15 12:53:32 UTC

Loyalty is very important to me. I will always remember those that engage me when it is not a giveaway post.

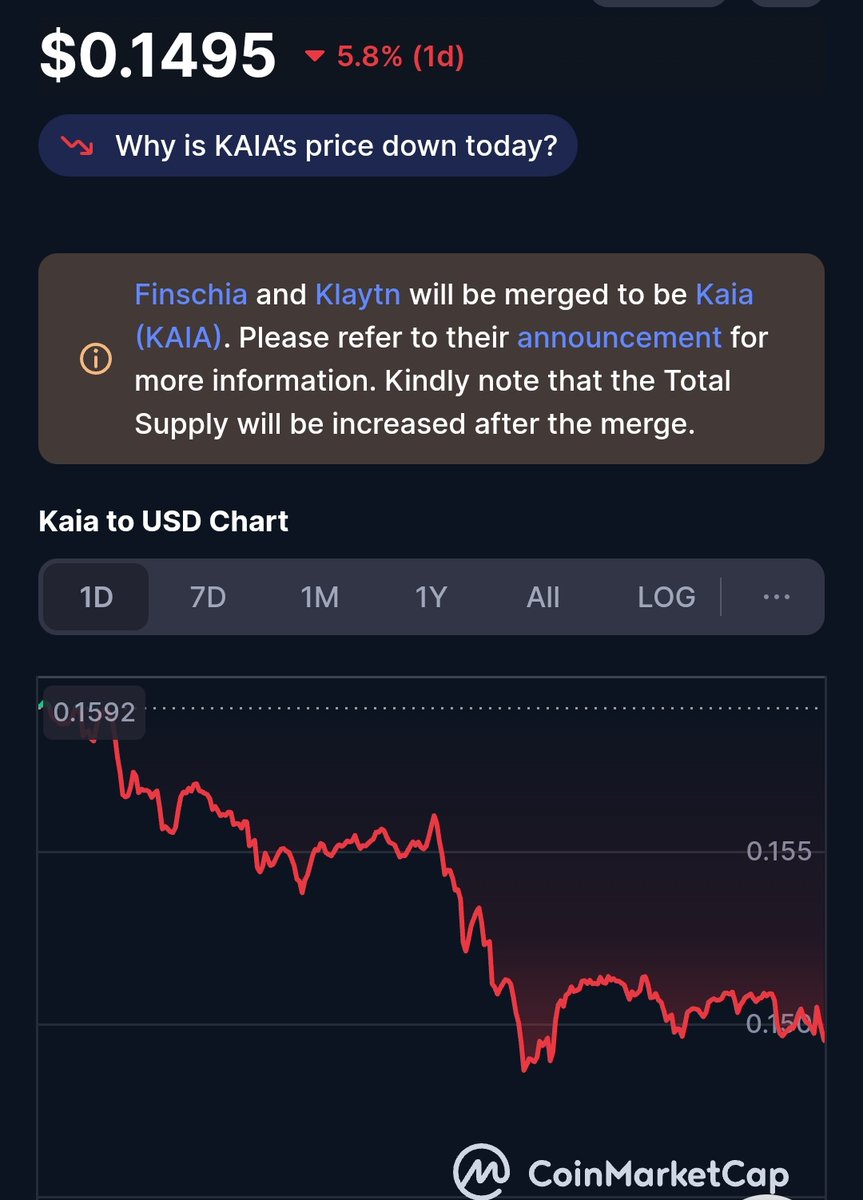

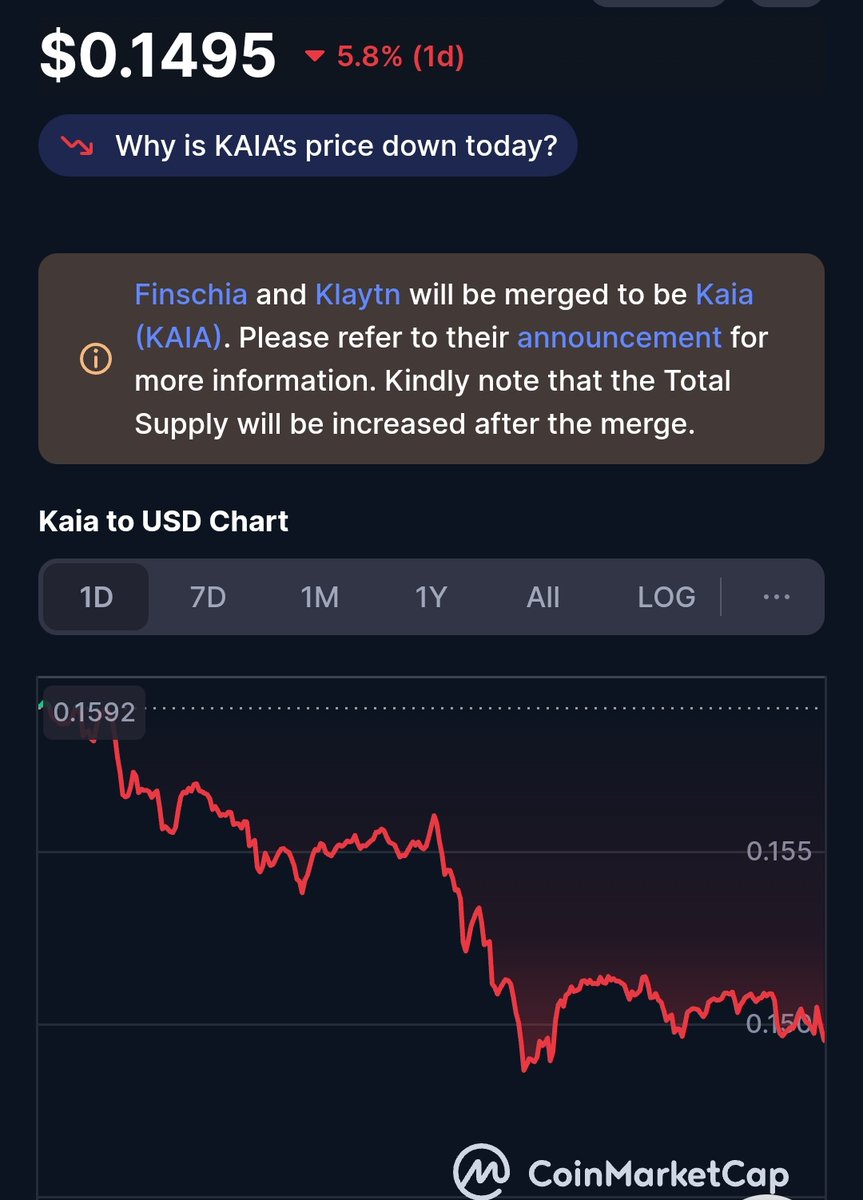

But let us talk about $KAIA for a bit.

@KaiaChain price dropped XXXX% in 24h due to pre-hard fork exchange suspensions and broader market weakness.

X. Network upgrade uncertainty: Binance halted KAIA deposits/withdrawals ahead of July XX hard fork.

X. Technical breakdown: Price fell below key support at $XXXXX pivot point.

X. Market-wide dip: Crypto market cap dropped XXXX% in 24h.

Deep Dive

X. Primary Catalyst: Hard Fork Preparations

Binance and ProBit Global paused KAIA deposits/withdrawals on July 15-16 ahead of the network’s hard fork at block height XXXXXXXXXXX While trading remains active, liquidity constraints and investor caution around protocol changes likely triggered selling pressure. Historical data shows similar pre-upgrade volatility in mid-cap tokens.

X. Technical Context

- Key levels breached: KAIA fell below its 7-day SMA ($0.154) and the pivot point ($0.156), activating stop-loss orders.

-Momentum shift: MACD histogram (-0.00165) and RSI X (43.08) signal bearish dominance. - Volume: 24h spot volume dropped XXX% to $33.3M, reflecting weaker buying interest.

X. Market Dynamics

-BTC correlation: Bitcoin dominance rose to 63.4%, pressuring altcoins like KAIA.

- Derivatives cooling: Open interest for altcoins dipped XXXX% weekly as traders reduced risk exposure.

-Fear & Greed Index: At XX (“Greed”), markets were primed for profit-taking.

Conclusion

$KAIA’s decline combines protocol uncertainty, technical breakdowns, and sector-wide risk aversion. Traders are likely repositioning ahead of the hard fork’s outcome and monitoring whether $XXXXX (June swing low) holds as support.

What to watch: Will KAIA’s post-upgrade tokenomics (e.g., gas abstraction) reignite demand if the network upgrade succeeds?

XXX engagements

Related Topics goat anoma binance kaiachain $trex $kaia coins layer 1