[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  DivyQueen 🇺🇸 [@DivysQueen](/creator/twitter/DivysQueen) on x 1299 followers Created: 2025-07-15 00:22:54 UTC I’ve got over $40K in $ULTY and can’t get enough of its weekly dividends—it’s a standout for my passive income portfolio. Here’s what made me consider $ULTY: Unmatched XXXXXX% yield: Weekly payouts of ~$0.08–$0.15/share deliver exceptional cash flow, perfect for daily buys and drip those dividends. Active management: The ZEGA Financial’s options strategy targets high-volatility stocks, with recent prospectus updates (dynamic rotation, put hedging) boosting NAV stability (+33.54% over X months). Outshines peers: SCHD (3.4%), VYM (2.9%), JEPI (7–9%), and QYLD (11–12%) lag far behind in yield. Drawbacks or Downside: XXXX% expense ratio is steep, and volatility can pressure NAV, though recent changes mitigate this. Why it compelled me: High income, tax-efficient ROC distributions, and a steady $X range share price make it liquid and accessible. You can review the prospectus at if you want to find out more.  XXXXX engagements  **Related Topics** [stocks](/topic/stocks) [cash flow](/topic/cash-flow) [$015share](/topic/$015share) [$ulty](/topic/$ulty) [$40k](/topic/$40k) [Post Link](https://x.com/DivysQueen/status/1944915540209717411)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

DivyQueen 🇺🇸 @DivysQueen on x 1299 followers

Created: 2025-07-15 00:22:54 UTC

DivyQueen 🇺🇸 @DivysQueen on x 1299 followers

Created: 2025-07-15 00:22:54 UTC

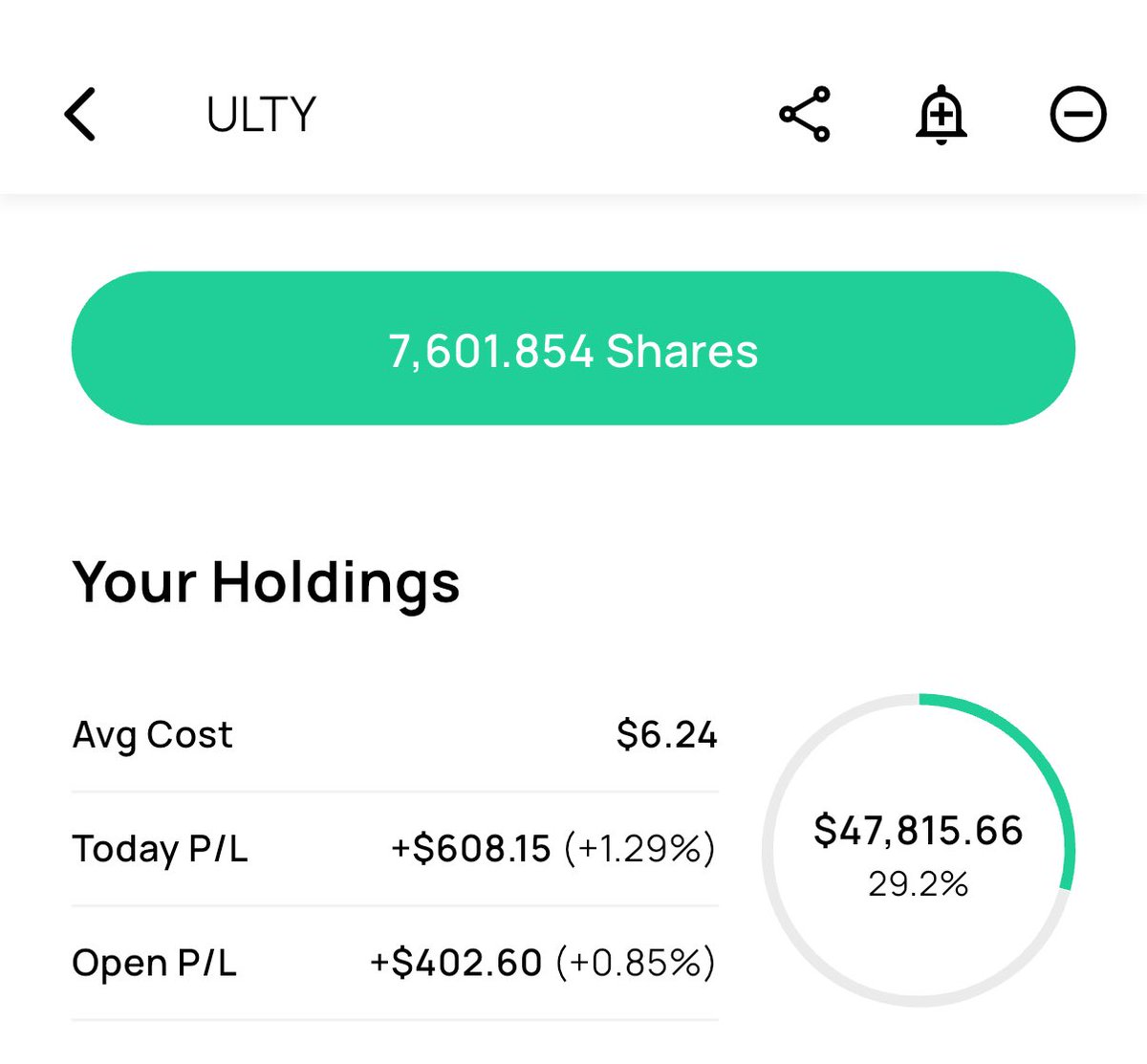

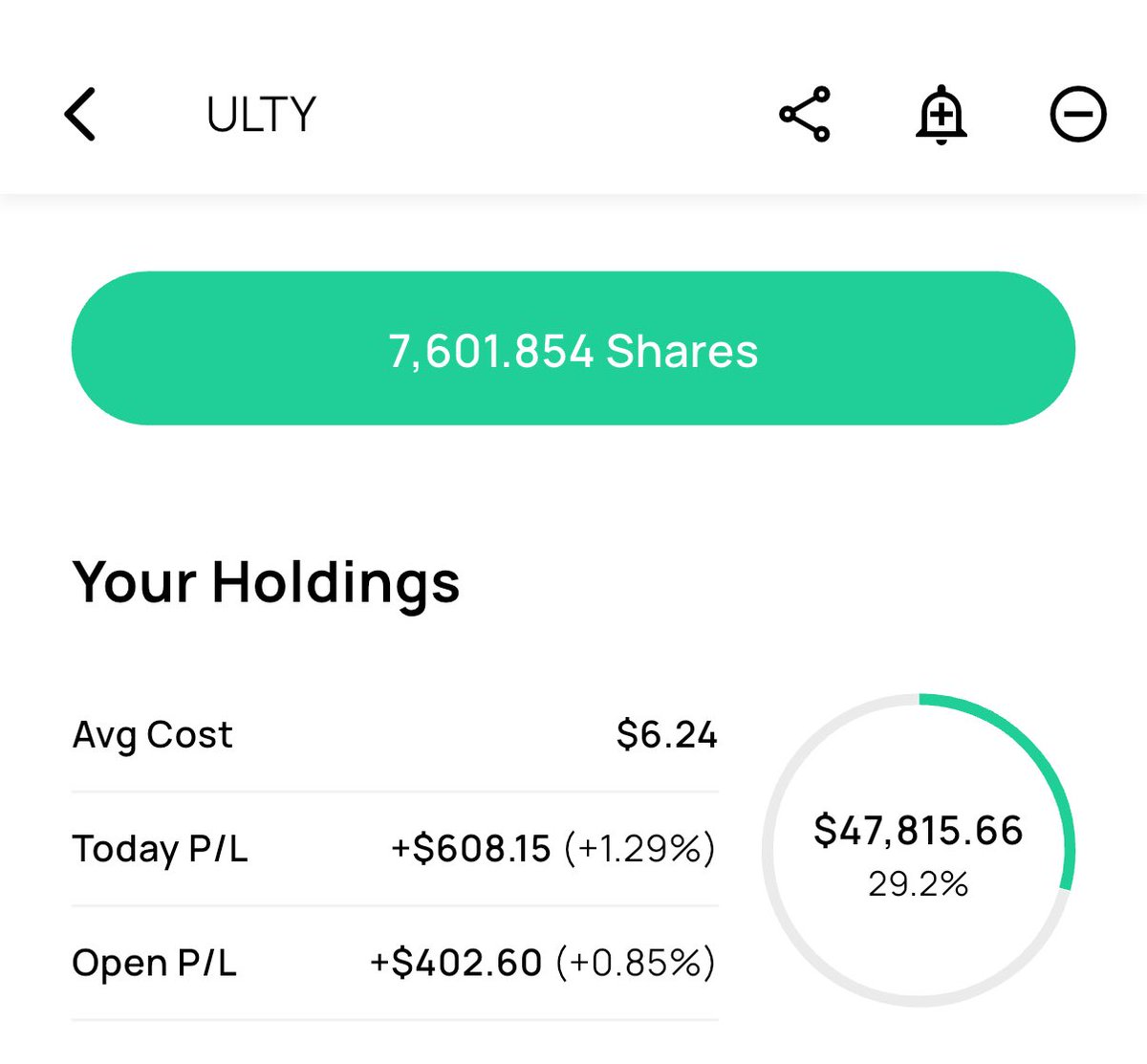

I’ve got over $40K in $ULTY and can’t get enough of its weekly dividends—it’s a standout for my passive income portfolio.

Here’s what made me consider $ULTY:

Unmatched XXXXXX% yield: Weekly payouts of ~$0.08–$0.15/share deliver exceptional cash flow, perfect for daily buys and drip those dividends.

Active management: The ZEGA Financial’s options strategy targets high-volatility stocks, with recent prospectus updates (dynamic rotation, put hedging) boosting NAV stability (+33.54% over X months).

Outshines peers: SCHD (3.4%), VYM (2.9%), JEPI (7–9%), and QYLD (11–12%) lag far behind in yield.

Drawbacks or Downside: XXXX% expense ratio is steep, and volatility can pressure NAV, though recent changes mitigate this.

Why it compelled me: High income, tax-efficient ROC distributions, and a steady $X range share price make it liquid and accessible.

You can review the prospectus at if you want to find out more.

XXXXX engagements