[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  DarwinKnows [@Darwin_Knows](/creator/twitter/Darwin_Knows) on x XXX followers Created: 2025-07-14 22:53:54 UTC Evotec SE (Valuation - Very Expensive) Evotec SE has the worst Darwin score in Germany. Evotec SE has an overall darwin score of -XX and there is one alert. The valuation ratios for Evotec SE suggest that the stock is very expensive. The Forward P/E ratio of XXXXXX is astronomically high compared to the peer average of 11.002, indicating that investors are paying a premium for each dollar of expected earnings. The Enterprise Value to Revenue ratio of XXXXX is lower than the peer average of 2.065, but this does not compensate for the extreme valuations seen in other metrics. The Price to Sales ratio of XXXXX is above the peer average of 1.481, reinforcing the notion that the stock is overvalued. Overall, these ratios indicate that Evotec SE is trading at a price that is not justified by its earnings potential, making it a very expensive investment. #DarwinKnows #Evotec #EVT $EVT.DE  XXX engagements  **Related Topics** [money](/topic/money) [germany](/topic/germany) [$evtde](/topic/$evtde) [Post Link](https://x.com/Darwin_Knows/status/1944893144690282782)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

DarwinKnows @Darwin_Knows on x XXX followers

Created: 2025-07-14 22:53:54 UTC

DarwinKnows @Darwin_Knows on x XXX followers

Created: 2025-07-14 22:53:54 UTC

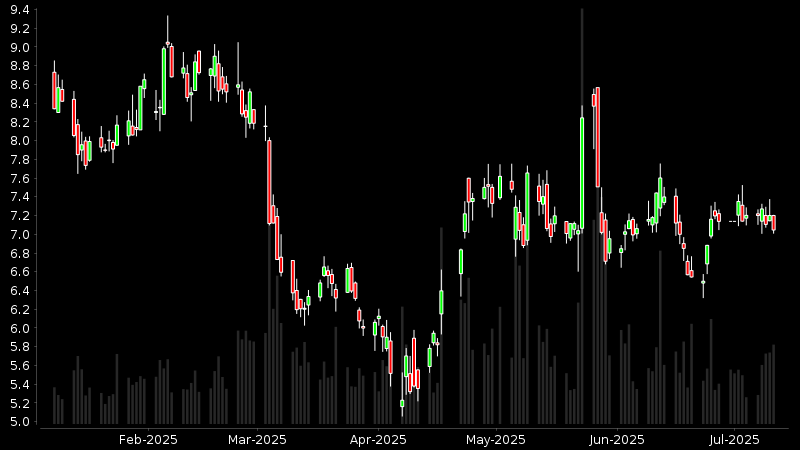

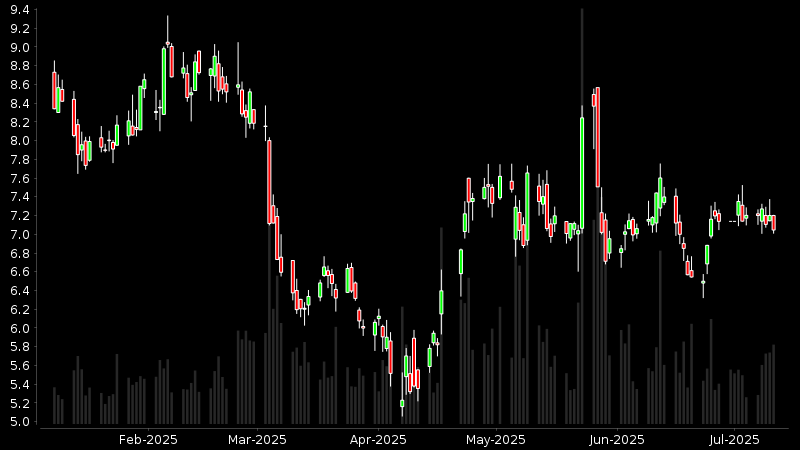

Evotec SE (Valuation - Very Expensive)

Evotec SE has the worst Darwin score in Germany. Evotec SE has an overall darwin score of -XX and there is one alert.

The valuation ratios for Evotec SE suggest that the stock is very expensive. The Forward P/E ratio of XXXXXX is astronomically high compared to the peer average of 11.002, indicating that investors are paying a premium for each dollar of expected earnings. The Enterprise Value to Revenue ratio of XXXXX is lower than the peer average of 2.065, but this does not compensate for the extreme valuations seen in other metrics. The Price to Sales ratio of XXXXX is above the peer average of 1.481, reinforcing the notion that the stock is overvalued. Overall, these ratios indicate that Evotec SE is trading at a price that is not justified by its earnings potential, making it a very expensive investment.

#DarwinKnows #Evotec #EVT $EVT.DE

XXX engagements