[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Chris in Canada 🍁 [@tsxman](/creator/twitter/tsxman) on x 10.5K followers Created: 2025-07-14 22:51:23 UTC $HR.UN still trading at a ~40% discount to IFRS NAV. Their current EV is around ~$5bn. If they sold the US residential and industrial assets to Blackstone at FMV it would be ~$5.8bn and you'd still have ~$3bn of retail/office assets left over plus $800mn if sold at NAV. R/R still very good. On previous calls H&R CEO described his retail assets as easily sellable and said they could be sold "anytime." H&R has better offices in better US markets then Canadian names so likely more liquid if they chose to sell them. Low quality/unaligned board seems to be the biggest risk. CEO has a lot of units creating a source of alignment.  XXXXXX engagements  **Related Topics** [$800mn](/topic/$800mn) [$3bn](/topic/$3bn) [$58bn](/topic/$58bn) [$5bn](/topic/$5bn) [$hrun](/topic/$hrun) [canada](/topic/canada) [Post Link](https://x.com/tsxman/status/1944892510653808908)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Chris in Canada 🍁 @tsxman on x 10.5K followers

Created: 2025-07-14 22:51:23 UTC

Chris in Canada 🍁 @tsxman on x 10.5K followers

Created: 2025-07-14 22:51:23 UTC

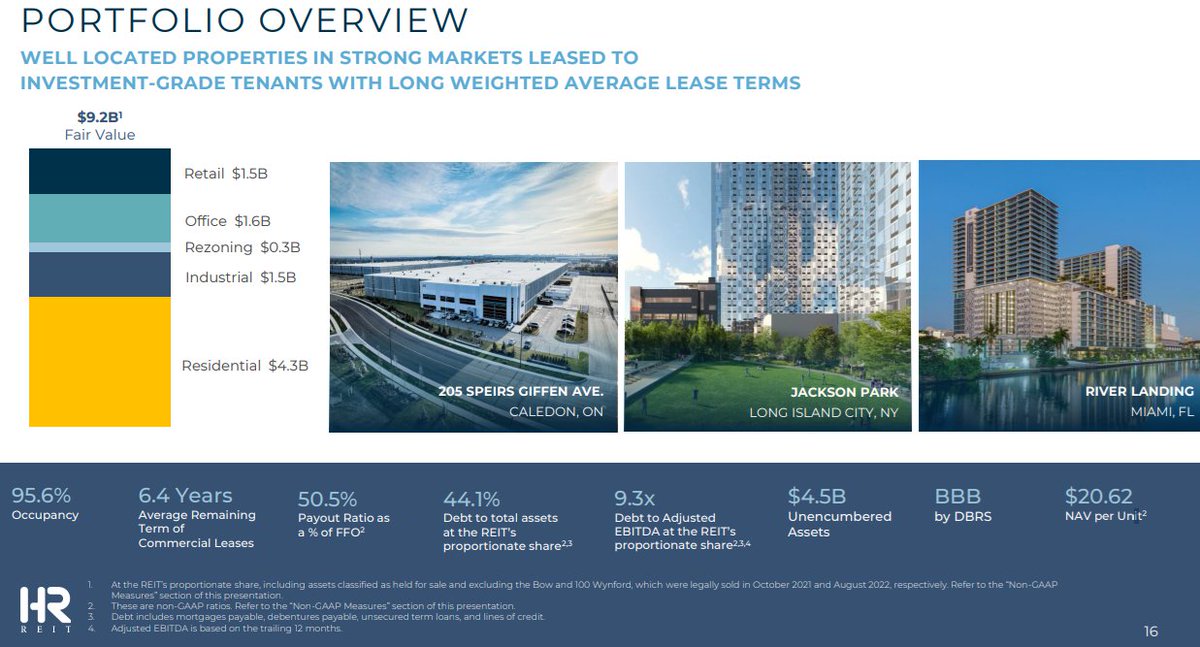

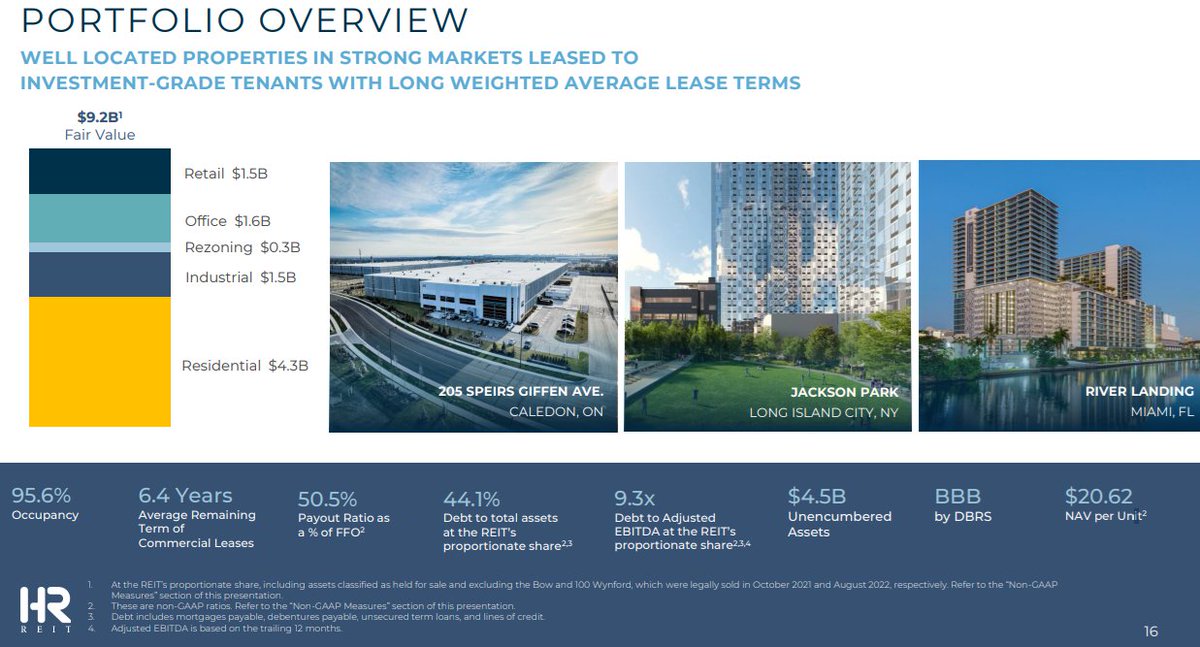

$HR.UN still trading at a ~40% discount to IFRS NAV. Their current EV is around ~$5bn. If they sold the US residential and industrial assets to Blackstone at FMV it would be ~$5.8bn and you'd still have ~$3bn of retail/office assets left over plus $800mn if sold at NAV. R/R still very good. On previous calls H&R CEO described his retail assets as easily sellable and said they could be sold "anytime." H&R has better offices in better US markets then Canadian names so likely more liquid if they chose to sell them. Low quality/unaligned board seems to be the biggest risk. CEO has a lot of units creating a source of alignment.

XXXXXX engagements