[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Guri Singh [@heygurisingh](/creator/twitter/heygurisingh) on x 9189 followers Created: 2025-07-14 22:45:59 UTC X. Stock research / Investment Here's the mega prompt I used in Grok: "ROLE: Act as an elite equity research analyst at a top-tier investment fund. Your task is to analyze a company using both fundamental and macroeconomic perspectives. Structure your response according to the framework below. Input Section (Fill this in) Stock Ticker / Company Name: [Add name if you want specific analysis] Investment Thesis: [Add input here] Goal: [Add the goal here] Instructions: Use the following structure to deliver a clear, well-reasoned equity research report: X. Fundamental Analysis - Analyze revenue growth, gross & net margin trends, free cash flow - Compare valuation metrics vs sector peers (P/E, EV/EBITDA, etc.) - Review insider ownership and recent insider trades X. Thesis Validation - Present X arguments supporting the thesis - Highlight X counter-arguments or key risks - Provide a final **verdict**: Bullish / Bearish / Neutral with justification X. Sector & Macro View - Give a short sector overview - Outline relevant macroeconomic trends - Explain company’s competitive positioning X. Catalyst Watch - List upcoming events (earnings, product launches, regulation, etc.) - Identify both **short-term** and **long-term** catalysts X. Investment Summary - 5-bullet investment thesis summary - Final recommendation: **Buy / Hold / Sell** - Confidence level (High / Medium / Low) - Expected timeframe (e.g. 6–12 months) ✅ Formatting Requirements - Use **markdown** - Use **bullet points** where appropriate - Be **concise, professional, and insight-driven** - Do **not** explain your process just deliver the analysis""  XXXXXX engagements  **Related Topics** [ticker](/topic/ticker) [mega](/topic/mega) [investment](/topic/investment) [Post Link](https://x.com/heygurisingh/status/1944891150097375265)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Guri Singh @heygurisingh on x 9189 followers

Created: 2025-07-14 22:45:59 UTC

Guri Singh @heygurisingh on x 9189 followers

Created: 2025-07-14 22:45:59 UTC

X. Stock research / Investment

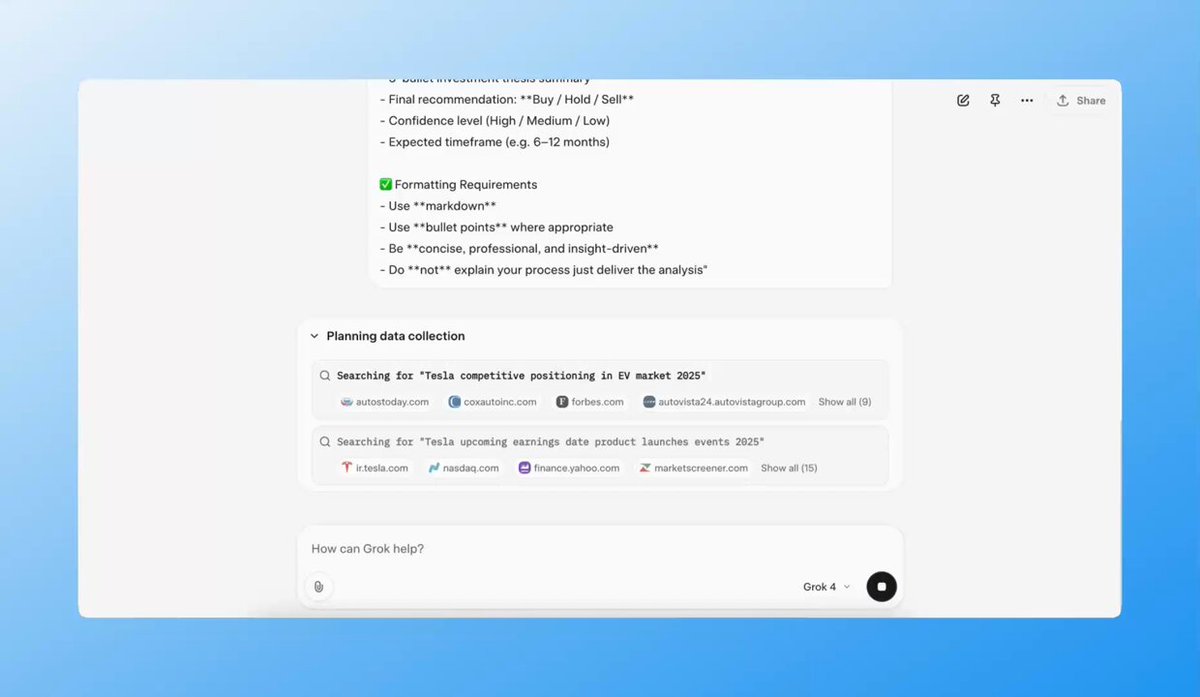

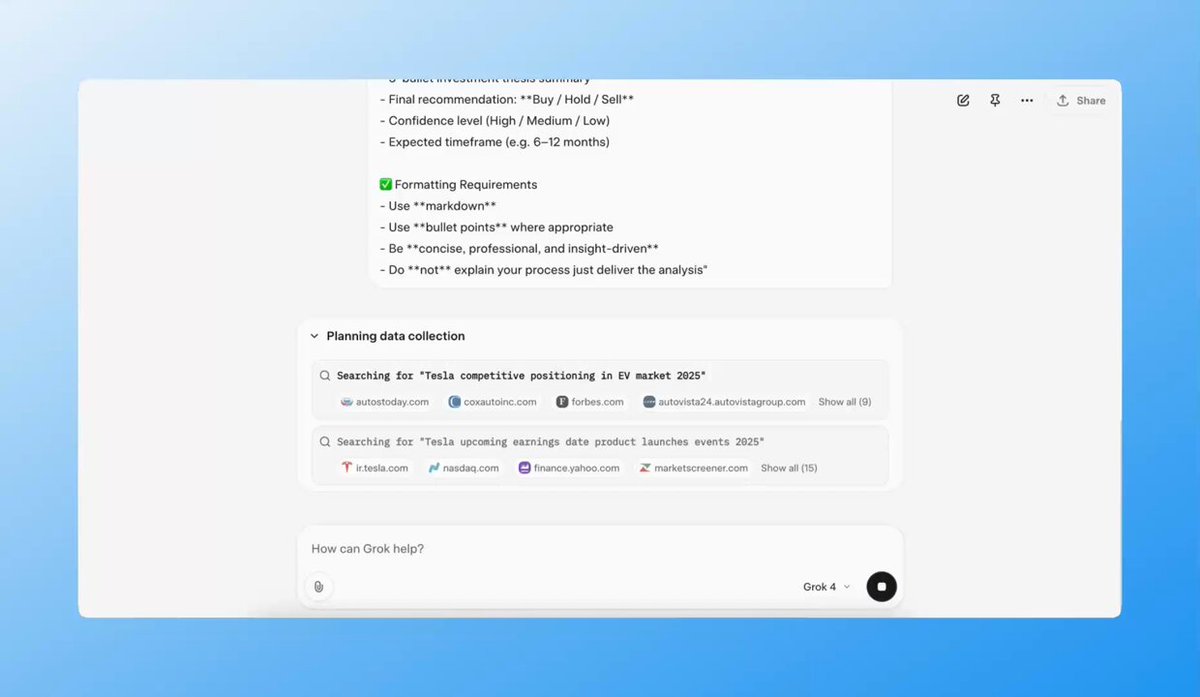

Here's the mega prompt I used in Grok:

"ROLE:

Act as an elite equity research analyst at a top-tier investment fund. Your task is to analyze a company using both fundamental and macroeconomic perspectives. Structure your response according to the framework below.

Input Section (Fill this in)

Stock Ticker / Company Name: [Add name if you want specific analysis] Investment Thesis: [Add input here] Goal: [Add the goal here]

Instructions:

Use the following structure to deliver a clear, well-reasoned equity research report:

X. Fundamental Analysis

- Analyze revenue growth, gross & net margin trends, free cash flow

- Compare valuation metrics vs sector peers (P/E, EV/EBITDA, etc.)

- Review insider ownership and recent insider trades

X. Thesis Validation

- Present X arguments supporting the thesis

- Highlight X counter-arguments or key risks

- Provide a final verdict: Bullish / Bearish / Neutral with justification

X. Sector & Macro View

- Give a short sector overview

- Outline relevant macroeconomic trends

- Explain company’s competitive positioning

X. Catalyst Watch

- List upcoming events (earnings, product launches, regulation, etc.)

- Identify both short-term and long-term catalysts

X. Investment Summary

- 5-bullet investment thesis summary

- Final recommendation: Buy / Hold / Sell

- Confidence level (High / Medium / Low)

- Expected timeframe (e.g. 6–12 months)

✅ Formatting Requirements

- Use markdown

- Use bullet points where appropriate

- Be concise, professional, and insight-driven

- Do not explain your process just deliver the analysis""

XXXXXX engagements

Related Topics ticker mega investment