[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  The Kobeissi Letter [@KobeissiLetter](/creator/twitter/KobeissiLetter) on x 948.6K followers Created: 2025-07-14 21:59:00 UTC Government bond liquidity has never been worse: The Bloomberg Government Bond Liquidity Index hit a record XXX points on Monday. A higher reading in this index means LESS liquidity for global bond markets. The index has DOUBLED over the last several months, as government spending surged in the US and Japan. This means liquidity is now worse than during the 2008 Financial Crisis. As a result, long-term government bonds are selling off, with Japan’s 30Y bond yield hitting 3.15%, the second-highest level since its debut in 1999. At the same time, the 30Y Treasury yield is approaching XXXX% for the first time since May. Keep watching bonds.  XXXXXXX engagements  **Related Topics** [japan](/topic/japan) [doubled](/topic/doubled) [bloomberg](/topic/bloomberg) [government spending](/topic/government-spending) [Post Link](https://x.com/KobeissiLetter/status/1944879327201378733)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

The Kobeissi Letter @KobeissiLetter on x 948.6K followers

Created: 2025-07-14 21:59:00 UTC

The Kobeissi Letter @KobeissiLetter on x 948.6K followers

Created: 2025-07-14 21:59:00 UTC

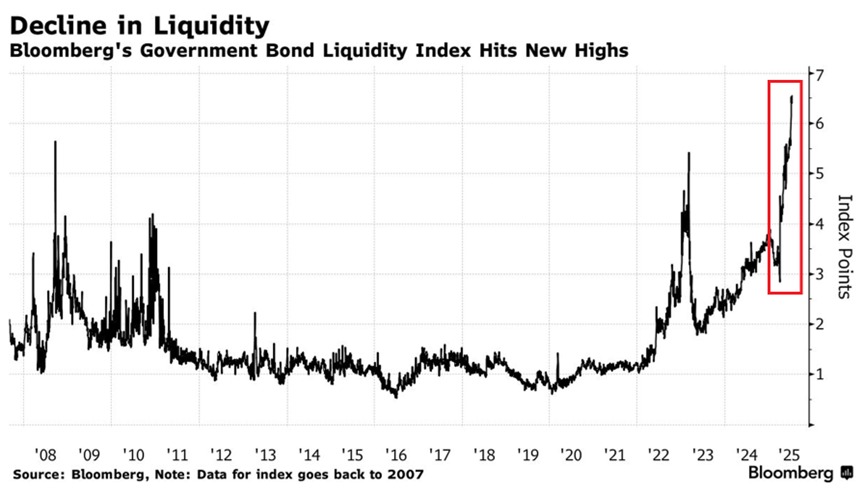

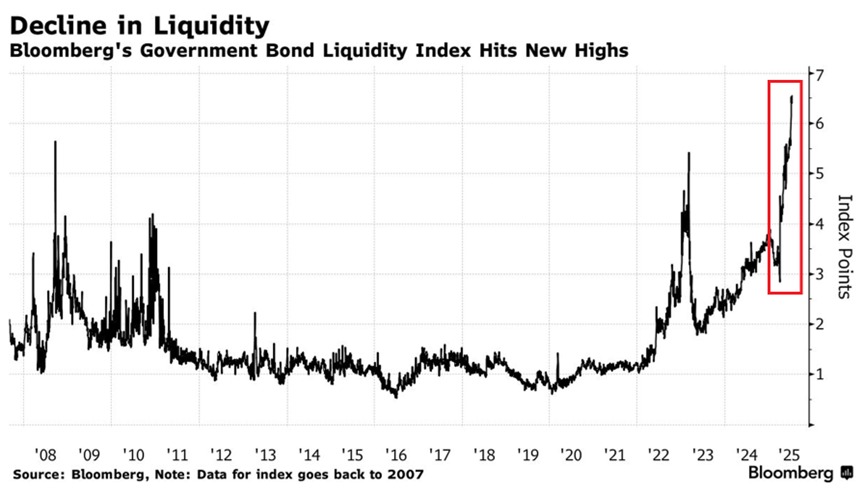

Government bond liquidity has never been worse:

The Bloomberg Government Bond Liquidity Index hit a record XXX points on Monday.

A higher reading in this index means LESS liquidity for global bond markets.

The index has DOUBLED over the last several months, as government spending surged in the US and Japan.

This means liquidity is now worse than during the 2008 Financial Crisis.

As a result, long-term government bonds are selling off, with Japan’s 30Y bond yield hitting 3.15%, the second-highest level since its debut in 1999.

At the same time, the 30Y Treasury yield is approaching XXXX% for the first time since May.

Keep watching bonds.

XXXXXXX engagements

Related Topics japan doubled bloomberg government spending