[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Cryptoguy49 [@Cryptoguy49](/creator/twitter/Cryptoguy49) on x XXX followers Created: 2025-07-14 20:48:54 UTC Most people still think of Lombard as “just another BTC LST.” That take completely misses the bigger picture. Lombard isn’t just building a product. It’s assembling an ecosystem a modular infrastructure mesh designed to make $LBTC usable at scale across the onchain economy. This isn’t a partner list. It’s an execution stack. X. Yield Infrastructure BTC has no native yield. That’s where vault design and collateral mechanics matter. Lombard integrates: Babylon BTC staking via trust minimized validator participation Veda, Concrete, Turtle vault engines and LSD frameworks tailored for Bitcoin-based assets This is what enables real, chain agnostic BTC yield. X. Restaking Alignment Restaking isn’t a narrative it’s a capital layer. Lombard connects $LBTC to: EigenLayer, Symbiotic, Karak opening the door for BTC to secure and earn across middleware and data networks This means $LBTC can sit at the intersection of BTC security and Ethereum style yield. X. Cross Chain Liquidity Routing BTC liquidity is fragmented. Lombard solves this by integrating: LayerZero, Axelar, Hyperlane modular transport rails This allows $LBTC to move across chains without relying on wrappers or custodial bridges. It’s about asset mobility with integrity. X. Real DeFi Liquidity Lombard isn’t listing $LBTC on dead DEXs to farm headlines. It’s pushing for depth where it matters: Curve, Balancer, Camelot, Sushi high liquidity venues with actual user flow This is how BTC gets plugged into DeFi liquidity layers with minimal slippage and real exposure. X. Onchain Price Infrastructure None of this works without reliable data. Lombard integrates: Redstone, Stork, Pyth oracle networks providing secure, low latency price feeds Essential for vault safety, liquidation logic, and TVL accuracy. This is the full stack. From staking to restaking, vaults to liquidity, oracles to cross-chain flows Lombard is building a modular system that turns BTC into programmable collateral. If you're still thinking of this as a wrapper or a copy paste LST, you’ve missed the execution layer completely. This is infrastructure. And it's already shipping. @Lombard_Finance @JacobPPhillips  XXX engagements  **Related Topics** [lbtc](/topic/lbtc) [onchain](/topic/onchain) [bitcoin](/topic/bitcoin) [coins layer 1](/topic/coins-layer-1) [coins bitcoin ecosystem](/topic/coins-bitcoin-ecosystem) [coins pow](/topic/coins-pow) [$lbtc](/topic/$lbtc) [coins pos](/topic/coins-pos) [Post Link](https://x.com/Cryptoguy49/status/1944861687418597833)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Cryptoguy49 @Cryptoguy49 on x XXX followers

Created: 2025-07-14 20:48:54 UTC

Cryptoguy49 @Cryptoguy49 on x XXX followers

Created: 2025-07-14 20:48:54 UTC

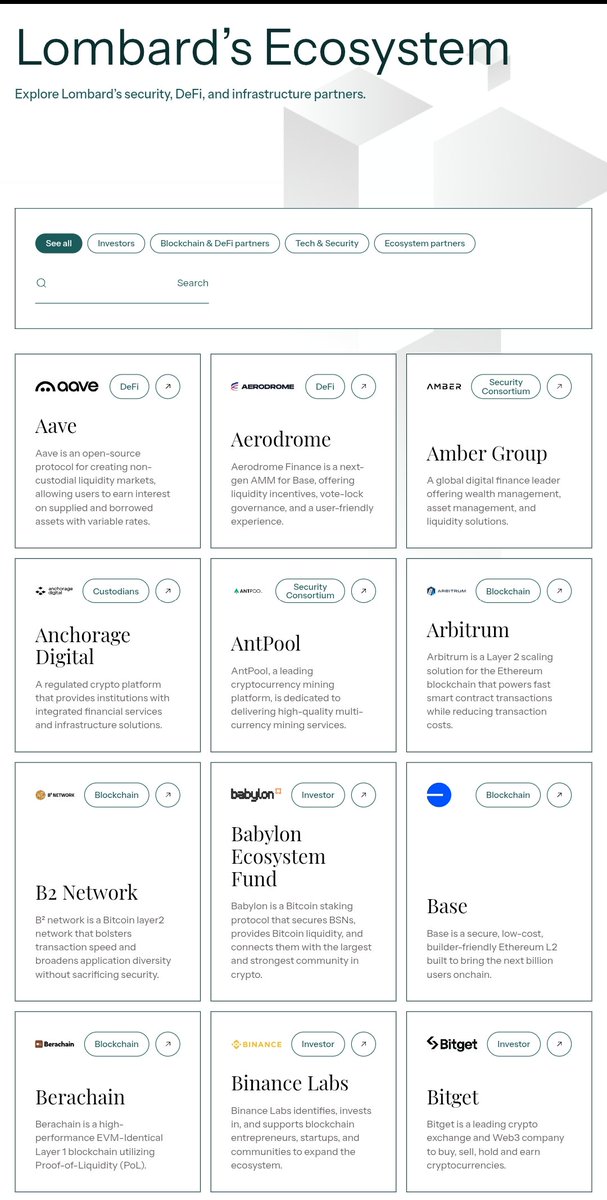

Most people still think of Lombard as “just another BTC LST.” That take completely misses the bigger picture.

Lombard isn’t just building a product. It’s assembling an ecosystem a modular infrastructure mesh designed to make $LBTC usable at scale across the onchain economy.

This isn’t a partner list. It’s an execution stack.

X. Yield Infrastructure BTC has no native yield. That’s where vault design and collateral mechanics matter. Lombard integrates:

Babylon BTC staking via trust minimized validator participation

Veda, Concrete, Turtle vault engines and LSD frameworks tailored for Bitcoin-based assets

This is what enables real, chain agnostic BTC yield.

X. Restaking Alignment Restaking isn’t a narrative it’s a capital layer. Lombard connects $LBTC to:

EigenLayer, Symbiotic, Karak opening the door for BTC to secure and earn across middleware and data networks

This means $LBTC can sit at the intersection of BTC security and Ethereum style yield.

X. Cross Chain Liquidity Routing BTC liquidity is fragmented. Lombard solves this by integrating:

LayerZero, Axelar, Hyperlane modular transport rails This allows $LBTC to move across chains without relying on wrappers or custodial bridges.

It’s about asset mobility with integrity.

X. Real DeFi Liquidity Lombard isn’t listing $LBTC on dead DEXs to farm headlines. It’s pushing for depth where it matters:

Curve, Balancer, Camelot, Sushi high liquidity venues with actual user flow This is how BTC gets plugged into DeFi liquidity layers with minimal slippage and real exposure.

X. Onchain Price Infrastructure None of this works without reliable data. Lombard integrates:

Redstone, Stork, Pyth oracle networks providing secure, low latency price feeds Essential for vault safety, liquidation logic, and TVL accuracy.

This is the full stack. From staking to restaking, vaults to liquidity, oracles to cross-chain flows Lombard is building a modular system that turns BTC into programmable collateral.

If you're still thinking of this as a wrapper or a copy paste LST, you’ve missed the execution layer completely.

This is infrastructure. And it's already shipping. @Lombard_Finance @JacobPPhillips

XXX engagements

Related Topics lbtc onchain bitcoin coins layer 1 coins bitcoin ecosystem coins pow $lbtc coins pos