[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  TokenLogic [@Token_Logic](/creator/twitter/Token_Logic) on x 1883 followers Created: 2025-07-14 15:12:33 UTC Just in case you missed it, and because we love when the truth is this obvious: On Aave, there’s over $1.4B in stablecoin liquidity. Want to borrow $100M in USDC? It will cost you just 5.27%, barely a XXX% increase from the current rate. Meanwhile you simply can’t borrow more than $38M in stablecoins across all the vaults of a protocol that claims to be “ready for institutional onchain adoption". Want to borrow that full $38M? Get ready to juggle between multiple vaults and pay around 15%. Thanks for the privilege, really. And by the way, this isn’t our data. It’s straight from one of their own risk team dashboards: On top of that, Aave Labs is building Horizon, a tokenization initiative that creates RWA products for institutions, where regulatory compliance still requires some level of centralization to integrate smoothly with permissionless DeFi. That is what a protocol truly ready for institutional capital looks like: deep liquidity, robust security, and dedicated instances designed to onboard serious funds.  XXXXXX engagements  **Related Topics** [all the](/topic/all-the) [onchain](/topic/onchain) [protocol](/topic/protocol) [stablecoins](/topic/stablecoins) [$38m](/topic/$38m) [$100m](/topic/$100m) [$14b](/topic/$14b) [coins stablecoin](/topic/coins-stablecoin) [Post Link](https://x.com/Token_Logic/status/1944777041435652179)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

TokenLogic @Token_Logic on x 1883 followers

Created: 2025-07-14 15:12:33 UTC

TokenLogic @Token_Logic on x 1883 followers

Created: 2025-07-14 15:12:33 UTC

Just in case you missed it, and because we love when the truth is this obvious:

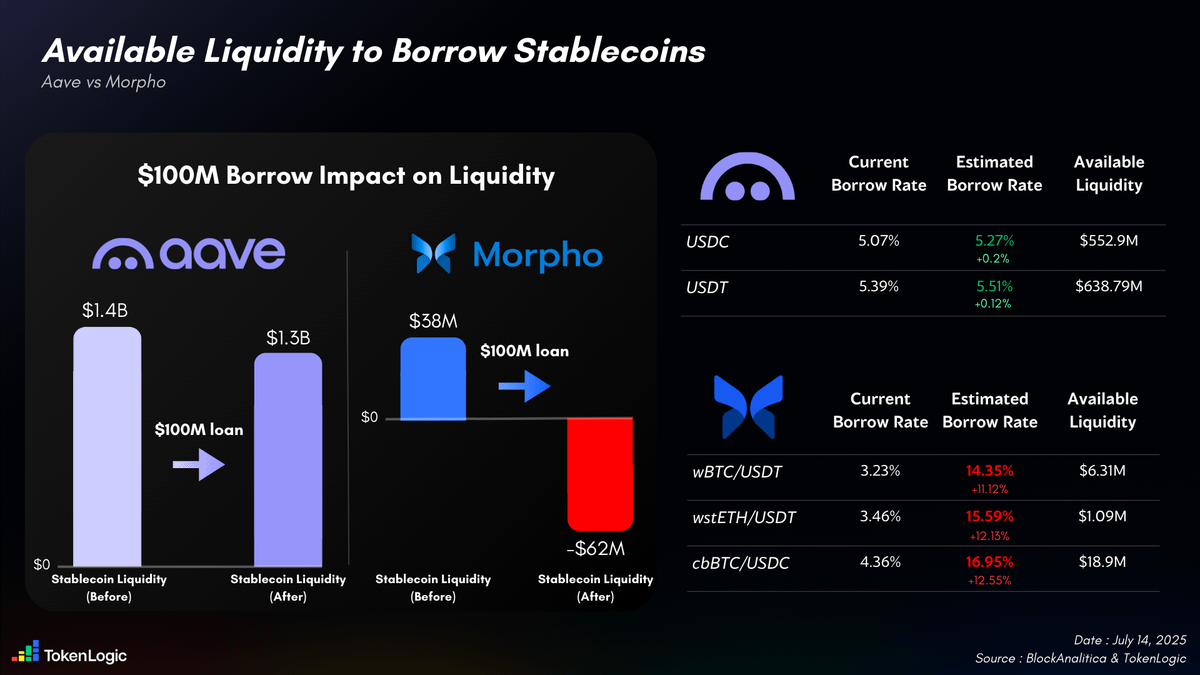

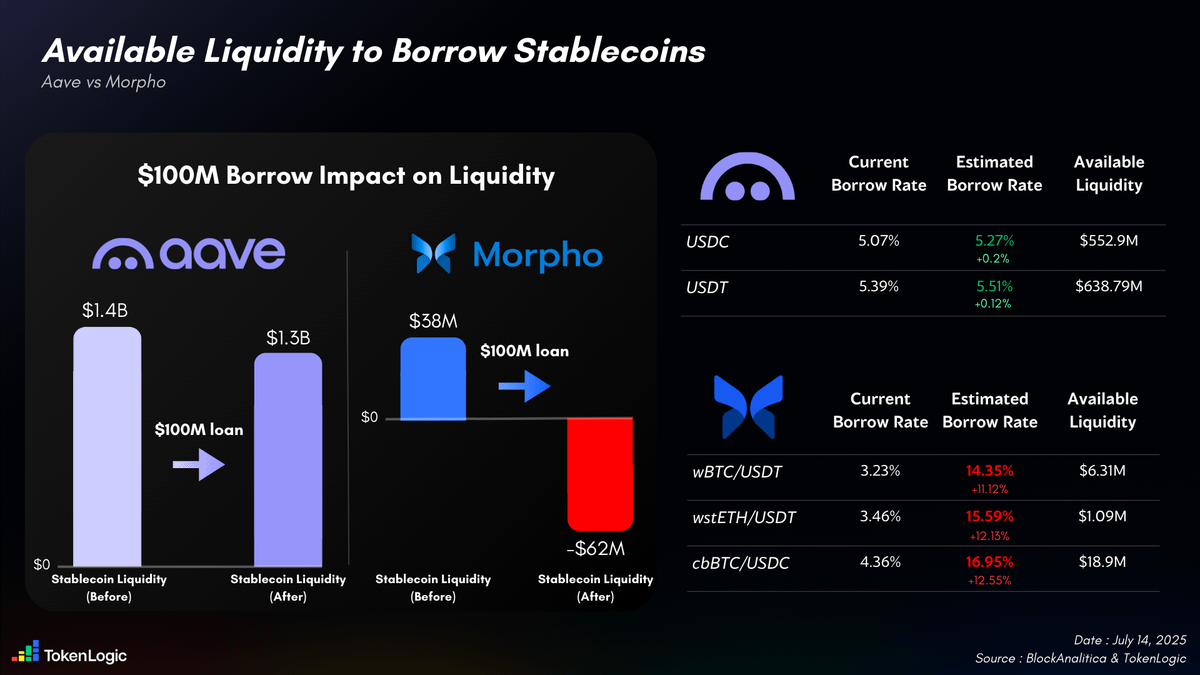

On Aave, there’s over $1.4B in stablecoin liquidity. Want to borrow $100M in USDC? It will cost you just 5.27%, barely a XXX% increase from the current rate.

Meanwhile you simply can’t borrow more than $38M in stablecoins across all the vaults of a protocol that claims to be “ready for institutional onchain adoption".

Want to borrow that full $38M? Get ready to juggle between multiple vaults and pay around 15%. Thanks for the privilege, really.

And by the way, this isn’t our data. It’s straight from one of their own risk team dashboards:

On top of that, Aave Labs is building Horizon, a tokenization initiative that creates RWA products for institutions, where regulatory compliance still requires some level of centralization to integrate smoothly with permissionless DeFi.

That is what a protocol truly ready for institutional capital looks like: deep liquidity, robust security, and dedicated instances designed to onboard serious funds.

XXXXXX engagements

Related Topics all the onchain protocol stablecoins $38m $100m $14b coins stablecoin