[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Ajit Singh [@ajit_x_singh](/creator/twitter/ajit_x_singh) on x XXX followers Created: 2025-07-14 14:54:54 UTC Most Active Large Cap Names with the Highest IV Skew This AM (Left) vs Largest IV Skew in Large Caps (Right): $CRCL $NVDA $CRWV $ENPH $AVGO $MU $PYPL $BABA $CVNA $DIS $BAC $BA $RKLB $TEM $NKE $FCX $OKLO $OXY $UBER $ARM $EXPD $HDB $CB $CNM $DLR $CCEP $GWW $CNA $KNSL $REG $ARGX $EW $AMP $ASR $EXR $RNR $CAH $CHRW $CSL A Few Notes: SKEW = (25dPut IV − 25dCall) - IV Higher = downside puts more expensive. NormSKEW = (Skew ÷ ATM IV[30d]) - Normalizes for stocks with high vol. This is the most meaningful measure. %ile (far right) = How extreme is this vs past XX weeks - High = unusual skew cc: #lizjny  XXXXX engagements  **Related Topics** [expd](/topic/expd) [asr](/topic/asr) [reg](/topic/reg) [oxy](/topic/oxy) [tem](/topic/tem) [dis](/topic/dis) [pypl](/topic/pypl) [nvda](/topic/nvda) [Post Link](https://x.com/ajit_x_singh/status/1944772600288207213)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Ajit Singh @ajit_x_singh on x XXX followers

Created: 2025-07-14 14:54:54 UTC

Ajit Singh @ajit_x_singh on x XXX followers

Created: 2025-07-14 14:54:54 UTC

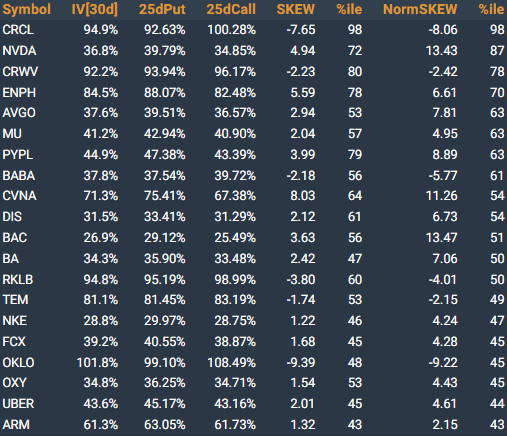

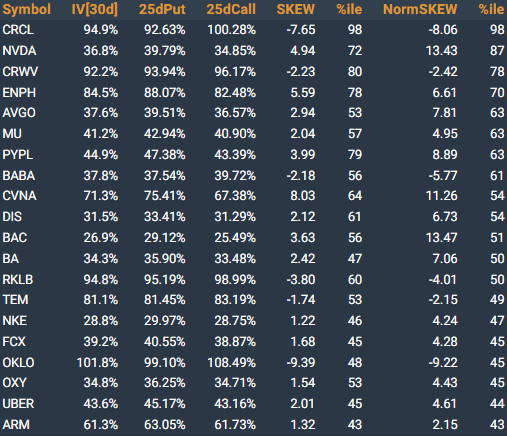

Most Active Large Cap Names with the Highest IV Skew This AM (Left) vs Largest IV Skew in Large Caps (Right):

$CRCL $NVDA $CRWV $ENPH $AVGO $MU $PYPL $BABA $CVNA $DIS $BAC $BA $RKLB $TEM $NKE $FCX $OKLO $OXY $UBER $ARM

$EXPD $HDB $CB $CNM $DLR $CCEP $GWW $CNA $KNSL $REG $ARGX $EW $AMP $ASR $EXR $RNR $CAH $CHRW $CSL

A Few Notes:

SKEW = (25dPut IV − 25dCall) - IV Higher = downside puts more expensive.

NormSKEW = (Skew ÷ ATM IV[30d]) - Normalizes for stocks with high vol. This is the most meaningful measure.

%ile (far right) = How extreme is this vs past XX weeks - High = unusual skew

cc: #lizjny

XXXXX engagements