[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Sergey [@SergeyCYW](/creator/twitter/SergeyCYW) on x 6333 followers Created: 2025-07-14 14:27:05 UTC Let's consider the Rule of XX metric for evaluating SaaS* companies compared to valuation by EV/S multiple (next year). The Rule of XX helps investors balance growth and profitability, offering deeper insights into company efficiency, unlike EV/S multiples which reflect only revenue expectations. Combining both metrics ensures you're paying a fair price for sustainable, high-quality growth rather than chasing top-line expansion alone. A company meeting or exceeding the XX% threshold is generally viewed positively, attracting investors who value both growth and profitability. In this analysis, I've used GAAP EBITDA Margin (TTM) combined with next year's revenue growth estimates. The Rule of XX is particularly valuable for comparing SaaS companies at different stages and scales. *-Selection criteria: software companies with the majority of their revenue subscription-based, EV over $X billion, and a gross margin above 40%. From the chart below, we can conclude that companies with a Rule of XX score above XX can be divided into categories: Undervalued: $DOCN $GOOGL $PAYC $ORCL $MSFT Fairly valued: $VEEV $INTU $FTNT $DT Overvalued: $PLTR $AXON $NET $CRWD P.S. To make the data on the chart easier to read, I removed $PLTR, which is trading at XXXX EV/Sales.  XXXXX engagements  **Related Topics** [saas](/topic/saas) [Post Link](https://x.com/SergeyCYW/status/1944765597147099582)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Sergey @SergeyCYW on x 6333 followers

Created: 2025-07-14 14:27:05 UTC

Sergey @SergeyCYW on x 6333 followers

Created: 2025-07-14 14:27:05 UTC

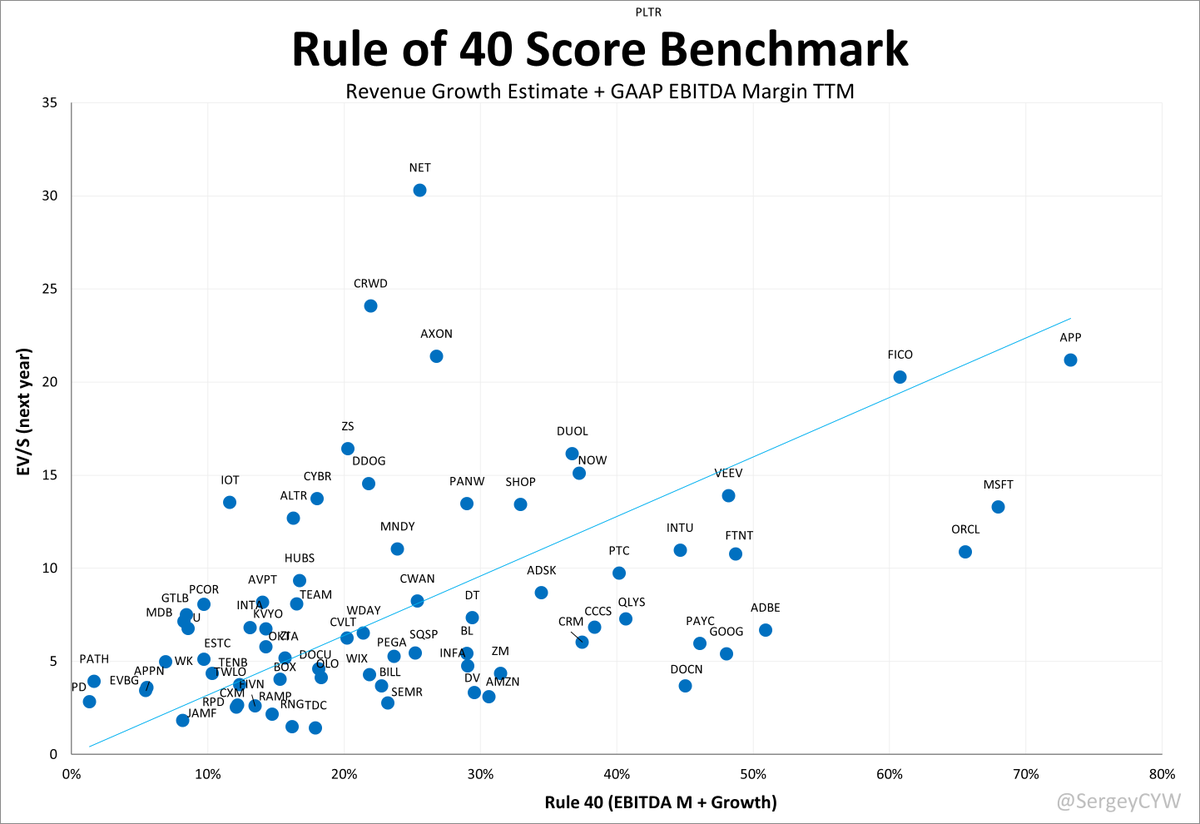

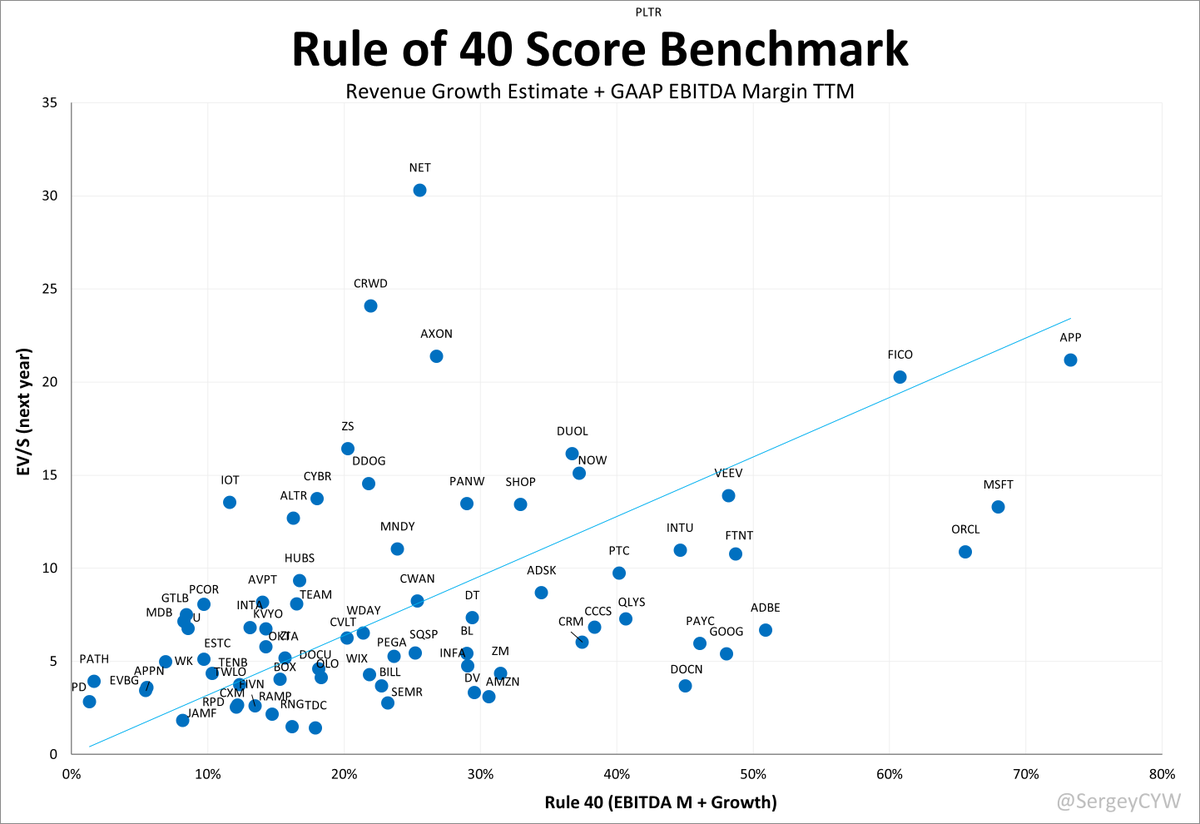

Let's consider the Rule of XX metric for evaluating SaaS* companies compared to valuation by EV/S multiple (next year).

The Rule of XX helps investors balance growth and profitability, offering deeper insights into company efficiency, unlike EV/S multiples which reflect only revenue expectations. Combining both metrics ensures you're paying a fair price for sustainable, high-quality growth rather than chasing top-line expansion alone.

A company meeting or exceeding the XX% threshold is generally viewed positively, attracting investors who value both growth and profitability. In this analysis, I've used GAAP EBITDA Margin (TTM) combined with next year's revenue growth estimates.

The Rule of XX is particularly valuable for comparing SaaS companies at different stages and scales.

*-Selection criteria: software companies with the majority of their revenue subscription-based, EV over $X billion, and a gross margin above 40%.

From the chart below, we can conclude that companies with a Rule of XX score above XX can be divided into categories: Undervalued: $DOCN $GOOGL $PAYC $ORCL $MSFT Fairly valued: $VEEV $INTU $FTNT $DT Overvalued: $PLTR $AXON $NET $CRWD

P.S. To make the data on the chart easier to read, I removed $PLTR, which is trading at XXXX EV/Sales.

XXXXX engagements

Related Topics saas