[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Next XXX Baggers [@Next100Baggers](/creator/twitter/Next100Baggers) on x 6128 followers Created: 2025-07-14 13:31:41 UTC 2/ $OSCR – Oscar Health Insider buy: Cofounder Josh Kushner & CEO Mark Bertolini dropped >$23M into stock in late 2024. All openmarket buys. Growth snapshot : Q1 2025 revenue: $3.05B (+42% YoY) Membership growth: +37% YoY First profitable quarter ever: $329M adj. EBITDA Claims SaaS platform now licensing to external insurers Gross margin rebounded to XXXXX% Why it’s broken: Legacy “insurtech junk pile” label. Trading at 0.2X forward sales despite hypergrowth and profitability. Why insiders are backing up the truck: Oscar isn’t just a health insurer anymore, it’s quietly becoming a software platform for payors and it’s positioned to ride the ICHRA wave as more employers shift to individual coverage platforms. Valuation already reflects worst case headlines but growth, margin expansion, and distribution optionality aren’t priced in.  XXXXX engagements  **Related Topics** [$329m](/topic/$329m) [$305b](/topic/$305b) [$23m](/topic/$23m) [insider](/topic/insider) [oscar](/topic/oscar) [$oscr](/topic/$oscr) [Post Link](https://x.com/Next100Baggers/status/1944751656526033315)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Next XXX Baggers @Next100Baggers on x 6128 followers

Created: 2025-07-14 13:31:41 UTC

Next XXX Baggers @Next100Baggers on x 6128 followers

Created: 2025-07-14 13:31:41 UTC

2/ $OSCR – Oscar Health

Insider buy: Cofounder Josh Kushner & CEO Mark Bertolini dropped >$23M into stock in late 2024. All openmarket buys.

Growth snapshot :

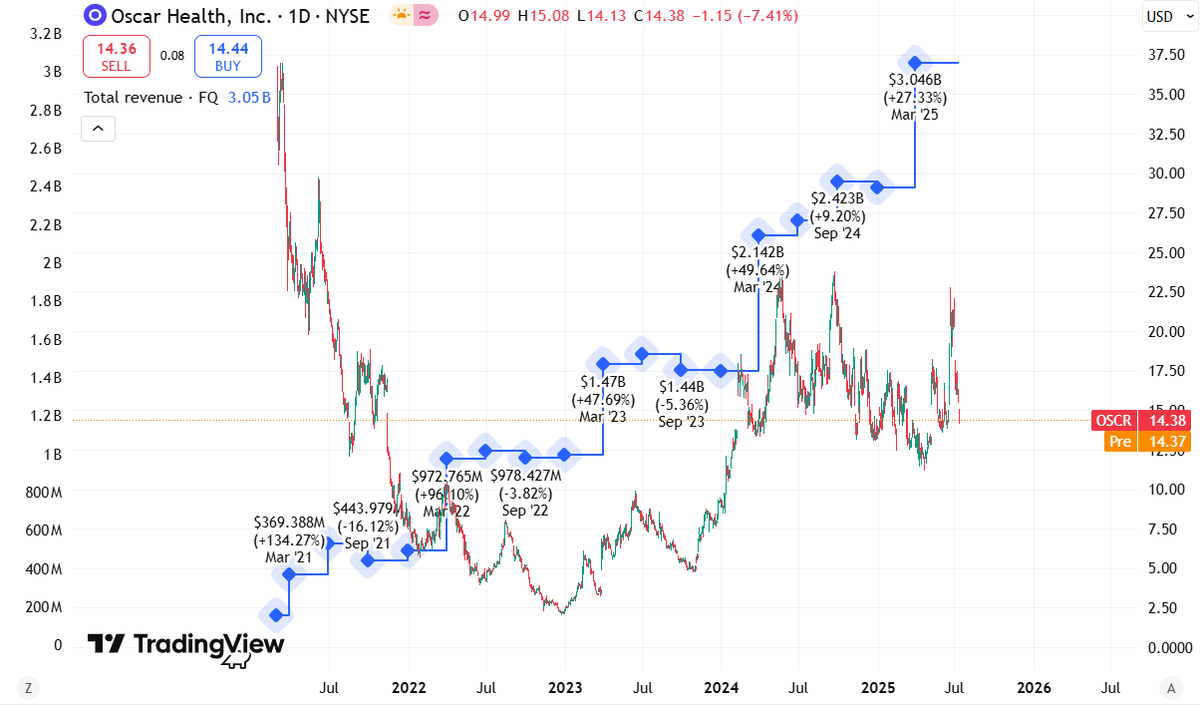

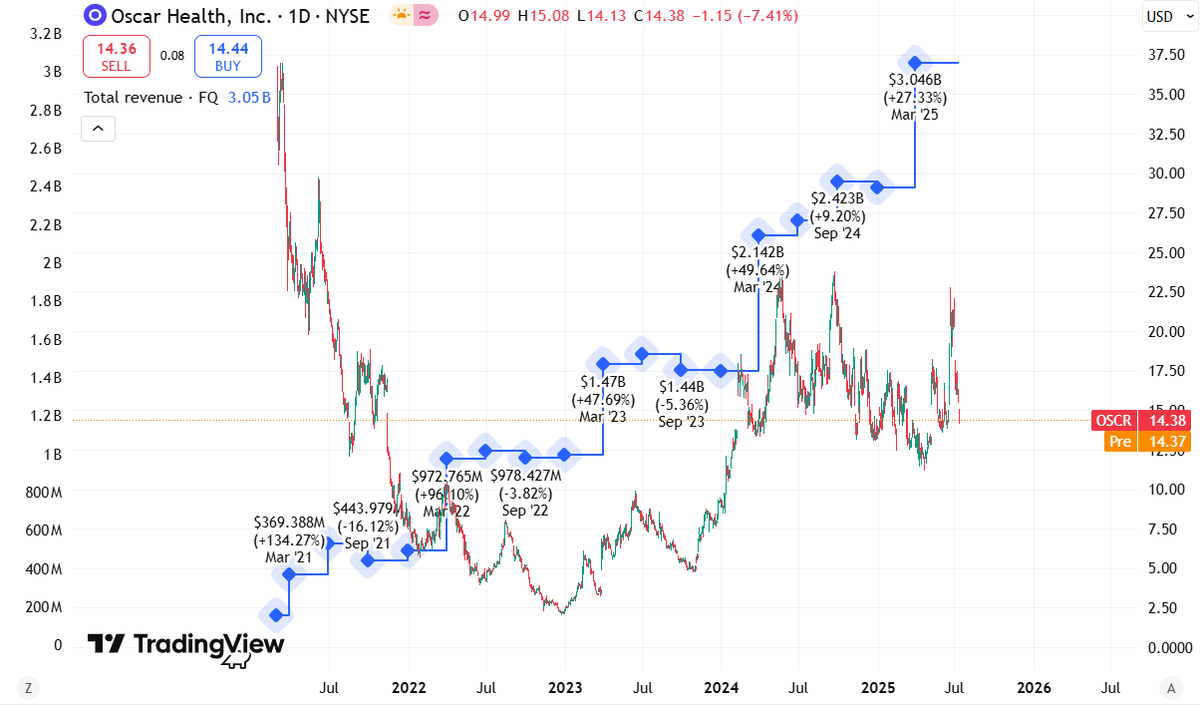

Q1 2025 revenue: $3.05B (+42% YoY) Membership growth: +37% YoY First profitable quarter ever: $329M adj. EBITDA

Claims SaaS platform now licensing to external insurers

Gross margin rebounded to XXXXX%

Why it’s broken: Legacy “insurtech junk pile” label. Trading at 0.2X forward sales despite hypergrowth and profitability.

Why insiders are backing up the truck: Oscar isn’t just a health insurer anymore, it’s quietly becoming a software platform for payors and it’s positioned to ride the ICHRA wave as more employers shift to individual coverage platforms.

Valuation already reflects worst case headlines but growth, margin expansion, and distribution optionality aren’t priced in.

XXXXX engagements