[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Made in Japan 🇯🇵 [@InvestInJapan](/creator/twitter/InvestInJapan) on x 8856 followers Created: 2025-07-14 08:43:04 UTC Alpha Purchase $7115.JP 🔩⚙️had a presentation last week. For this size company, I thought their IR was extremely good. A new nuance was that prior they were communicating to market that they were expecting margin expansion/inflection when revenue hits ¥100b in 2029. They admitted they were wrong here and the margin expansion is already starting to happen i.e. way in advance. Partly thanks to their new recommendation engine that helps customers find suppliers that provide the same product for cheaper. This negatively impacts revenue for AP but positive for margins/earnings. Although they didn't admit it, it almost sounded like they might even hit their 2029 margins sooner.. I continue to hold but had to trim because it became >20% of my port at one point lol, I'm looking to be a long-term holder as they continue to execute. The company is in a twilight zone, where its run up quickly, but around the 3000 JPY mark, they can start thinking about uplisting to Prime Market which should invite some high-quality shareholders + liquidity. The yellow is the annual gross revenue Churn for enterprise clients for MRO. Insane.  XXXXX engagements  **Related Topics** [$7115jp](/topic/$7115jp) [japan](/topic/japan) [Post Link](https://x.com/InvestInJapan/status/1944679026313826656)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Made in Japan 🇯🇵 @InvestInJapan on x 8856 followers

Created: 2025-07-14 08:43:04 UTC

Made in Japan 🇯🇵 @InvestInJapan on x 8856 followers

Created: 2025-07-14 08:43:04 UTC

Alpha Purchase $7115.JP 🔩⚙️had a presentation last week. For this size company, I thought their IR was extremely good.

A new nuance was that prior they were communicating to market that they were expecting margin expansion/inflection when revenue hits ¥100b in 2029. They admitted they were wrong here and the margin expansion is already starting to happen i.e. way in advance. Partly thanks to their new recommendation engine that helps customers find suppliers that provide the same product for cheaper. This negatively impacts revenue for AP but positive for margins/earnings. Although they didn't admit it, it almost sounded like they might even hit their 2029 margins sooner..

I continue to hold but had to trim because it became >20% of my port at one point lol, I'm looking to be a long-term holder as they continue to execute. The company is in a twilight zone, where its run up quickly, but around the 3000 JPY mark, they can start thinking about uplisting to Prime Market which should invite some high-quality shareholders + liquidity.

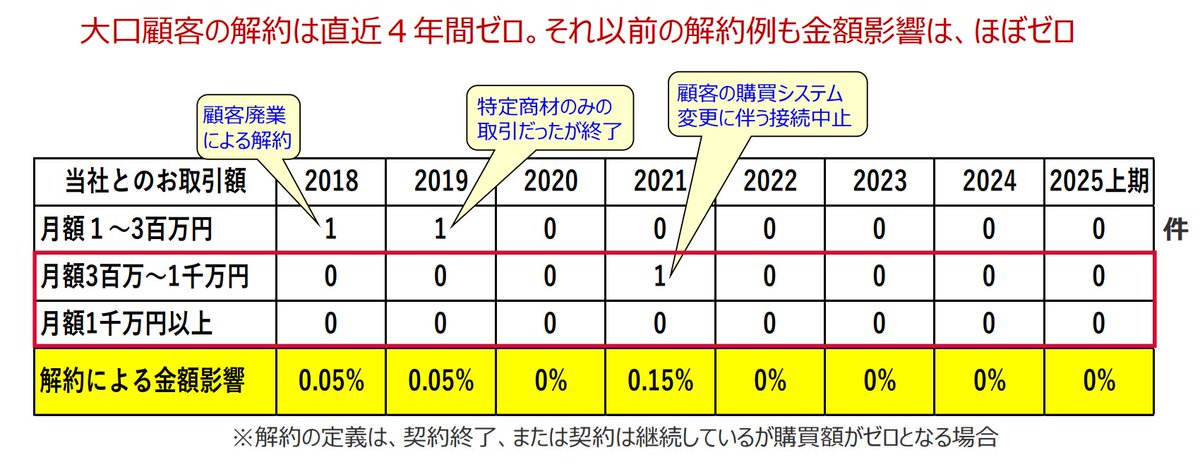

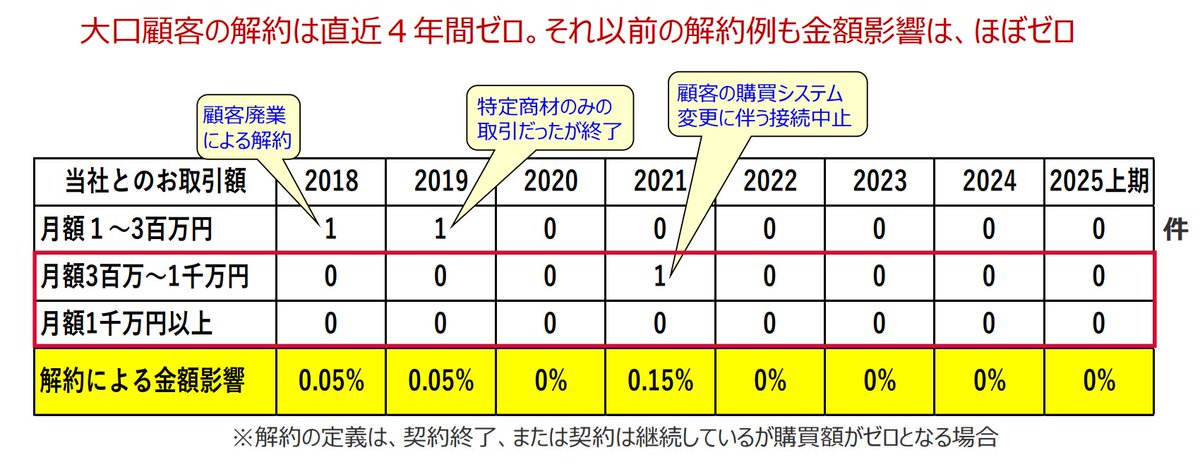

The yellow is the annual gross revenue Churn for enterprise clients for MRO. Insane.

XXXXX engagements