[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Framework Investment [@FrameworkWisely](/creator/twitter/FrameworkWisely) on x 4027 followers Created: 2025-07-13 20:20:16 UTC Investment Takeaways 👉ETH is mispriced relative to its structural role. It trades at less than XXXX BTC and under XX% of its 2021 USD peak, even as Ethereum’s network usage, value secured and institutional penetration all sit at all‑time highs. 👉Yield reshapes the risk‑reward equation. Staking turns $ETH into a productive asset enabling it to be compounded over time—something that’s unavailable to $BTC holders. 👉In portfolio construction, $ETH is the natural second core position in a digital asset sleeve that already holds $BTC. It offers broad beta to onchain GDP and a deflationary supply schedule, none of which Bitcoin provides. 👉Risk factors include execution risk on the roadmap, consensus bugs, fat‑protocol competition (e.g., Solana), regulatory pressure, and macro liquidity. Crucially, however, none of these change $ETH’s programmed supply mechanics. They shift the adoption curve’s timing, not its final destination.  XXX engagements  **Related Topics** [$eth](/topic/$eth) [staking](/topic/staking) [alltime](/topic/alltime) [united states dollar](/topic/united-states-dollar) [investment](/topic/investment) [ethereum](/topic/ethereum) [coins layer 1](/topic/coins-layer-1) [Post Link](https://x.com/FrameworkWisely/status/1944492092073689181)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Framework Investment @FrameworkWisely on x 4027 followers

Created: 2025-07-13 20:20:16 UTC

Framework Investment @FrameworkWisely on x 4027 followers

Created: 2025-07-13 20:20:16 UTC

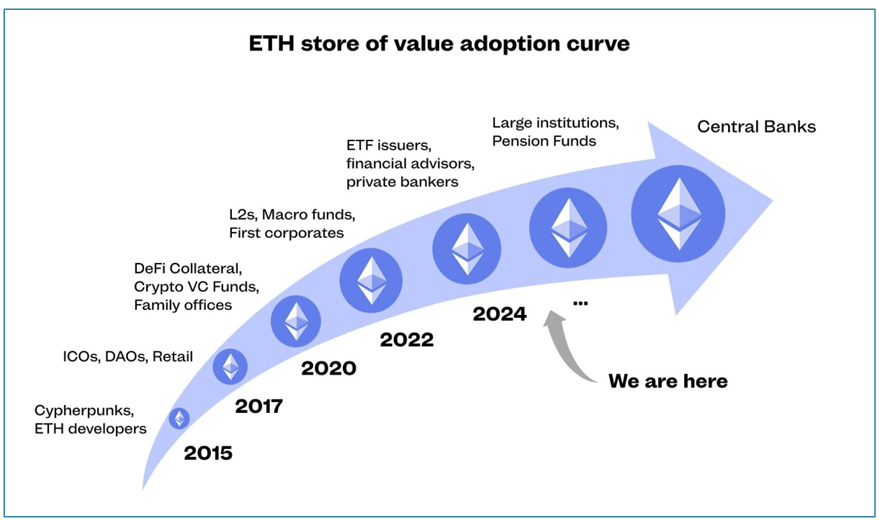

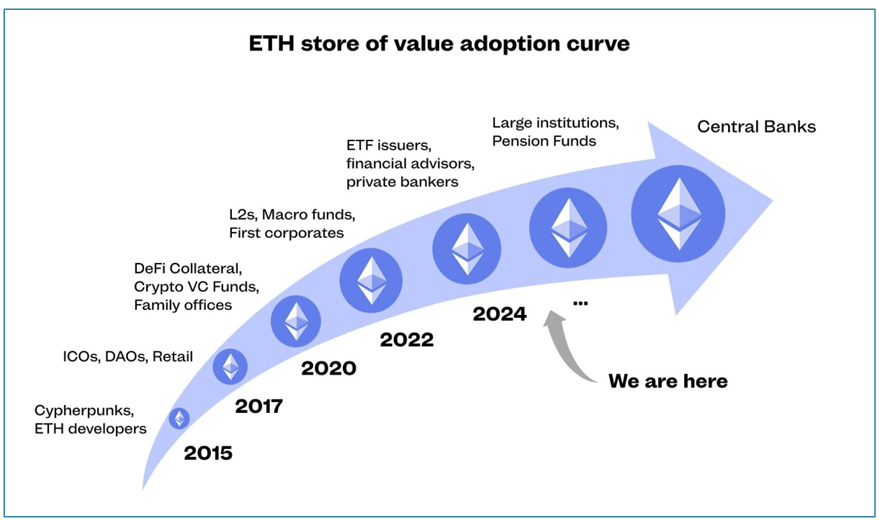

Investment Takeaways 👉ETH is mispriced relative to its structural role. It trades at less than XXXX BTC and under XX% of its 2021 USD peak, even as Ethereum’s network usage, value secured and institutional penetration all sit at all‑time highs.

👉Yield reshapes the risk‑reward equation. Staking turns $ETH into a productive asset enabling it to be compounded over time—something that’s unavailable to $BTC holders.

👉In portfolio construction, $ETH is the natural second core position in a digital asset sleeve that already holds $BTC. It offers broad beta to onchain GDP and a deflationary supply schedule, none of which Bitcoin provides.

👉Risk factors include execution risk on the roadmap, consensus bugs, fat‑protocol competition (e.g., Solana), regulatory pressure, and macro liquidity. Crucially, however, none of these change $ETH’s programmed supply mechanics. They shift the adoption curve’s timing, not its final destination.

XXX engagements

Related Topics $eth staking alltime united states dollar investment ethereum coins layer 1