[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  DarwinKnows [@Darwin_Knows](/creator/twitter/Darwin_Knows) on x XXX followers Created: 2025-07-13 19:40:05 UTC Evotec SE (Valuation - Very Expensive) Evotec SE has the worst Darwin score in Germany. Evotec SE has an overall darwin score of -XX and there is one alert. The valuation ratios for Evotec SE suggest it is very expensive. The Forward P/E ratio of XXXXXX is significantly higher than the peer average of 11.002, indicating that the stock is overvalued based on its earnings potential. The Enterprise Value to Revenue ratio of XXXXX is also higher than the peer average of 2.065, suggesting that the company is valued unfavorably in terms of its revenue generation. The Price to Sales ratio of XXXXX is below the peer average, but the overall high P/E ratios indicate that the stock may be overpriced. Thus, the overall valuation appears unfavorable, making it a less appealing option for investors. #DarwinKnows #Evotec #EVT $EVT.DE  XXX engagements  **Related Topics** [germany](/topic/germany) [darwin](/topic/darwin) [$evtde](/topic/$evtde) [Post Link](https://x.com/Darwin_Knows/status/1944481980453921079)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

DarwinKnows @Darwin_Knows on x XXX followers

Created: 2025-07-13 19:40:05 UTC

DarwinKnows @Darwin_Knows on x XXX followers

Created: 2025-07-13 19:40:05 UTC

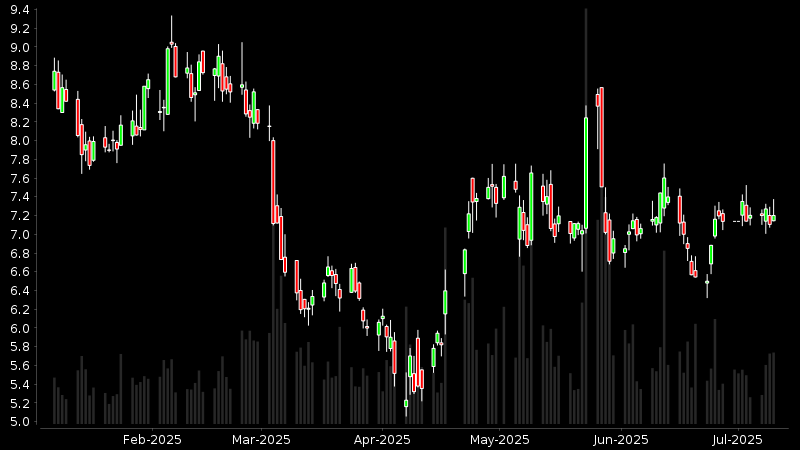

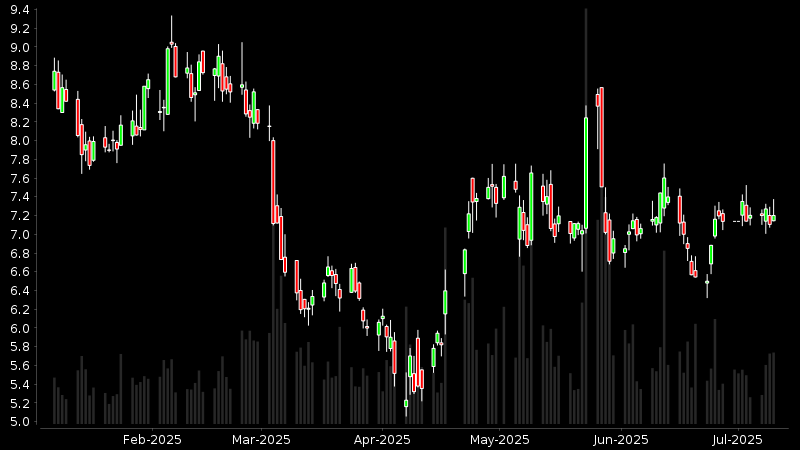

Evotec SE (Valuation - Very Expensive) Evotec SE has the worst Darwin score in Germany. Evotec SE has an overall darwin score of -XX and there is one alert. The valuation ratios for Evotec SE suggest it is very expensive. The Forward P/E ratio of XXXXXX is significantly higher than the peer average of 11.002, indicating that the stock is overvalued based on its earnings potential. The Enterprise Value to Revenue ratio of XXXXX is also higher than the peer average of 2.065, suggesting that the company is valued unfavorably in terms of its revenue generation. The Price to Sales ratio of XXXXX is below the peer average, but the overall high P/E ratios indicate that the stock may be overpriced. Thus, the overall valuation appears unfavorable, making it a less appealing option for investors.

#DarwinKnows #Evotec #EVT $EVT.DE

XXX engagements