[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Investors Compass [@selvaprathee](/creator/twitter/selvaprathee) on x 11.5K followers Created: 2025-07-13 18:54:30 UTC Scoda Tubes Ltd – Stainless Steel, Seamless Growth Ahead ? - Post IPO, this smallcap pipe player is doubling capacity, ramping exports, and expanding into high-demand welded segments. - Let’s decode the transition with hard numbers, capex milestones, and margin shifts 1⃣ From Pipes to Platform: Scoda’s Stack Scoda isn’t chasing volume for volume’s sake. ▪️Seamless Capacity: XXXXXX TPA ▪️Welded Capacity: XXXXX TPA ▪️Mother Hollow: XXXXXX TPA (hot piercing mill since May 2022) ➡️ In FY25, 85%+ of revenue came from seamless tubes, not welded. 2⃣ Capex That Reflects Intent, Not Just Scale Capex Outlay: ₹105 Cr (from IPO) ▪️₹55 Cr → Seamless Expansion ▪️₹45 Cr → Welded Pipe Expansion ▪️Timeline: Seamless ramp-up by Aug–Sep 2025 (H1 FY26) Welded pipes plant commercial by Q1 FY27 ▪️Finished Goods Capacity → XXXXXX TPA → XXXXXX TPA ➡️ 3x total output by FY27, not for chasing tubes, but strategic pipes 3⃣ Financials Show Operating Leverage Already Working ▪️Revenue stood at ₹484.9 Cr in FY25 ⬆️ XX% YoY ▪️EBITDA came in at ₹78.1 Cr ⬆️ XX% YoY ▪️PAT surged to ₹31.7 Cr ⬆️ XX% YoY ▪️EBITDA Margin: XXXX% (+139 bps YoY) ▪️PAT Margin: XXX% (+197 bps YoY) ▪️Return ratios remain robust: ◦ ROE: XXXX% ◦ ROCE: XXXX% ◦ Debt/Equity: 1.40× ➡️ Revenue is growing, but margin & PAT surge show operating leverage kicking in with scale. 4⃣ Q4 Margin Dip – Explained, Not Alarming ▪️Margin dip was due to higher mother hollow sales, which are lower-margin products ▪️Management clarified: From FY26, all mother hollows will be used in-house 🗣️ “The decline in gross margins was due to a higher proportion of mother hollow sales in Q4.” 🗣️ “Next year, these will be XXX% captive.” ➡️ Temporary product mix impact, not a structural issue. Margins expected to normalise. 5⃣ Welded Tubes ⛔ → Welded Pipes ✅ - Scoda is reshaping its welded product strategy. ▪️Current capacity: Welded tubes, demand declining ▪️New capex targets: Welded pipes, broader infra & commercial use ▪️Margin Profiles: ◦ Seamless: 16-18% EBITDA ◦ Welded Pipes: 12-13% EBITDA ◦ Blended: ~15-16% post-expansion ➡️ Management is pivoting into higher-growth, higher-margin product lines. 6⃣ Exports: Europe Now, US Next - FY25 Export Share: XX% ▪️Europe: XX% | Americas: X% ▪️Export footprint: XX countries ▪️Active stockists: XX (including exclusive partners in US & Europe) ▪️Europe office setup underway 🗣️ “We are setting up offices in Europe to manage logistics and customer interface locally.” ➡️ Scoda is evolving from an exporter to a globally-embedded supplier. 7⃣ Industry Tailwinds Support the Growth Thesis ▪️Global anti-China sentiment continues ▪️EU/US anti-dumping duties on Chinese steel remain in effect ▪️Domestic capacity still below global demand ▪️Industry growth for SS pipes & tubes: 6–8% CAGR (FY24–29) ▪️Management target: 15–20% volume CAGR 🗣️ “We aim to grow 2.5–3x the industry rate in volumes.” ➡️ Scoda is positioned to outgrow the sector, not just ride it. 8⃣ Where the Next Leg of Growth Will Come From Targeting approvals in new sectors: ▪️Marine ▪️Power ▪️Green Energy ▪️Defence ➡️ These sectors are not included in base growth guidance but offer future upside. 9⃣ Key Risks as Per Management ▪️No volume disclosure (competitive reasons) ▪️Q4 margins impacted by mother hollow mix (temporary) ▪️Revenue concentration: ◦ Top X Customers: XX% ◦ Top 10: XX% ▪️Debt/Equity: 1.40× ▪️No immediate plan to reduce finance costs ➡️ Execution + diversification are the key risks to monitor 🧭 Investor Compass Verdict – Pipes with Purpose - Scoda isn’t a vanilla pipe manufacturer anymore. - It’s transforming into a: ▪️Backward-integrated stainless player ▪️Export-anchored margin story ▪️Capex-backed volume compounder ▪️Strategically positioned for PSU infra and global sourcing shifts - If they execute, it compounds. If they delay, it de-rates. - High risk. High conviction. No Buy/Sell recommendation #StocksInFocus #StocksToWatch #scodatubes #Scoda  XXXXXX engagements  **Related Topics** [ipo](/topic/ipo) [stainless steel](/topic/stainless-steel) [Post Link](https://x.com/selvaprathee/status/1944470508977991891)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Investors Compass @selvaprathee on x 11.5K followers

Created: 2025-07-13 18:54:30 UTC

Investors Compass @selvaprathee on x 11.5K followers

Created: 2025-07-13 18:54:30 UTC

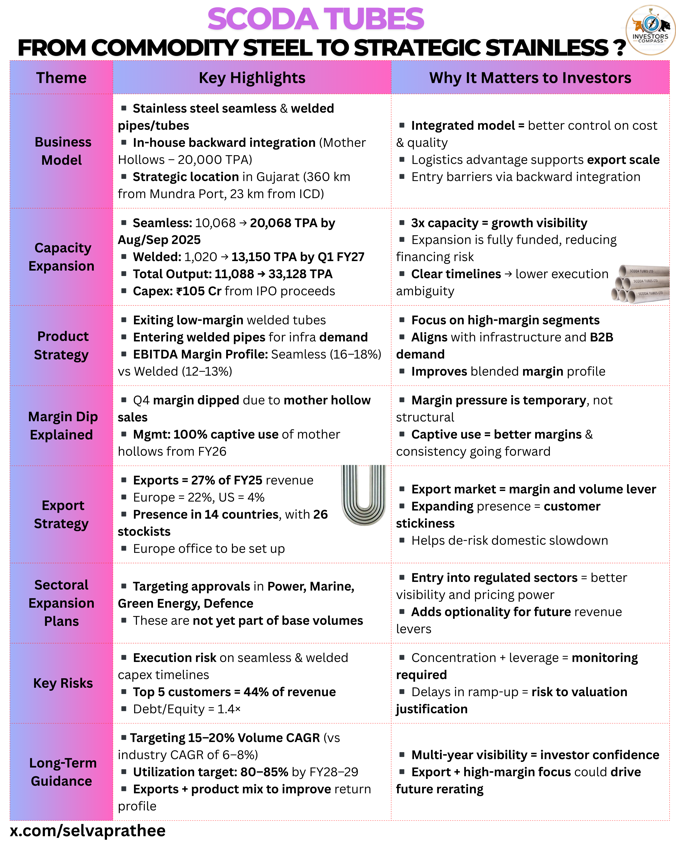

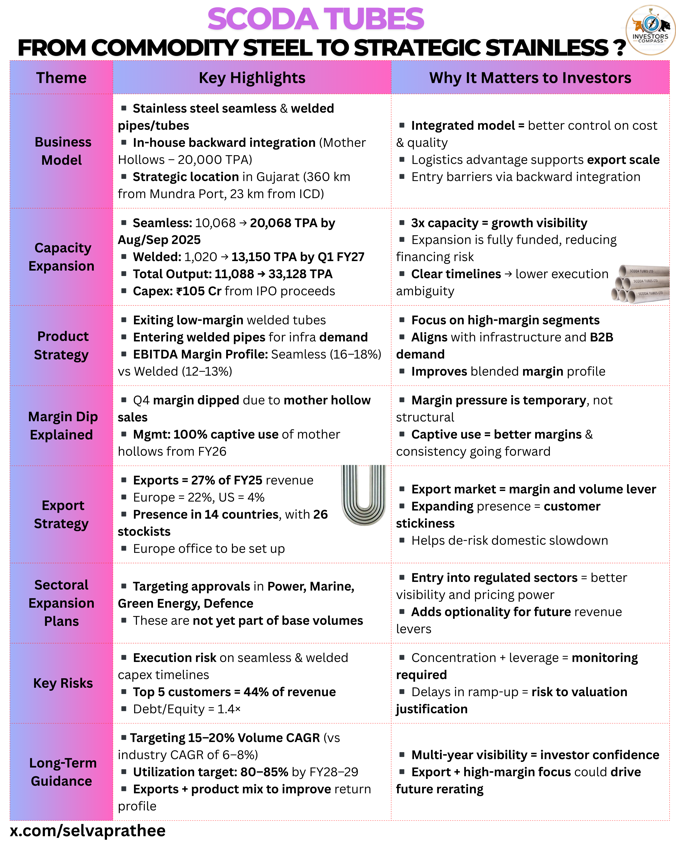

Scoda Tubes Ltd – Stainless Steel, Seamless Growth Ahead ?

- Post IPO, this smallcap pipe player is doubling capacity, ramping exports, and expanding into high-demand welded segments.

- Let’s decode the transition with hard numbers, capex milestones, and margin shifts

1⃣ From Pipes to Platform: Scoda’s Stack Scoda isn’t chasing volume for volume’s sake. ▪️Seamless Capacity: XXXXXX TPA ▪️Welded Capacity: XXXXX TPA ▪️Mother Hollow: XXXXXX TPA (hot piercing mill since May 2022) ➡️ In FY25, 85%+ of revenue came from seamless tubes, not welded.

2⃣ Capex That Reflects Intent, Not Just Scale Capex Outlay: ₹105 Cr (from IPO) ▪️₹55 Cr → Seamless Expansion ▪️₹45 Cr → Welded Pipe Expansion ▪️Timeline: Seamless ramp-up by Aug–Sep 2025 (H1 FY26) Welded pipes plant commercial by Q1 FY27 ▪️Finished Goods Capacity → XXXXXX TPA → XXXXXX TPA ➡️ 3x total output by FY27, not for chasing tubes, but strategic pipes

3⃣ Financials Show Operating Leverage Already Working ▪️Revenue stood at ₹484.9 Cr in FY25 ⬆️ XX% YoY ▪️EBITDA came in at ₹78.1 Cr ⬆️ XX% YoY ▪️PAT surged to ₹31.7 Cr ⬆️ XX% YoY ▪️EBITDA Margin: XXXX% (+139 bps YoY) ▪️PAT Margin: XXX% (+197 bps YoY) ▪️Return ratios remain robust: ◦ ROE: XXXX% ◦ ROCE: XXXX% ◦ Debt/Equity: 1.40× ➡️ Revenue is growing, but margin & PAT surge show operating leverage kicking in with scale.

4⃣ Q4 Margin Dip – Explained, Not Alarming ▪️Margin dip was due to higher mother hollow sales, which are lower-margin products ▪️Management clarified: From FY26, all mother hollows will be used in-house 🗣️ “The decline in gross margins was due to a higher proportion of mother hollow sales in Q4.” 🗣️ “Next year, these will be XXX% captive.” ➡️ Temporary product mix impact, not a structural issue. Margins expected to normalise.

5⃣ Welded Tubes ⛔ → Welded Pipes ✅

- Scoda is reshaping its welded product strategy. ▪️Current capacity: Welded tubes, demand declining ▪️New capex targets: Welded pipes, broader infra & commercial use ▪️Margin Profiles: ◦ Seamless: 16-18% EBITDA ◦ Welded Pipes: 12-13% EBITDA ◦ Blended: ~15-16% post-expansion ➡️ Management is pivoting into higher-growth, higher-margin product lines.

6⃣ Exports: Europe Now, US Next

- FY25 Export Share: XX% ▪️Europe: XX% | Americas: X% ▪️Export footprint: XX countries ▪️Active stockists: XX (including exclusive partners in US & Europe) ▪️Europe office setup underway 🗣️ “We are setting up offices in Europe to manage logistics and customer interface locally.” ➡️ Scoda is evolving from an exporter to a globally-embedded supplier.

7⃣ Industry Tailwinds Support the Growth Thesis ▪️Global anti-China sentiment continues ▪️EU/US anti-dumping duties on Chinese steel remain in effect ▪️Domestic capacity still below global demand ▪️Industry growth for SS pipes & tubes: 6–8% CAGR (FY24–29) ▪️Management target: 15–20% volume CAGR 🗣️ “We aim to grow 2.5–3x the industry rate in volumes.” ➡️ Scoda is positioned to outgrow the sector, not just ride it.

8⃣ Where the Next Leg of Growth Will Come From Targeting approvals in new sectors: ▪️Marine ▪️Power ▪️Green Energy ▪️Defence ➡️ These sectors are not included in base growth guidance but offer future upside.

9⃣ Key Risks as Per Management ▪️No volume disclosure (competitive reasons) ▪️Q4 margins impacted by mother hollow mix (temporary) ▪️Revenue concentration: ◦ Top X Customers: XX% ◦ Top 10: XX% ▪️Debt/Equity: 1.40× ▪️No immediate plan to reduce finance costs ➡️ Execution + diversification are the key risks to monitor

🧭 Investor Compass Verdict – Pipes with Purpose

- Scoda isn’t a vanilla pipe manufacturer anymore.

- It’s transforming into a: ▪️Backward-integrated stainless player ▪️Export-anchored margin story ▪️Capex-backed volume compounder ▪️Strategically positioned for PSU infra and global sourcing shifts

- If they execute, it compounds. If they delay, it de-rates.

- High risk. High conviction.

No Buy/Sell recommendation #StocksInFocus #StocksToWatch #scodatubes #Scoda

XXXXXX engagements

Related Topics ipo stainless steel