[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Yosuke🀄 [@yosuke_xyz](/creator/twitter/yosuke_xyz) on x XXX followers Created: 2025-07-13 14:49:37 UTC Lombard is quietly becoming the backbone of Bitcoin’s role in DeFi. This graphic reveals something powerful: nearly XX% of all $LBTC supply is actively used in DeFi protocols. That’s not just adoption, it’s utility. And when you break down where LBTC is going, it’s clear that @Lombard_Finance has built the most productive version of Bitcoin yet. Let’s unpack the strategy behind it all: ▫️ Cross-Chain DeFi Integration LBTC isn’t confined to one chain. It's spreading across Ethereum, Sui, Katana, and more. That means users can move BTC capital where it's most effective. By earning yield, collateralizing loans, or farming points. Top protocols using LBTC include: • EtherFi • Aave • Spark • Morpho • SatLayer • Katana • Pendle • Sentora, and many others. ▫️ Best Strategies for LBTC Holders Here’s how to make your Bitcoin work across different layers of DeFi: X. Dex Aggregators & AMMs Uniswap, Curve, Aerodrome, Momentum (Sui): Use LBTC in liquidity pools to earn swap fees and incentives. X. Money Markets Morpho, Aave, Euler, SuiLend: Supply LBTC as collateral or lend it out for yield. Great for looping strategies or borrowing stablecoins. X. Restaking Layers SatLayer, Symbiotic, Karak, EtherFi: Restake LBTC to enhance Bitcoin’s role in securing other networks and earn layered rewards. X. Vault Protocols Katana, Sentora, Sonic, TAC: Deposit LBTC into specialized vaults to earn boosted yield, ecosystem rewards, and even partner tokens like $KAT. X. Yield Leverage Platforms Pendle, Penpie, Concrete, Contango: Get creative with yield tokenization (Pendle YT) to amplify your Lux Points or optimize for high APY. ▫️ What This All Means Lombard isn’t just offering a wrapped Bitcoin. It’s created a dynamic, yield-bearing Bitcoin layer (LBTC) that integrates deeply into today’s most powerful DeFi stacks, all without bridges or custodians. Whether you’re yield farming, borrowing, looping, restaking, or farming points. $LBTC is now one of the most versatile assets in the crypto ecosystem. This is how Bitcoin becomes productive, programmable capital without losing its trustless core. If you’re still sitting on idle BTC, this is your signal. Lombard turned Bitcoin into the most powerful building block in DeFi. Are you using it yet? Shoutout to @Jonasoeth for the clean visuals 🫡  XXX engagements  **Related Topics** [lombardfinance](/topic/lombardfinance) [adoption](/topic/adoption) [$lbtc](/topic/$lbtc) [coins bitcoin ecosystem](/topic/coins-bitcoin-ecosystem) [coins pow](/topic/coins-pow) [coins pos](/topic/coins-pos) [bitcoin](/topic/bitcoin) [coins layer 1](/topic/coins-layer-1) [Post Link](https://x.com/yosuke_xyz/status/1944408880701681879)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Yosuke🀄 @yosuke_xyz on x XXX followers

Created: 2025-07-13 14:49:37 UTC

Yosuke🀄 @yosuke_xyz on x XXX followers

Created: 2025-07-13 14:49:37 UTC

Lombard is quietly becoming the backbone of Bitcoin’s role in DeFi.

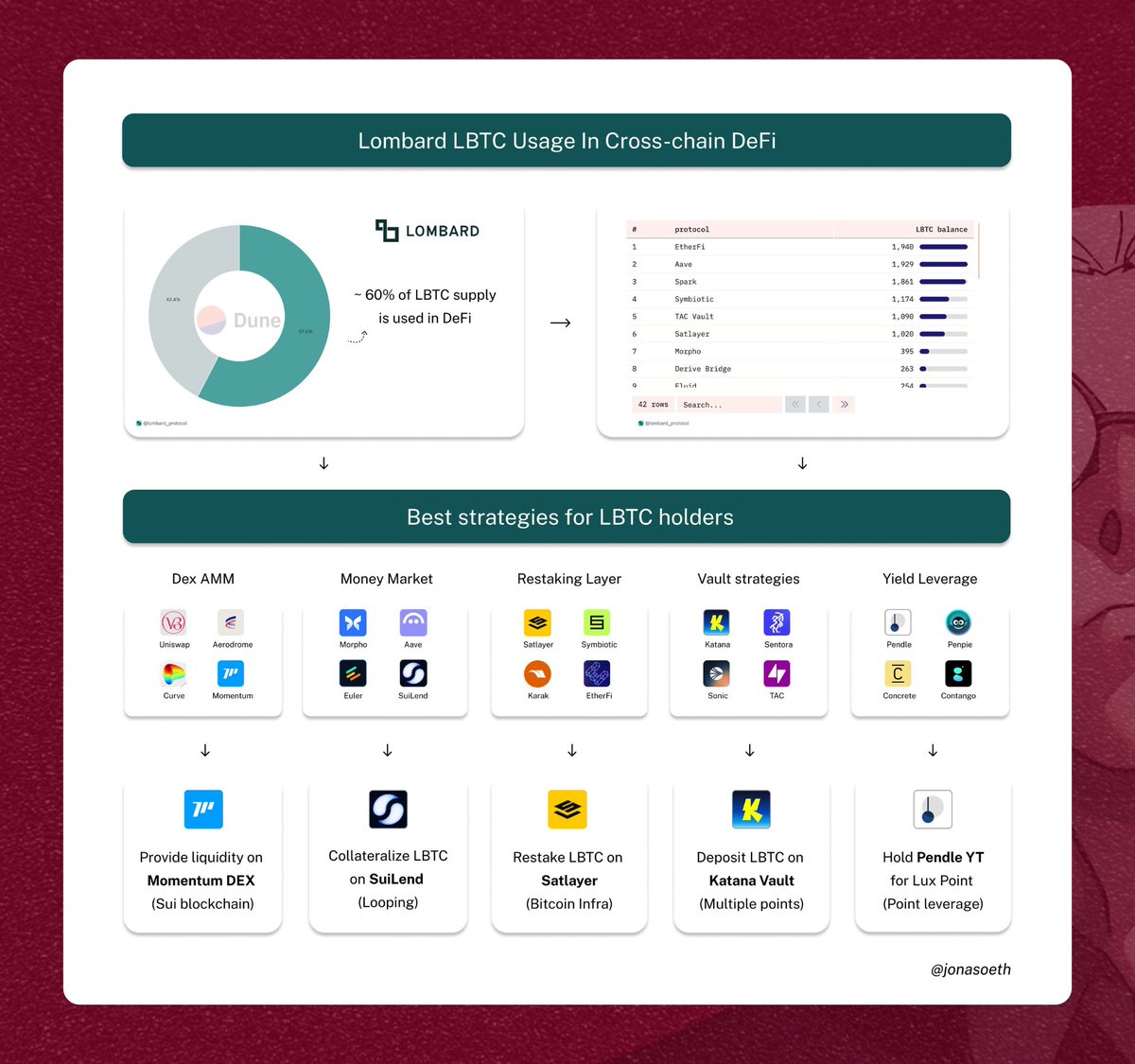

This graphic reveals something powerful: nearly XX% of all $LBTC supply is actively used in DeFi protocols. That’s not just adoption, it’s utility.

And when you break down where LBTC is going, it’s clear that @Lombard_Finance has built the most productive version of Bitcoin yet.

Let’s unpack the strategy behind it all:

▫️ Cross-Chain DeFi Integration

LBTC isn’t confined to one chain. It's spreading across Ethereum, Sui, Katana, and more. That means users can move BTC capital where it's most effective. By earning yield, collateralizing loans, or farming points.

Top protocols using LBTC include:

• EtherFi • Aave • Spark • Morpho • SatLayer • Katana • Pendle • Sentora, and many others.

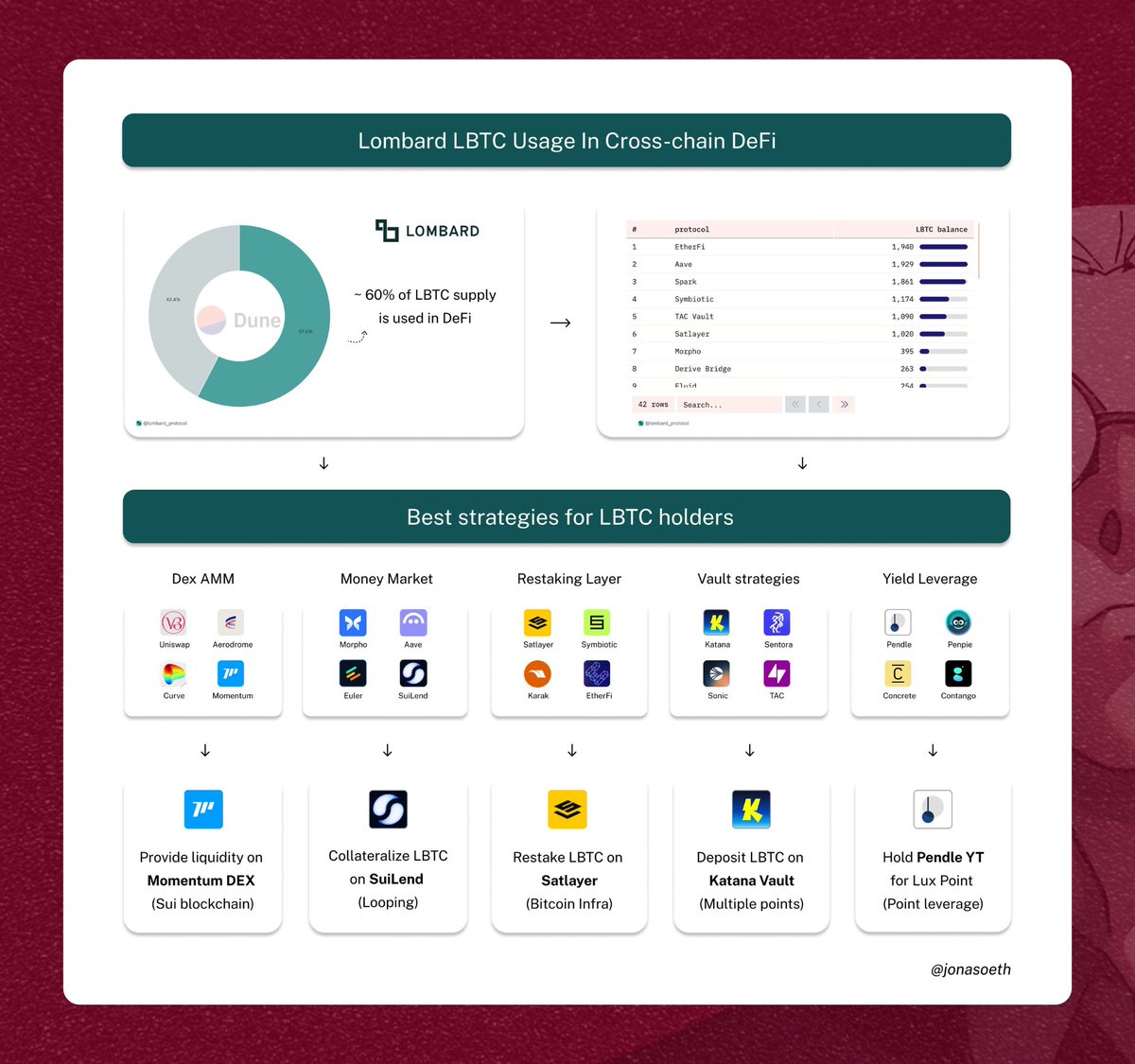

▫️ Best Strategies for LBTC Holders

Here’s how to make your Bitcoin work across different layers of DeFi:

X. Dex Aggregators & AMMs

Uniswap, Curve, Aerodrome, Momentum (Sui): Use LBTC in liquidity pools to earn swap fees and incentives.

X. Money Markets

Morpho, Aave, Euler, SuiLend: Supply LBTC as collateral or lend it out for yield. Great for looping strategies or borrowing stablecoins.

X. Restaking Layers

SatLayer, Symbiotic, Karak, EtherFi: Restake LBTC to enhance Bitcoin’s role in securing other networks and earn layered rewards.

X. Vault Protocols

Katana, Sentora, Sonic, TAC: Deposit LBTC into specialized vaults to earn boosted yield, ecosystem rewards, and even partner tokens like $KAT.

X. Yield Leverage Platforms

Pendle, Penpie, Concrete, Contango: Get creative with yield tokenization (Pendle YT) to amplify your Lux Points or optimize for high APY.

▫️ What This All Means

Lombard isn’t just offering a wrapped Bitcoin. It’s created a dynamic, yield-bearing Bitcoin layer (LBTC) that integrates deeply into today’s most powerful DeFi stacks, all without bridges or custodians.

Whether you’re yield farming, borrowing, looping, restaking, or farming points. $LBTC is now one of the most versatile assets in the crypto ecosystem.

This is how Bitcoin becomes productive, programmable capital without losing its trustless core.

If you’re still sitting on idle BTC, this is your signal.

Lombard turned Bitcoin into the most powerful building block in DeFi. Are you using it yet?

Shoutout to @Jonasoeth for the clean visuals 🫡

XXX engagements

Related Topics lombardfinance adoption $lbtc coins bitcoin ecosystem coins pow coins pos bitcoin coins layer 1