[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  THEDEFIPLUG [@TheDeFiPlug](/creator/twitter/TheDeFiPlug) on x 53.9K followers Created: 2025-07-13 13:26:37 UTC Crypto Roundup: Week #28 (July X - July 12, 2025) Narrative shift confirmed. Bitcoin broke ATHs. Ethereum outpaced it. But that’s not the story. The real signal was in how institutions, corporates, and protocols moved: -> BlackRock’s Bitcoin ETF printed $1B+ inflows two days in a row -> $ETH staking hit XXXX% as the Pectra upgrade kicked in -> SharpLink bought 10K $ETH OTC from the Ethereum Foundation to hold + restake -> @BitMNR and @BitDigital_BTBT pivoted their entire treasury strategy to $ETH -> ETF flows into Ethereum hit $907M in a week, double their previous high ● Market Stats $BTC - $XXXXXXX (+9.04%) - $2.34T market cap - $2.72B ETF inflow (7D) - ATH hit Friday $ETH - $XXXXX (+17.29%) - $357.1B market cap - $907.99M ETF inflow (7D) - XXXXX% of supply now staked ● Top Movers (>$200M MC) X. $M: +839.9% X. $XLM: +85.2% X. $MOG: +81.5% X. $IP: +48.6% X. $HBAR: +45.2% ● Sectors That Saw Significant Increase X. Directed Acyclic Graph (DAG): +37.9% X. Modular Chains: +26.8% X. RWA Infra: +25.6% X. DEX Aggregators: +25.2% X. Perps: +21.8% ● Fundraising Flows Liquidity rotated back to early-stage bets, but this time around, memes, infra, and AI split the pot. -> @pumpdotfun raised $500M in XX minutes -> Agora raised $50M from Paradigm (stablecoin infra) -> ZeroHash raising $100M at near-$1B valuation -> DigitalX raised $13.5M (Bitcoin treasury play) -> Harmonic AI closed a $100M Series B led by Kleiner + Paradigm -> ReserveOne targeting $1B raise ahead of Nasdaq listing ● Major Headline Stack - BTC ETFs hit $158B AUM, new all-time high - ETH ETFs: $1B+ inflows over X days - Kraken & Backed launch tokenized stocks on BNB Chain - Dubai approves tokenized MM fund with Qatar National Bank - GMX exploiter returns $40M - acquires Solana wallet tracker Kolscan - Myriad Protocol goes live on Linea, powered by EigenCloud - Australia greenlights next stage of Project Acacia (CBDC + tokenized settlement pilots) ● The Alpha $ETH has quietly become the reserve asset of crypto-native institutions. If you're still framing Ethereum as “tech infrastructure,” you're missing the bigger picture. The next bull wave isn’t just memes or L2s, it’s financialization of crypto-native collateral across chains, products, and real-world rails. ● What to Watch (Week #29) -> U.S. “Crypto Week” kicks off — key bills: GENIUS Act, Anti-CBDC, Stablecoin Framework -> Any ETF movement, especially on Cardano/AltL1s -> Restaking flywheel around ETH accelerates post-Pectra -> Early rotations into mid-cap BTCFi, RWA, and AI-DeFi hybrids continue -> Unlocks and new token drops could skew sector flows This was one of the clearest institutional inflection points we’ve seen in a while. $BTC led. $ETH ran faster. The stack is moving. Stay sharp.  XXXXXX engagements  **Related Topics** [10k](/topic/10k) [staking](/topic/staking) [$eth](/topic/$eth) [$1b](/topic/$1b) [fund manager](/topic/fund-manager) [bitcoin etf](/topic/bitcoin-etf) [bitcoin](/topic/bitcoin) [coins layer 1](/topic/coins-layer-1) [Post Link](https://x.com/TheDeFiPlug/status/1944387993101357508)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

THEDEFIPLUG @TheDeFiPlug on x 53.9K followers

Created: 2025-07-13 13:26:37 UTC

THEDEFIPLUG @TheDeFiPlug on x 53.9K followers

Created: 2025-07-13 13:26:37 UTC

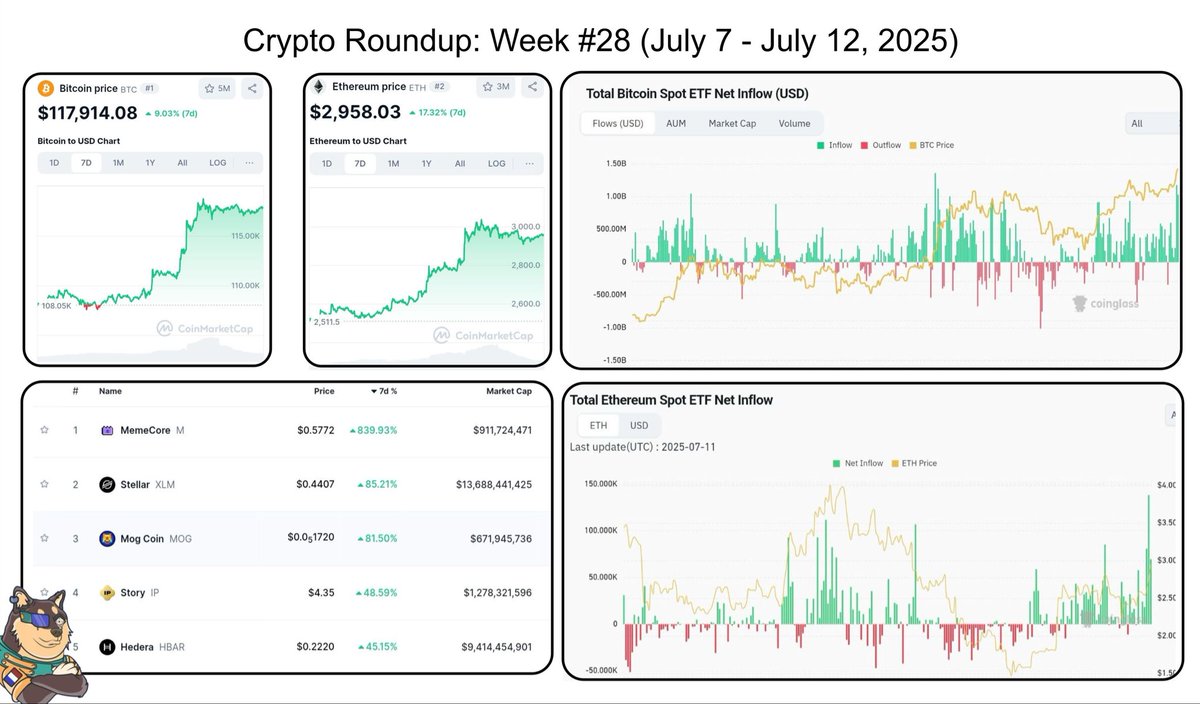

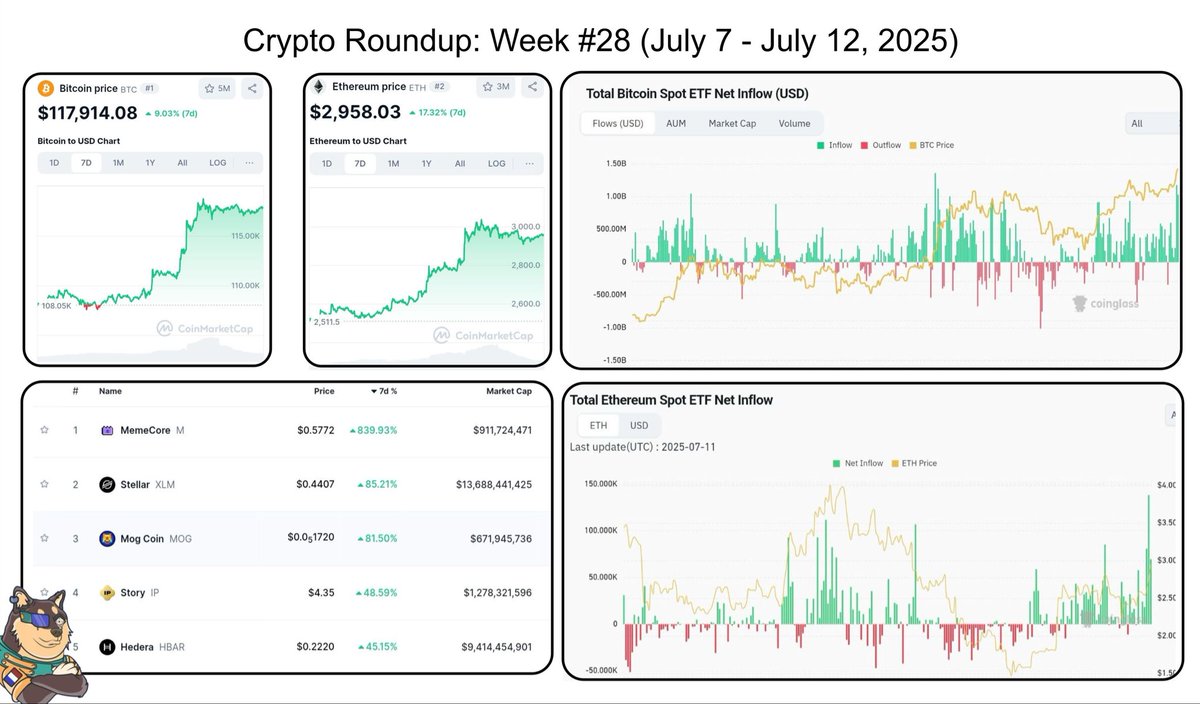

Crypto Roundup: Week #28 (July X - July 12, 2025)

Narrative shift confirmed.

Bitcoin broke ATHs. Ethereum outpaced it. But that’s not the story.

The real signal was in how institutions, corporates, and protocols moved:

-> BlackRock’s Bitcoin ETF printed $1B+ inflows two days in a row

-> $ETH staking hit XXXX% as the Pectra upgrade kicked in

-> SharpLink bought 10K $ETH OTC from the Ethereum Foundation to hold + restake

-> @BitMNR and @BitDigital_BTBT pivoted their entire treasury strategy to $ETH

-> ETF flows into Ethereum hit $907M in a week, double their previous high

● Market Stats

$BTC

- $XXXXXXX (+9.04%)

- $2.34T market cap

- $2.72B ETF inflow (7D)

- ATH hit Friday

$ETH

- $XXXXX (+17.29%)

- $357.1B market cap

- $907.99M ETF inflow (7D)

- XXXXX% of supply now staked

● Top Movers (>$200M MC)

X. $M: +839.9% X. $XLM: +85.2% X. $MOG: +81.5% X. $IP: +48.6% X. $HBAR: +45.2%

● Sectors That Saw Significant Increase

X. Directed Acyclic Graph (DAG): +37.9%

X. Modular Chains: +26.8%

X. RWA Infra: +25.6%

X. DEX Aggregators: +25.2%

X. Perps: +21.8%

● Fundraising Flows

Liquidity rotated back to early-stage bets, but this time around, memes, infra, and AI split the pot.

-> @pumpdotfun raised $500M in XX minutes

-> Agora raised $50M from Paradigm (stablecoin infra)

-> ZeroHash raising $100M at near-$1B valuation

-> DigitalX raised $13.5M (Bitcoin treasury play)

-> Harmonic AI closed a $100M Series B led by Kleiner + Paradigm

-> ReserveOne targeting $1B raise ahead of Nasdaq listing

● Major Headline Stack

- BTC ETFs hit $158B AUM, new all-time high

- ETH ETFs: $1B+ inflows over X days

- Kraken & Backed launch tokenized stocks on BNB Chain

- Dubai approves tokenized MM fund with Qatar National Bank

- GMX exploiter returns $40M

- acquires Solana wallet tracker Kolscan

- Myriad Protocol goes live on Linea, powered by EigenCloud

- Australia greenlights next stage of Project Acacia (CBDC + tokenized settlement pilots)

● The Alpha

$ETH has quietly become the reserve asset of crypto-native institutions.

If you're still framing Ethereum as “tech infrastructure,” you're missing the bigger picture.

The next bull wave isn’t just memes or L2s, it’s financialization of crypto-native collateral across chains, products, and real-world rails.

● What to Watch (Week #29)

-> U.S. “Crypto Week” kicks off — key bills: GENIUS Act, Anti-CBDC, Stablecoin Framework

-> Any ETF movement, especially on Cardano/AltL1s

-> Restaking flywheel around ETH accelerates post-Pectra

-> Early rotations into mid-cap BTCFi, RWA, and AI-DeFi hybrids continue

-> Unlocks and new token drops could skew sector flows

This was one of the clearest institutional inflection points we’ve seen in a while.

$BTC led. $ETH ran faster. The stack is moving.

Stay sharp.

XXXXXX engagements

Related Topics 10k staking $eth $1b fund manager bitcoin etf bitcoin coins layer 1