[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  AskToRahulSingh©️ [@AskToRahulSingh](/creator/twitter/AskToRahulSingh) on x 6241 followers Created: 2025-07-13 09:07:04 UTC #Bitcoin Trading around $117.8k The Current market sentiment is Greed (CMC Fear & Greed Index: 68/100). Key points of Market highlights: Fear & Greed Index – XX (down X point in 24h, up XX points in 7d) → profit-taking caution amid mid-term optimism. Institutional inflows – Bitcoin #ETFs up $4.14B (+3%) in last XX hours. → sustained demand. Altcoin divergence – XLM (+28%), HBAR (+15%) surge vs. BTC stagnation → selective risk-taking. X. What's Market Sentiments : This is neutral-bearish short-term because reduced leverage and a XX% drop in 24h trading volume suggest consolidation, but the 30-day market cap rise (+11%) signals underlying strength. X. Institutional Demand: ETF Inflows Defy Tariff FUD Overview: Bitcoin ETF AUM hits $143.2B (+3% in 24h), with BlackRock’s IBIT alone holding $80B. This occurred despite Trump’s XX% tariff announcement triggering a brief BTC dip to $117.5K (View CMC F&G). What is this means in Market: This is bullish because ETF buyers absorbed $17.15M in BTC liquidations (-66% YoY), demonstrating institutional conviction. X. Altcoin Rotation: Narrative-Driven Surges However, the #AltcoinSeason Index remains low at 28/100, with BTC dominance at XXXXX% (-0.14% in 24h). CONCLUSION - Market sentiment leans bullish with caution—strong ETF inflows and a $3.68T market cap (+10.66% weekly) offset tariff risks and overbought RSI-7 (91). Watch the BTC dominance trend: A break below XX% could signal altcoin momentum, while holding above XX% may prolong Bitcoin-centric action. The CME FedWatch Tool’s XXXX% rate-hike pause probability adds macro stability, but monitor Trump’s tariff enforcement (effective August 1) for volatility triggers. Also watch the initial Higher-Low Support level around $112k - 113k. Anyways, Always #DYOR and Trade Wisely by using of #StopLoss in Crypto...🙏  XXXXX engagements  **Related Topics** [24 hours](/topic/24-hours) [hbar](/topic/hbar) [xlm](/topic/xlm) [altcoin](/topic/altcoin) [$414b](/topic/$414b) [greed](/topic/greed) [Sentiment](/topic/sentiment) [$1178k](/topic/$1178k) [Post Link](https://x.com/AskToRahulSingh/status/1944322676895662520)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

AskToRahulSingh©️ @AskToRahulSingh on x 6241 followers

Created: 2025-07-13 09:07:04 UTC

AskToRahulSingh©️ @AskToRahulSingh on x 6241 followers

Created: 2025-07-13 09:07:04 UTC

#Bitcoin Trading around $117.8k

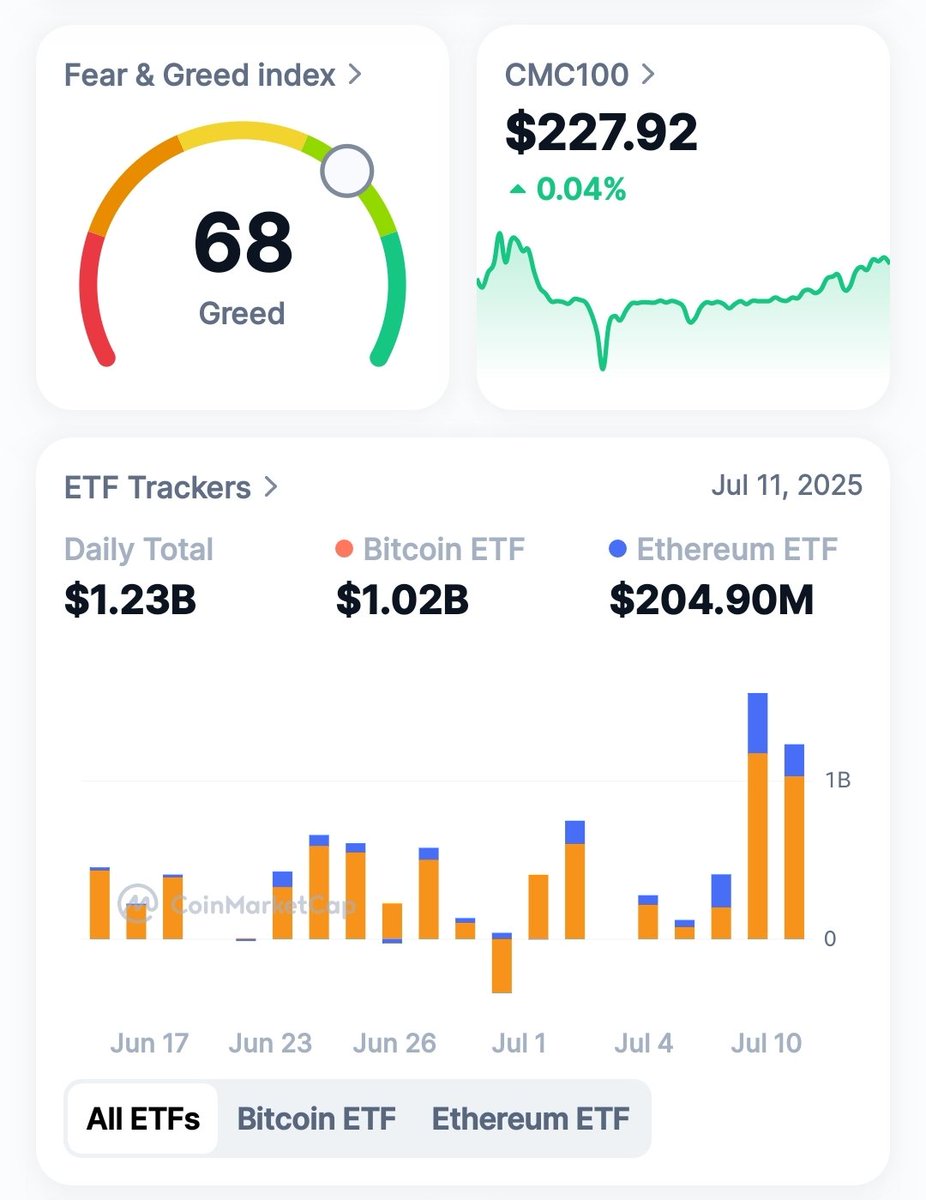

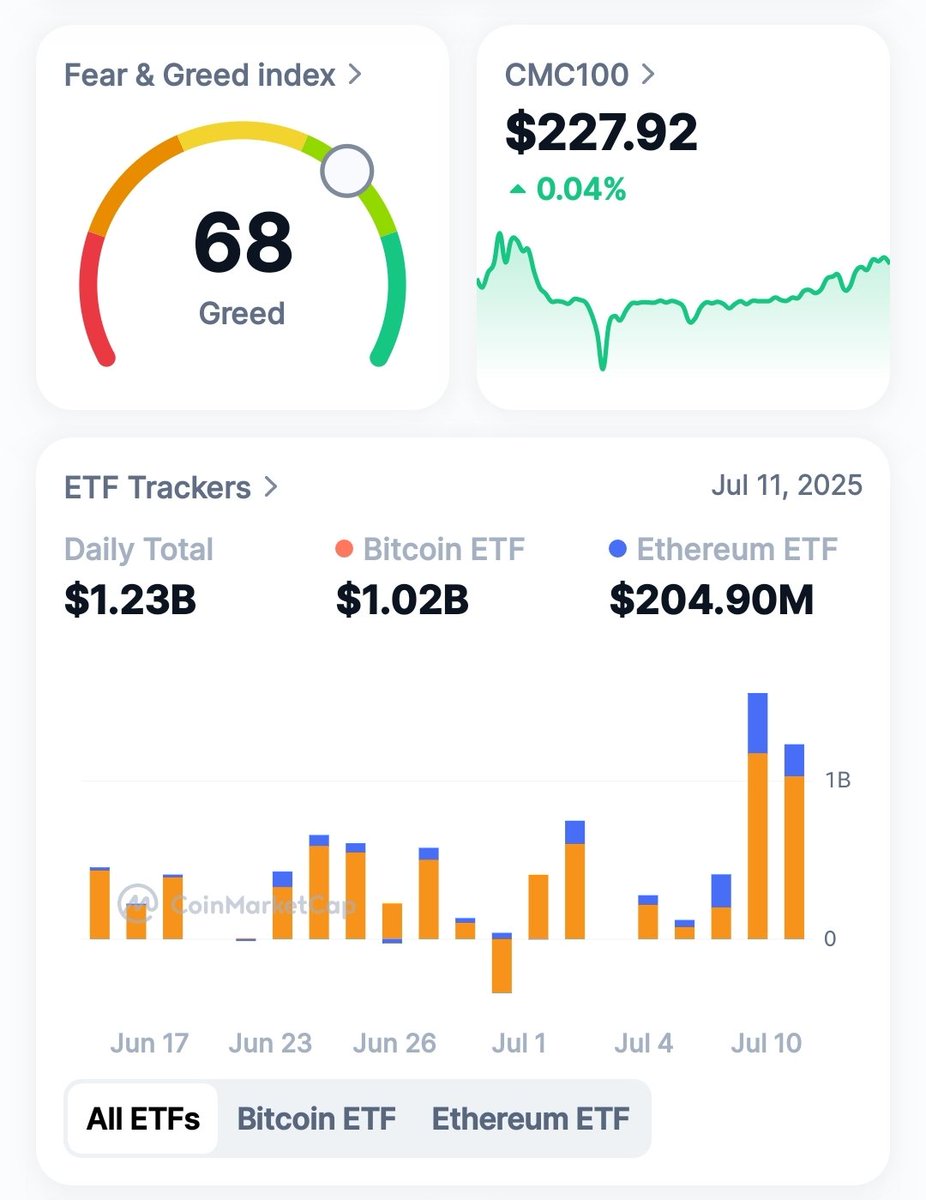

The Current market sentiment is Greed (CMC Fear & Greed Index: 68/100).

Key points of Market highlights:

Fear & Greed Index – XX (down X point in 24h, up XX points in 7d) → profit-taking caution amid mid-term optimism.

Institutional inflows – Bitcoin #ETFs up $4.14B (+3%) in last XX hours. → sustained demand.

Altcoin divergence – XLM (+28%), HBAR (+15%) surge vs. BTC stagnation → selective risk-taking.

X. What's Market Sentiments :

This is neutral-bearish short-term because reduced leverage and a XX% drop in 24h trading volume suggest consolidation, but the 30-day market cap rise (+11%) signals underlying strength.

X. Institutional Demand: ETF Inflows Defy Tariff FUD

Overview: Bitcoin ETF AUM hits $143.2B (+3% in 24h), with BlackRock’s IBIT alone holding $80B. This occurred despite Trump’s XX% tariff announcement triggering a brief BTC dip to $117.5K (View CMC F&G).

What is this means in Market:

This is bullish because ETF buyers absorbed $17.15M in BTC liquidations (-66% YoY), demonstrating institutional conviction.

X. Altcoin Rotation: Narrative-Driven Surges

However, the #AltcoinSeason Index remains low at 28/100, with BTC dominance at XXXXX% (-0.14% in 24h).

CONCLUSION -

Market sentiment leans bullish with caution—strong ETF inflows and a $3.68T market cap (+10.66% weekly) offset tariff risks and overbought RSI-7 (91).

Watch the BTC dominance trend: A break below XX% could signal altcoin momentum, while holding above XX% may prolong Bitcoin-centric action.

The CME FedWatch Tool’s XXXX% rate-hike pause probability adds macro stability, but monitor Trump’s tariff enforcement (effective August 1) for volatility triggers.

Also watch the initial Higher-Low Support level around $112k - 113k.

Anyways, Always #DYOR and Trade Wisely by using of #StopLoss in Crypto...🙏

XXXXX engagements

Related Topics 24 hours hbar xlm altcoin $414b greed Sentiment $1178k