[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Oliver | MMMT Wealth (CPA) [@MMMTwealth](/creator/twitter/MMMTwealth) on x 53.1K followers Created: 2025-07-12 17:56:06 UTC Here's how I CONSERVATIVELY value $TSLA by 2030: Optimus 👇 Potential TAM by 2030 = $18B (per forecasts), though I anticipate this will be much higher. Some estimates suggest $5T by 2030 for example. So XX% of the market is $1.8B in revenue. Given $TSLA want to produce XX million robots per annum by 2030, $1.8B in revenue by 2030 is only XXXXXX sales (at $20,000) so I suspect this is too low. If we conservatively assume $TSLA sells X million robots per year by 2030-2032 (1/15th of planned production), they'll hit $20B in annual Optimus revenue. $NVDA trades at 19x sales as does $ISRG. Private companies like Figure AI are suggested to be a bit lower but still ~15x or higher. Now let's conservatively say Optimus deserves a 15x sales multiple. 15x * $20B in revenue = $300B. Robotaxis👇 Waymo are winning currently. FWIW I'm bullish on $GOOGL. But $TSLA unit economics will be much better down the road and the market won't be a monopoly or a first mover advantage market, so Waymo's successes so far aren't too material if you're looking +5 years out. Bullish forecasts put the AV market ~$1T upwards with some forecasts much higher at $13T but that's far too high for me now. I think $1T is a good midpoint between some bullish and bearish forecasts. At XX% market share, you're looking at a $100B revenue opportunity. That would mean ~$0.40 per mile, XXXXXX miles per year, and a fleet size of XXXX million robotaxis which seems feasible given the $TSLA production projections of multiple millions of robotaxis by 2030. Based on good unit economics, and ownership of the entire stack, a XX% operating margin seems feasible which gives $30B in operating income by 2030. With a 20x multiple you're looking at $600B valuation for the robotaxi market by 2030. I've shown how I've got to $900B ($300B Optimus + $600B robotaxis) by 2030 whilst excluding: - Robotaxis globally (namely the India opportunity) - Energy business - EV business - Dojo - Insurance - Supercharger network FWIW, I think if you're looking at 2035 onwards this $900B Optimus and FSD number will be much, much higher. I'm no $TSLA fanboy, but if you're playing the risk to reward game, $TSLA's reward outweighs the risk.  XXXXX engagements  **Related Topics** [$5t](/topic/$5t) [$18b](/topic/$18b) [optimus](/topic/optimus) [$tsla](/topic/$tsla) [tesla](/topic/tesla) [stocks consumer cyclical](/topic/stocks-consumer-cyclical) [stocks bitcoin treasuries](/topic/stocks-bitcoin-treasuries) [Post Link](https://x.com/MMMTwealth/status/1944093424887517292)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Oliver | MMMT Wealth (CPA) @MMMTwealth on x 53.1K followers

Created: 2025-07-12 17:56:06 UTC

Oliver | MMMT Wealth (CPA) @MMMTwealth on x 53.1K followers

Created: 2025-07-12 17:56:06 UTC

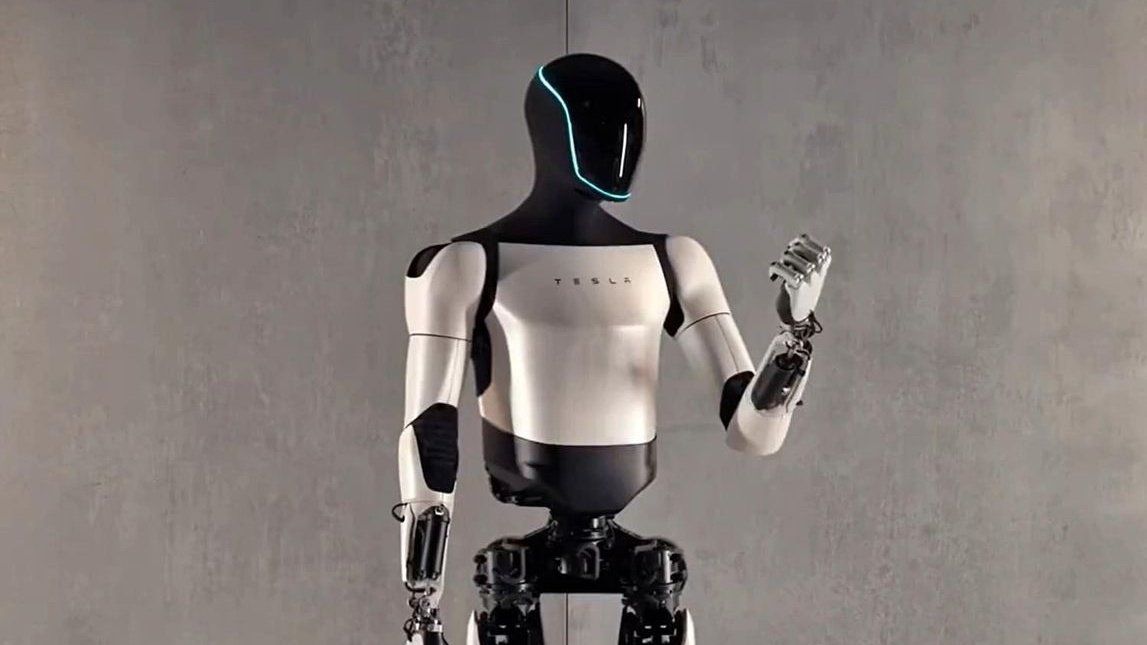

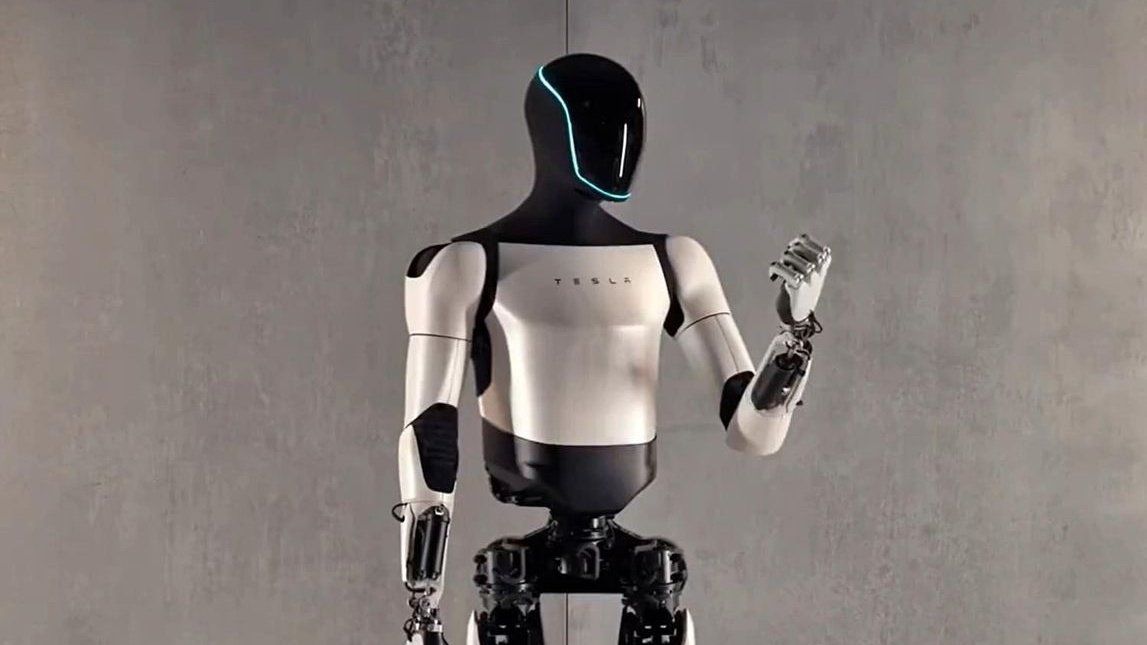

Here's how I CONSERVATIVELY value $TSLA by 2030:

Optimus 👇 Potential TAM by 2030 = $18B (per forecasts), though I anticipate this will be much higher. Some estimates suggest $5T by 2030 for example. So XX% of the market is $1.8B in revenue.

Given $TSLA want to produce XX million robots per annum by 2030, $1.8B in revenue by 2030 is only XXXXXX sales (at $20,000) so I suspect this is too low. If we conservatively assume $TSLA sells X million robots per year by 2030-2032 (1/15th of planned production), they'll hit $20B in annual Optimus revenue.

$NVDA trades at 19x sales as does $ISRG. Private companies like Figure AI are suggested to be a bit lower but still ~15x or higher. Now let's conservatively say Optimus deserves a 15x sales multiple.

15x * $20B in revenue = $300B.

Robotaxis👇 Waymo are winning currently. FWIW I'm bullish on $GOOGL. But $TSLA unit economics will be much better down the road and the market won't be a monopoly or a first mover advantage market, so Waymo's successes so far aren't too material if you're looking +5 years out.

Bullish forecasts put the AV market ~$1T upwards with some forecasts much higher at $13T but that's far too high for me now. I think $1T is a good midpoint between some bullish and bearish forecasts.

At XX% market share, you're looking at a $100B revenue opportunity. That would mean ~$0.40 per mile, XXXXXX miles per year, and a fleet size of XXXX million robotaxis which seems feasible given the $TSLA production projections of multiple millions of robotaxis by 2030.

Based on good unit economics, and ownership of the entire stack, a XX% operating margin seems feasible which gives $30B in operating income by 2030. With a 20x multiple you're looking at $600B valuation for the robotaxi market by 2030.

I've shown how I've got to $900B ($300B Optimus + $600B robotaxis) by 2030 whilst excluding:

- Robotaxis globally (namely the India opportunity)

- Energy business

- EV business

- Dojo

- Insurance

- Supercharger network

FWIW, I think if you're looking at 2035 onwards this $900B Optimus and FSD number will be much, much higher.

I'm no $TSLA fanboy, but if you're playing the risk to reward game, $TSLA's reward outweighs the risk.

XXXXX engagements

Related Topics $5t $18b optimus $tsla tesla stocks consumer cyclical stocks bitcoin treasuries