[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  PropulsionPoint Capital [@propulsionpoint](/creator/twitter/propulsionpoint) on x 1012 followers Created: 2025-07-12 16:56:30 UTC $SPY $QQQ $SPX My most recent two call options trade $UPST $SMCI had good charts, yet they have given up their gains. The Friday price action in growth and momo names was ugly. Look at quantum or cyber security stocks for example The indices have held up , but under the hood things are looking shaky. The breadth is declining. The valuations are also at peak levels ( see attached image) To summarise, my guards are up. It is going to be difficult to generate any meaningful alpha from these levels, unless markets pullback, atleast a bit. However, I dont predict an armageddon or anything. Earnings expectations still remain good. The Trump news on Mexico and Canada on the weekend are also a red flag. In summary, its a choppy market to trade. A pullback of some sort in the next X to X weeks, will help to bring prices to reasonable levels. I feel the fact that hedge funds missed this rally from April bottoms have a vested interest in orchestrating a pullback too. The odds and risk return is not in our favour anymore. Starting tomorrow I will pursue no leveraged trades, no options and raise cash levels, as I expect a pullback in the ensuing months. Time to risk off in trading. I am still bullish on Ethereum though and China is starting to look interesting again. Money rotating out of US equities, a bit of it might find itself in China.  XXXXX engagements  **Related Topics** [smci](/topic/smci) [spx](/topic/spx) [qqq](/topic/qqq) [spy](/topic/spy) [hood](/topic/hood) [stocks](/topic/stocks) [$spx](/topic/$spx) [$qqq](/topic/$qqq) [Post Link](https://x.com/propulsionpoint/status/1944078424769015931)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

PropulsionPoint Capital @propulsionpoint on x 1012 followers

Created: 2025-07-12 16:56:30 UTC

PropulsionPoint Capital @propulsionpoint on x 1012 followers

Created: 2025-07-12 16:56:30 UTC

$SPY $QQQ $SPX

My most recent two call options trade $UPST $SMCI had good charts, yet they have given up their gains. The Friday price action in growth and momo names was ugly. Look at quantum or cyber security stocks for example

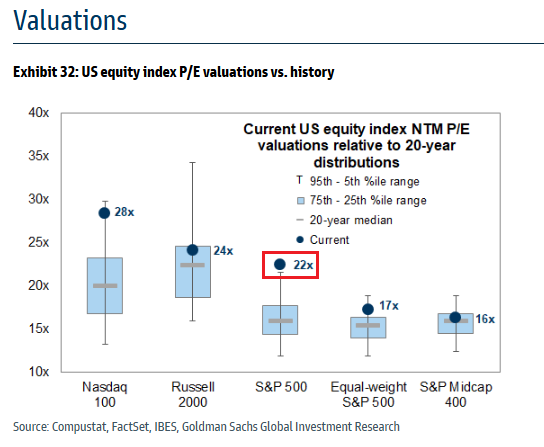

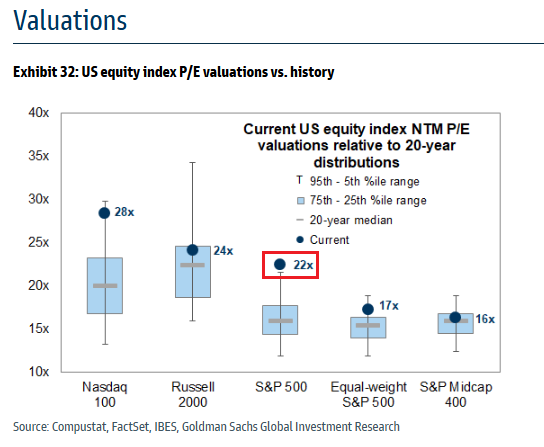

The indices have held up , but under the hood things are looking shaky. The breadth is declining. The valuations are also at peak levels ( see attached image)

To summarise, my guards are up. It is going to be difficult to generate any meaningful alpha from these levels, unless markets pullback, atleast a bit. However, I dont predict an armageddon or anything. Earnings expectations still remain good. The Trump news on Mexico and Canada on the weekend are also a red flag.

In summary, its a choppy market to trade. A pullback of some sort in the next X to X weeks, will help to bring prices to reasonable levels. I feel the fact that hedge funds missed this rally from April bottoms have a vested interest in orchestrating a pullback too. The odds and risk return is not in our favour anymore.

Starting tomorrow I will pursue no leveraged trades, no options and raise cash levels, as I expect a pullback in the ensuing months. Time to risk off in trading.

I am still bullish on Ethereum though and China is starting to look interesting again. Money rotating out of US equities, a bit of it might find itself in China.

XXXXX engagements