[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Dimitry Nakhla | Babylon Capital® [@DimitryNakhla](/creator/twitter/DimitryNakhla) on x 14.6K followers Created: 2025-07-12 16:55:15 UTC $ASML is often considered one of the world’s most important companies, crafting advanced lithography machines that power chip innovation & keep Moore’s Law alive amid the AI surge 🤖 With the stock trading at a compelling valuation relative to growth, & Q2 earnings next week, here are several visuals & insights about the company that you should know👇🏽 X. INTRO 📝 ASML is a Dutch company that’s basically the king of making machines used to manufacturer computer chips These machines use light to “print” tiny patterns on silicon wafers, which become the brains of everything from phones to cars to AI servers Their two main types of lithography machines are DUV (Deep Ultraviolet) and EUV (Extreme Ultraviolet) X. DIFFERENCE BETWEEN DUV & EUV ☀️ DUV Machines are the “workhorses” of chipmaking. They use ultraviolet light with longer wavelengths (around XXX nm or XXX nm) to create patterns on chips. Think of it like using a regular printer for everyday documents—reliable but not super precise for tiny details. DUV has been around for decades and is used for making chips with larger features (like 10nm and above). To make even smaller stuff, chipmakers often have to run multiple passes (called multi-patterning) DUV Machines make up ~45% of ASML’s total revenues (as of 2024) EUV Machines are the high-tech superstars. They use much shorter wavelengths (13.5 nm) light, which lets them print insanely small patterns in one go (single-exposure) It’s like upgrading to a laser printer that can do ultra-fine art. EUV is essential for advanced chips (7nm and smaller), powering things like AI GPUs and high-end smartphones. But EUV is way more complex—the light is generated using lasers hitting tin droplets, and the whole setup needs a vacuum because air absorbs EUV light The key tech difference boils down to precision and efficiency: EUV enables smaller, faster, more power-efficient chips, but it’s harder and costlier to build and operate EUV Machines make up ~29% of ASML’s total revenues (as of 2024, EXE Net system sales not included to normalize prior years) X. SERVICE & FIELD OPTION REVENUE 💵 Service Revenue covers, ongoing maintenance, repairs, spare parts, and software updates for the machines ASML has already sold. Chip factories (fabs) run these machines 24/7, so they need regular check-ups to avoid downtime, which could cost millions. It’s similar to taking your car in for oil changes and tune-ups, but on a billion-dollar scale Field Option Revenue are upgrades or add-ons installed directly at the customer’s site (the “field”). For example, hardware tweaks to boost a machine’s, speed, precision, or compatibility with new processes—without buying a whole new system. This extends the life of older machines, like adding a turbo to an existing engine Together, these make up ~23% of ASML’s total revenues (as of 2024). This segment is growing steadily as ASML’s “installed base” (the total number of machines out there in fabs worldwide) expands X. SERVICES RECURRING REVENUE 💰 The beauty here is that it’s not a one-and-done sale like the machines themselves. It’s recurring, meaning it generates predictable cash flow year after year, tied to the growing installed base. Here’s why it's so valuable: Tied to the Installed Base: ASML has sold thousands of lithography systems over the decades over XXXXX active ones as of recent estimates. Each machine can last 20-30 years, but they require constant support. As ASML sells more systems (like the EUV boom from Al demand), the installed base grows, automatically boosting service needs. It’s like how Apple iPhone sales lead to ongoing App Store or iCloud revenue-the more devices out there, the more steady income High Margins and Stability: Services have juicy profit margins (often 50-60%, similar to the overall business), because they're mostly labor, parts, and software no huge R&D or manufacturing costs like building a new EUV machine. This makes ASML’s overall revenue less volatile  XXXXXX engagements  **Related Topics** [the worlds](/topic/the-worlds) [asml](/topic/asml) [coins ai](/topic/coins-ai) [$asml](/topic/$asml) [Post Link](https://x.com/DimitryNakhla/status/1944078111769080220)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Dimitry Nakhla | Babylon Capital® @DimitryNakhla on x 14.6K followers

Created: 2025-07-12 16:55:15 UTC

Dimitry Nakhla | Babylon Capital® @DimitryNakhla on x 14.6K followers

Created: 2025-07-12 16:55:15 UTC

$ASML is often considered one of the world’s most important companies, crafting advanced lithography machines that power chip innovation & keep Moore’s Law alive amid the AI surge 🤖

With the stock trading at a compelling valuation relative to growth, & Q2 earnings next week, here are several visuals & insights about the company that you should know👇🏽

X. INTRO 📝

ASML is a Dutch company that’s basically the king of making machines used to manufacturer computer chips

These machines use light to “print” tiny patterns on silicon wafers, which become the brains of everything from phones to cars to AI servers

Their two main types of lithography machines are DUV (Deep Ultraviolet) and EUV (Extreme Ultraviolet)

X. DIFFERENCE BETWEEN DUV & EUV ☀️

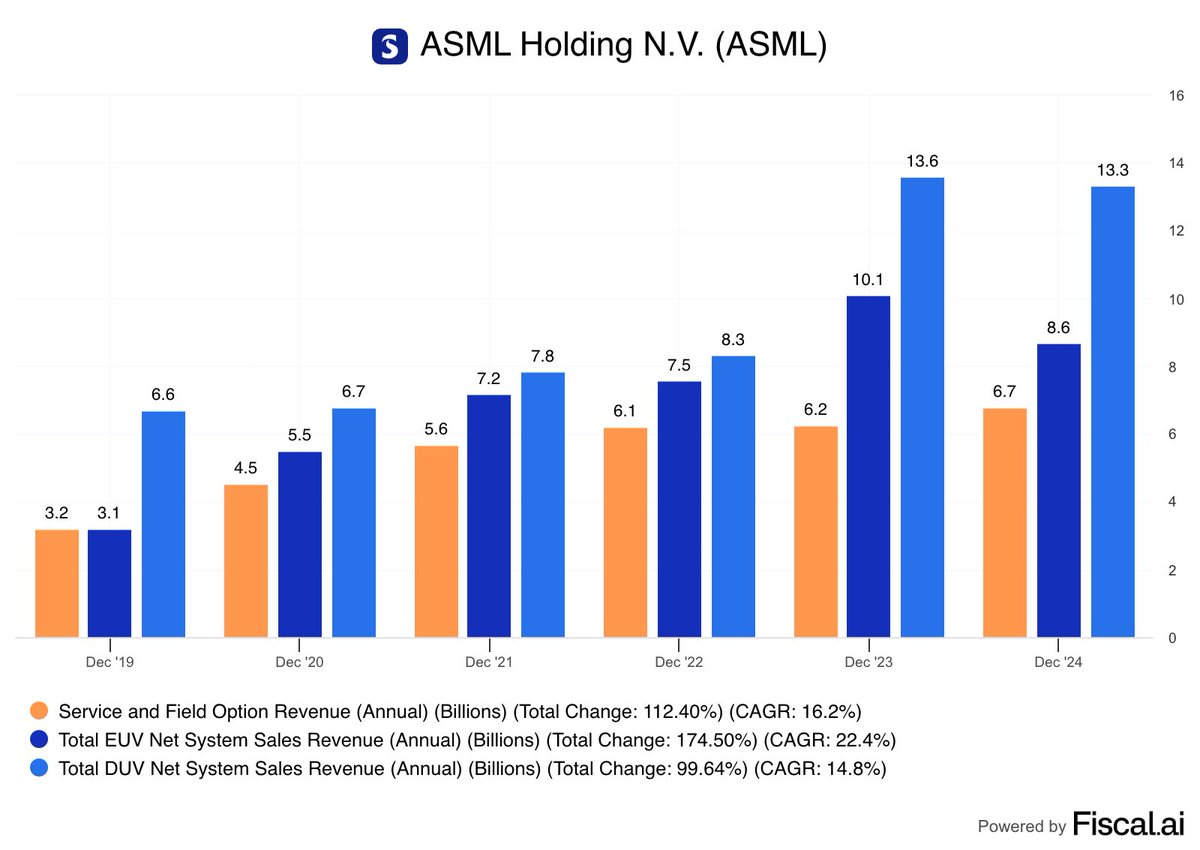

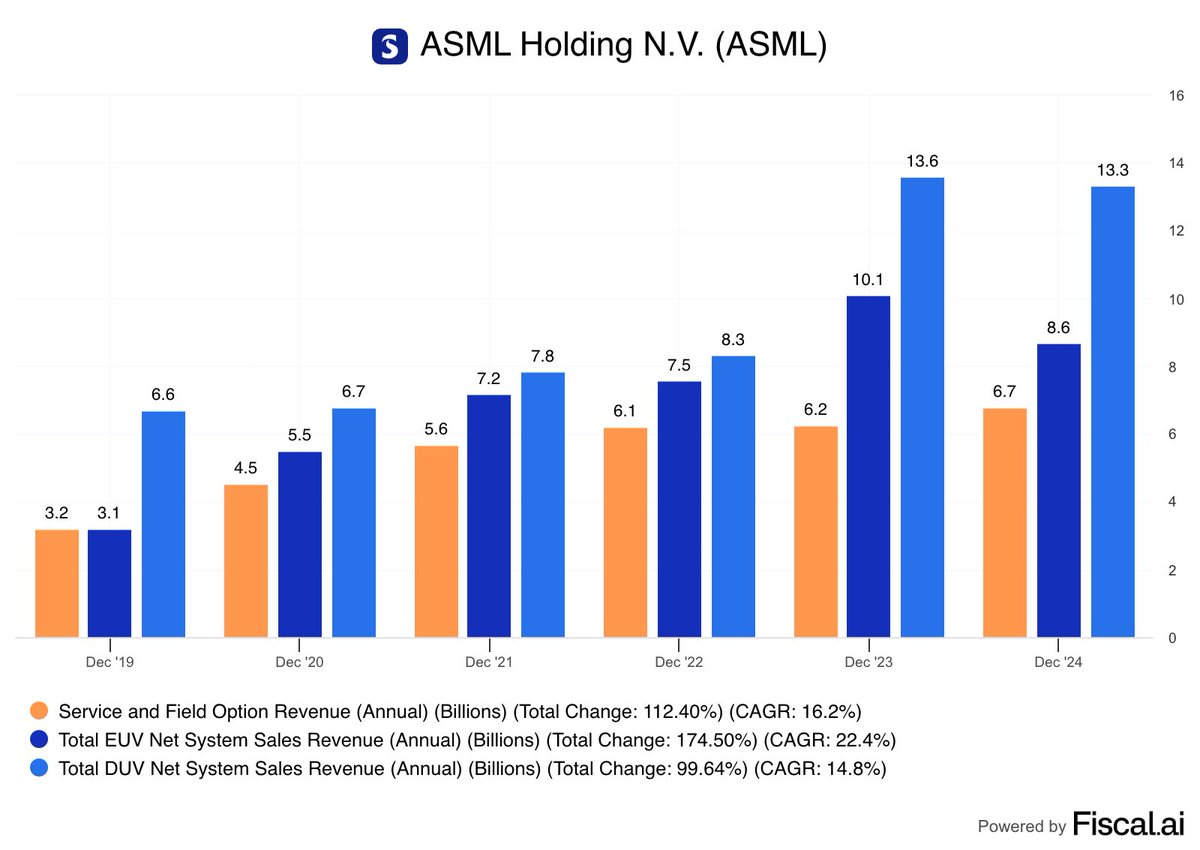

DUV Machines are the “workhorses” of chipmaking. They use ultraviolet light with longer wavelengths (around XXX nm or XXX nm) to create patterns on chips. Think of it like using a regular printer for everyday documents—reliable but not super precise for tiny details. DUV has been around for decades and is used for making chips with larger features (like 10nm and above). To make even smaller stuff, chipmakers often have to run multiple passes (called multi-patterning)

DUV Machines make up ~45% of ASML’s total revenues (as of 2024)

EUV Machines are the high-tech superstars. They use much shorter wavelengths (13.5 nm) light, which lets them print insanely small patterns in one go (single-exposure)

It’s like upgrading to a laser printer that can do ultra-fine art. EUV is essential for advanced chips (7nm and smaller), powering things like AI GPUs and high-end smartphones. But EUV is way more complex—the light is generated using lasers hitting tin droplets, and the whole setup needs a vacuum because air absorbs EUV light

The key tech difference boils down to precision and efficiency: EUV enables smaller, faster, more power-efficient chips, but it’s harder and costlier to build and operate

EUV Machines make up ~29% of ASML’s total revenues (as of 2024, EXE Net system sales not included to normalize prior years)

X. SERVICE & FIELD OPTION REVENUE 💵

Service Revenue covers, ongoing maintenance, repairs, spare parts, and software updates for the machines ASML has already sold. Chip factories (fabs) run these machines 24/7, so they need regular check-ups to avoid downtime, which could cost millions. It’s similar to taking your car in for oil changes and tune-ups, but on a billion-dollar scale

Field Option Revenue are upgrades or add-ons installed directly at the customer’s site (the “field”). For example, hardware tweaks to boost a machine’s, speed, precision, or compatibility with new processes—without buying a whole new system. This extends the life of older machines, like adding a turbo to an existing engine

Together, these make up ~23% of ASML’s total revenues (as of 2024). This segment is growing steadily as ASML’s “installed base” (the total number of machines out there in fabs worldwide) expands

X. SERVICES RECURRING REVENUE 💰

The beauty here is that it’s not a one-and-done sale like the machines themselves. It’s recurring, meaning it generates predictable cash flow year after year, tied to the growing installed base. Here’s why it's so valuable:

Tied to the Installed Base: ASML has sold thousands of lithography systems over the decades over XXXXX active ones as of recent estimates. Each machine can last 20-30 years, but they require constant support. As ASML sells more systems (like the EUV boom from Al demand), the installed base grows, automatically boosting service needs. It’s like how Apple iPhone sales lead to ongoing App Store or iCloud revenue-the more devices out there, the more steady income

High Margins and Stability: Services have juicy profit margins (often 50-60%, similar to the overall business), because they're mostly labor, parts, and software no huge R&D or manufacturing costs like building a new EUV machine. This makes ASML’s overall revenue less volatile

XXXXXX engagements

Related Topics the worlds asml coins ai $asml