[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  GeoMetric [@GeoMetric_9](/creator/twitter/GeoMetric_9) on x 3904 followers Created: 2025-07-12 09:43:36 UTC Altcoins are primed for a massive run — if you know, you know. Since I arrived here on X, I’ve seen endless bickering, moaning, and noise from altcoin holders — and just as much arrogance and bragging from $BTC maxis. Everyone keeps saying, “What a terrible cycle for alts”, while analysts obsess over a single $BTC.D chart since it hasn't broken its uptrend, proudly claiming there’s been no #Altseason ... yet offering zero explanation besides the usual, “Bitcoin is king, alts are trash.” If you're ready to step away from that noise and look at this cycle through a different lens — one I've been presenting since my earliest posts — then take the time to read and understand the quoted thread. This isn’t your typical mainstream TA, but it offers deeper insight backed by historical confluence. The core problem is that most people have time capitulated on their alts. Simply forming a bear market bottom — price capitulation — isn’t enough to start a new bull run. There's another condition that must be met. What I’ve repeatedly seen is that the true bottom happens when there’s a mean reversion back to the long-term growth trajectory — a convergence of both time and price capitulation. When $BTC bottomed in November 2022, it did so below its long-term growth trajectory mean — a complete time and price capitulation. But most alts didn’t do this. As reflected in the $OTHERS and $ADA charts, they didn’t revert to the mean back in 2022. That final pre-condition has only recently been met: $OTHERS did it during the tariff liquidations — that was the true bottom. $ADA achieved this in August 2024. Since then, both have been printing higher highs and building obvious bullish structure. Also, pay attention to the behavior: every dip below the mean (a firesale) builds serious upside momentum after all that demand absorption. That’s your signal. To the $BTC maxis still mocking alts — please, take a real look at BTC’s growth trajectory since 2022 in terms of $ADA. Not exactly brag-worthy, is it? These alts are perfectly positioned to catch up and even outperform — fast. So the question is: Are you still following the BTC.D echo chamber junkies? Or have you been seeing through the noise and positioning yourself for the next move? If you're an investor looking for deep value, low-risk entries, the pink accumulation beams were your perfect opportunity. But you had to be patient and tune out the narrative — because time capitulation (return to mean) hadn’t happened yet. If you wanted faster upside, your best entry was under the mean, after both time and price capitulation. We've had two of those chances this year alone. But if you're still waiting for BTC dominance to break down and for altseason indicators to flash green, then hey — all the best. Just know that you’ll likely be buying much, much higher. Yes, this was a long post — but if you were looking for a better perspective, this is it. I won’t bother explaining it again, at least not here on X. And for the record: My conviction never wavered — even at the scariest lows, surrounded by FUD and bearish narratives — because the charts never lied. It's why I have been confidently positioning in quality Alts like $CRV, $CVX, $LINK, $XRP, $AAVE, $TAO to name a few at every firesale or accumulatoin beam that has flashed. And those same charts are telling me now: Altcoins are primed. The fireworks are about to begin. And the ignition point was the tariff liquidations.  XXXXXX engagements  **Related Topics** [kicks](/topic/kicks) [$btcd](/topic/$btcd) [alts](/topic/alts) [$btc](/topic/$btc) [holders](/topic/holders) [altcoin](/topic/altcoin) [altcoins](/topic/altcoins) [bitcoin](/topic/bitcoin) [Post Link](https://x.com/GeoMetric_9/status/1943969483883766184)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

GeoMetric @GeoMetric_9 on x 3904 followers

Created: 2025-07-12 09:43:36 UTC

GeoMetric @GeoMetric_9 on x 3904 followers

Created: 2025-07-12 09:43:36 UTC

Altcoins are primed for a massive run — if you know, you know.

Since I arrived here on X, I’ve seen endless bickering, moaning, and noise from altcoin holders — and just as much arrogance and bragging from $BTC maxis. Everyone keeps saying, “What a terrible cycle for alts”, while analysts obsess over a single $BTC.D chart since it hasn't broken its uptrend, proudly claiming there’s been no #Altseason ... yet offering zero explanation besides the usual, “Bitcoin is king, alts are trash.”

If you're ready to step away from that noise and look at this cycle through a different lens — one I've been presenting since my earliest posts — then take the time to read and understand the quoted thread. This isn’t your typical mainstream TA, but it offers deeper insight backed by historical confluence.

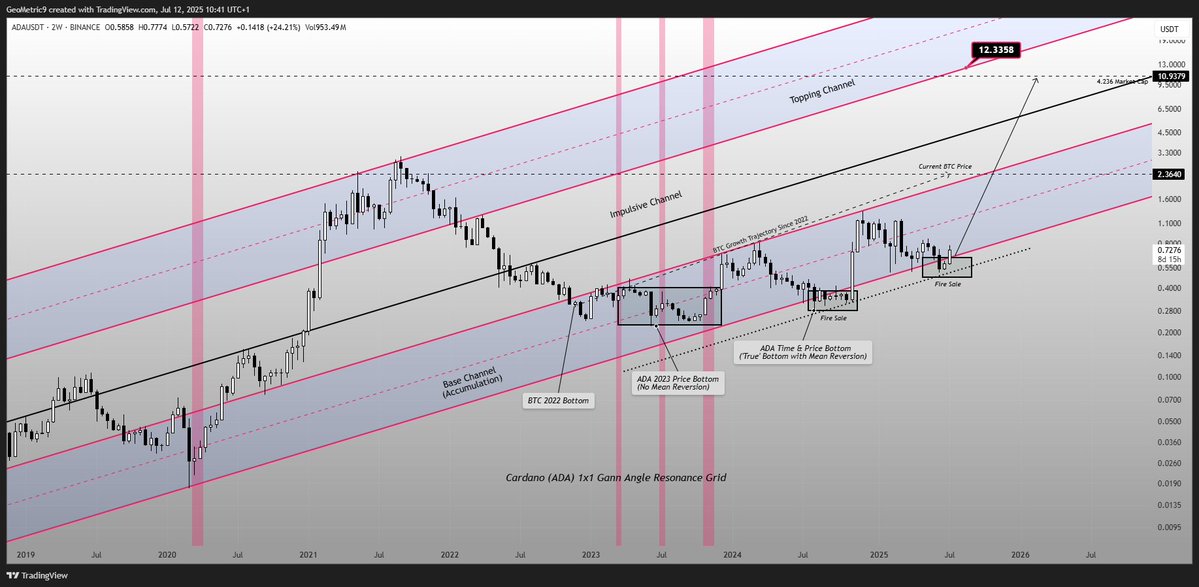

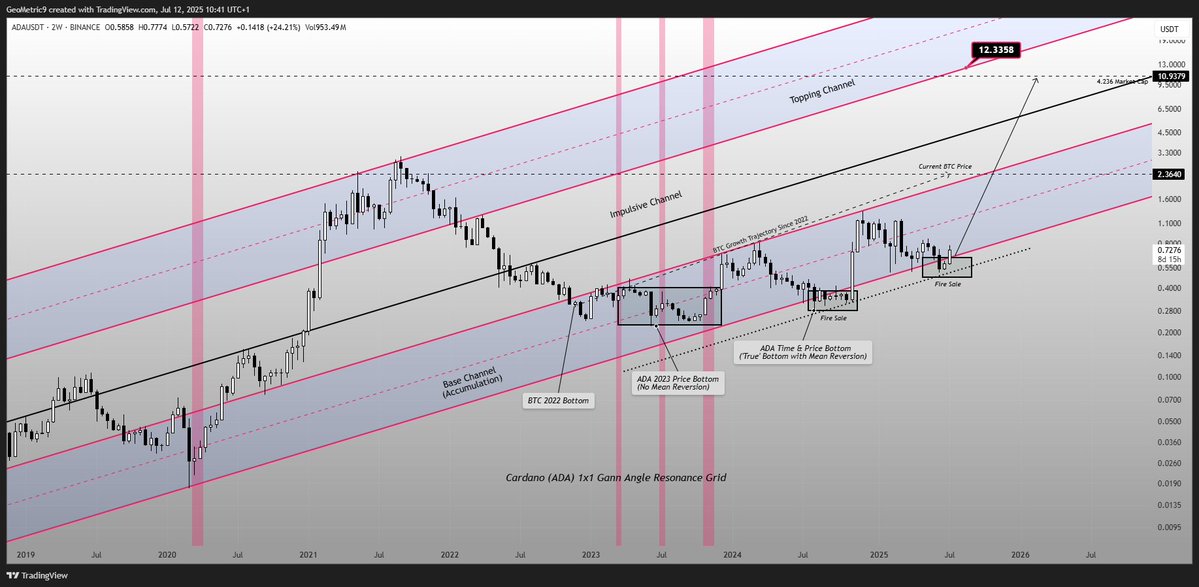

The core problem is that most people have time capitulated on their alts. Simply forming a bear market bottom — price capitulation — isn’t enough to start a new bull run. There's another condition that must be met.

What I’ve repeatedly seen is that the true bottom happens when there’s a mean reversion back to the long-term growth trajectory — a convergence of both time and price capitulation.

When $BTC bottomed in November 2022, it did so below its long-term growth trajectory mean — a complete time and price capitulation. But most alts didn’t do this. As reflected in the $OTHERS and $ADA charts, they didn’t revert to the mean back in 2022.

That final pre-condition has only recently been met:

$OTHERS did it during the tariff liquidations — that was the true bottom.

$ADA achieved this in August 2024.

Since then, both have been printing higher highs and building obvious bullish structure.

Also, pay attention to the behavior: every dip below the mean (a firesale) builds serious upside momentum after all that demand absorption. That’s your signal.

To the $BTC maxis still mocking alts — please, take a real look at BTC’s growth trajectory since 2022 in terms of $ADA. Not exactly brag-worthy, is it? These alts are perfectly positioned to catch up and even outperform — fast.

So the question is: Are you still following the BTC.D echo chamber junkies? Or have you been seeing through the noise and positioning yourself for the next move? If you're an investor looking for deep value, low-risk entries, the pink accumulation beams were your perfect opportunity. But you had to be patient and tune out the narrative — because time capitulation (return to mean) hadn’t happened yet. If you wanted faster upside, your best entry was under the mean, after both time and price capitulation. We've had two of those chances this year alone.

But if you're still waiting for BTC dominance to break down and for altseason indicators to flash green, then hey — all the best. Just know that you’ll likely be buying much, much higher.

Yes, this was a long post — but if you were looking for a better perspective, this is it. I won’t bother explaining it again, at least not here on X.

And for the record: My conviction never wavered — even at the scariest lows, surrounded by FUD and bearish narratives — because the charts never lied. It's why I have been confidently positioning in quality Alts like $CRV, $CVX, $LINK, $XRP, $AAVE, $TAO to name a few at every firesale or accumulatoin beam that has flashed.

And those same charts are telling me now: Altcoins are primed. The fireworks are about to begin. And the ignition point was the tariff liquidations.

XXXXXX engagements

Related Topics kicks $btcd alts $btc holders altcoin altcoins bitcoin