[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Ihwan Efendi [@ihwanfe](/creator/twitter/ihwanfe) on x XXX followers Created: 2025-07-12 03:51:05 UTC Fed Funds Futures masih bet XX% kemungkinan rate cut September, tapi data XX Juli ini bisa hancurkan ekspektasi market dalam sekejap BMO Economics warning: CPI Juni expected jump ke XXX% YoY dari 2.4%. Core inflation XXXX% MoM vs XXXX% sebelumnya Energy tailwind hilang, services cooling melambat. Game changer: Trump announce tariff wave X Agustus effective rate XX% → XX% (tertinggi sejak 1934). Copper XX% Canada XX% Brazil XX% Pass-through effect baru dimulai. OBBBA disahkan: $4.5T tax cuts vs $1.2T spending cuts = net deficit expansion $3.3T. Fiscal stimulus vs tariff-induced inflation = policy conflict untuk Fed. Fed dilemma: Tariff = supply shock (inflation up) + demand destruction (growth down). Stagflation risk scenario yang paling dibenci central bankers. Crypto positioning: Jangka pendek bearish (higher rates fear) medium-term setup bullish (fiscal debasement + geopolitical tension + BRICS de-dollarization). Critical timeline: XX Juli CPI X Agustus tariff implementation September FOMC. Market akan volatile reaktif setiap data point. If CPI surprise upside → Fed pivot hawkish → DXY rally → Crypto Correction If CPI in-line → September cut masih on table → risk-on resume → Crypto Bull Source: BMO Economics $BTC #Crypto  XXXXX engagements  **Related Topics** [tariffs](/topic/tariffs) [donald trump](/topic/donald-trump) [javascript](/topic/javascript) [coins energy](/topic/coins-energy) [dari](/topic/dari) [inflation](/topic/inflation) [fed rate](/topic/fed-rate) [futures](/topic/futures) [Post Link](https://x.com/ihwanfe/status/1943880767559643210)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Ihwan Efendi @ihwanfe on x XXX followers

Created: 2025-07-12 03:51:05 UTC

Ihwan Efendi @ihwanfe on x XXX followers

Created: 2025-07-12 03:51:05 UTC

Fed Funds Futures masih bet XX% kemungkinan rate cut September, tapi data XX Juli ini bisa hancurkan ekspektasi market dalam sekejap

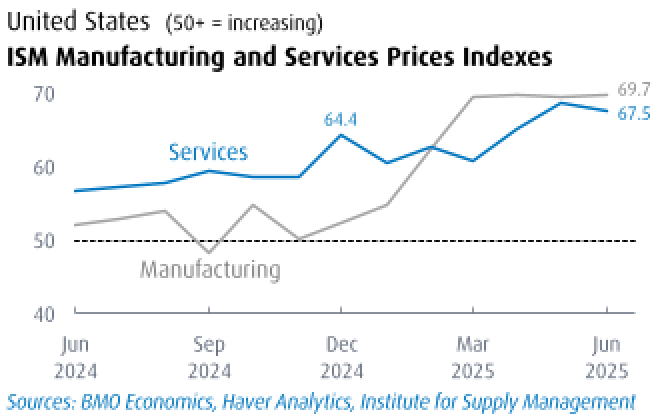

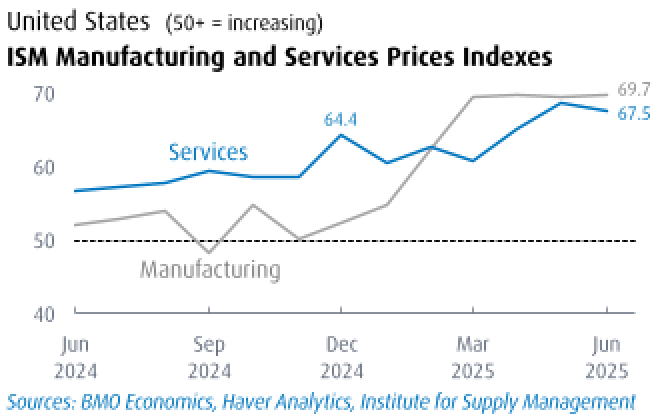

BMO Economics warning: CPI Juni expected jump ke XXX% YoY dari 2.4%. Core inflation XXXX% MoM vs XXXX% sebelumnya Energy tailwind hilang, services cooling melambat.

Game changer: Trump announce tariff wave X Agustus effective rate XX% → XX% (tertinggi sejak 1934). Copper XX% Canada XX% Brazil XX% Pass-through effect baru dimulai.

OBBBA disahkan: $4.5T tax cuts vs $1.2T spending cuts = net deficit expansion $3.3T. Fiscal stimulus vs tariff-induced inflation = policy conflict untuk Fed.

Fed dilemma: Tariff = supply shock (inflation up) + demand destruction (growth down). Stagflation risk scenario yang paling dibenci central bankers.

Crypto positioning: Jangka pendek bearish (higher rates fear) medium-term setup bullish (fiscal debasement + geopolitical tension + BRICS de-dollarization).

Critical timeline: XX Juli CPI X Agustus tariff implementation September FOMC. Market akan volatile reaktif setiap data point.

If CPI surprise upside → Fed pivot hawkish → DXY rally → Crypto Correction

If CPI in-line → September cut masih on table → risk-on resume → Crypto Bull

Source: BMO Economics

$BTC #Crypto

XXXXX engagements

Related Topics tariffs donald trump javascript coins energy dari inflation fed rate futures