[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Say No To Trading [@SayNoToTrading](/creator/twitter/SayNoToTrading) on x 6168 followers Created: 2025-07-11 17:51:49 UTC When $OSCR falls, it's a "panic crash" due to "misunderstood" model. When $UNH, $CNC, $MOH fall, it's a "broken model" and "bad business." Be aware of your biases. Bottom line is you can't say UnitedHealth Group is evil and Oscar Health is not. All insurers are unscrupulous. Likewise for the many owned by Buffett, but since he sips Cherry Cokes nibbling on See's Candies, his folksy persona makes people forget his insurers are screwing people, too. Yes, $OSCR is down XX% from 2025 highs. But this is not a "panic crash" as its high was less than X weeks ago! The selloffs in larger insurers, especially $CNC, truly are panic. Not to say they can't keep falling, but they are true definition of panic. As I've been saying with Oscar stock... Love the company... Love the management... Hate that finicky momo chasing retail is behind it lately. As far as it being "misunderstood" I see a lot of criticisms of analysts covering it. Hey, I hate analysts too. Their PTs just chase price, not other way around. Other than guestimations on earnings, I don't follow them. Even then, almost zero weight on projections more than X year out. But credit where due, they know something a lot of people on here don't. Fintwit's rebuttal that $OSCR is HIX and not Medicaid exposure is oversimplication. Medicaid are the unhealthiest to insure. For those kicked off, many will buy coverage via HIX. The devil you know is better than the devil you don't. $CNC and especially $MOH specialize in Medicaid. They know their customer. $OSCR is priced for typical HIX demographics, who are much healthier. You may think people being kicked off Medicaid is a tailwind for Oscar, as they will gain more customers. But not the type of customers they want! Nor the type they have anticipated for in their pricing. I'm done trying to teach people: (1) Cash on hand is mostly float. (2) FCF generally excludes interest, of which insurers pay a lot due to the way they offset cash (float) with debt. (3) Stop citing future PEs when the stock is still 20%+ higher than that PE calc was based on. Am I nibbling on $OSCR today? Yes, but as I have repeatedly said - back when price was $20s - I really don't feel too comfortable adding above $12/$13. Even at those prices, not comfortable because of the retail overhang. That doesn't mean I predict it's going to those prices or lower. Rather, I predict it could and the odds are higher than most people realize. As ugly as small caps $CNC and $MOH are, I am slightly more comfortable with them simply because while they have real risk of another leg down, they don't have additional risk of leg down from retail chasers bailing. They are 4x and 3x larger than $OSCR respectively. The retail concentration in Oscar is very high and an added risk, which cuts both ways.  XXXXXX engagements  **Related Topics** [oscar](/topic/oscar) [unitedhealth group](/topic/unitedhealth-group) [$moh](/topic/$moh) [$oscr](/topic/$oscr) [$unh](/topic/$unh) [stocks healthcare](/topic/stocks-healthcare) [$cnc](/topic/$cnc) [molina healthcare inc](/topic/molina-healthcare-inc) [Post Link](https://x.com/SayNoToTrading/status/1943729958087798889)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Say No To Trading @SayNoToTrading on x 6168 followers

Created: 2025-07-11 17:51:49 UTC

Say No To Trading @SayNoToTrading on x 6168 followers

Created: 2025-07-11 17:51:49 UTC

When $OSCR falls, it's a "panic crash" due to "misunderstood" model.

When $UNH, $CNC, $MOH fall, it's a "broken model" and "bad business."

Be aware of your biases. Bottom line is you can't say UnitedHealth Group is evil and Oscar Health is not.

All insurers are unscrupulous. Likewise for the many owned by Buffett, but since he sips Cherry Cokes nibbling on See's Candies, his folksy persona makes people forget his insurers are screwing people, too.

Yes, $OSCR is down XX% from 2025 highs. But this is not a "panic crash" as its high was less than X weeks ago!

The selloffs in larger insurers, especially $CNC, truly are panic. Not to say they can't keep falling, but they are true definition of panic.

As I've been saying with Oscar stock... Love the company... Love the management... Hate that finicky momo chasing retail is behind it lately.

As far as it being "misunderstood" I see a lot of criticisms of analysts covering it.

Hey, I hate analysts too. Their PTs just chase price, not other way around. Other than guestimations on earnings, I don't follow them. Even then, almost zero weight on projections more than X year out.

But credit where due, they know something a lot of people on here don't.

Fintwit's rebuttal that $OSCR is HIX and not Medicaid exposure is oversimplication.

Medicaid are the unhealthiest to insure. For those kicked off, many will buy coverage via HIX.

The devil you know is better than the devil you don't. $CNC and especially $MOH specialize in Medicaid. They know their customer.

$OSCR is priced for typical HIX demographics, who are much healthier. You may think people being kicked off Medicaid is a tailwind for Oscar, as they will gain more customers.

But not the type of customers they want! Nor the type they have anticipated for in their pricing.

I'm done trying to teach people:

(1) Cash on hand is mostly float. (2) FCF generally excludes interest, of which insurers pay a lot due to the way they offset cash (float) with debt. (3) Stop citing future PEs when the stock is still 20%+ higher than that PE calc was based on.

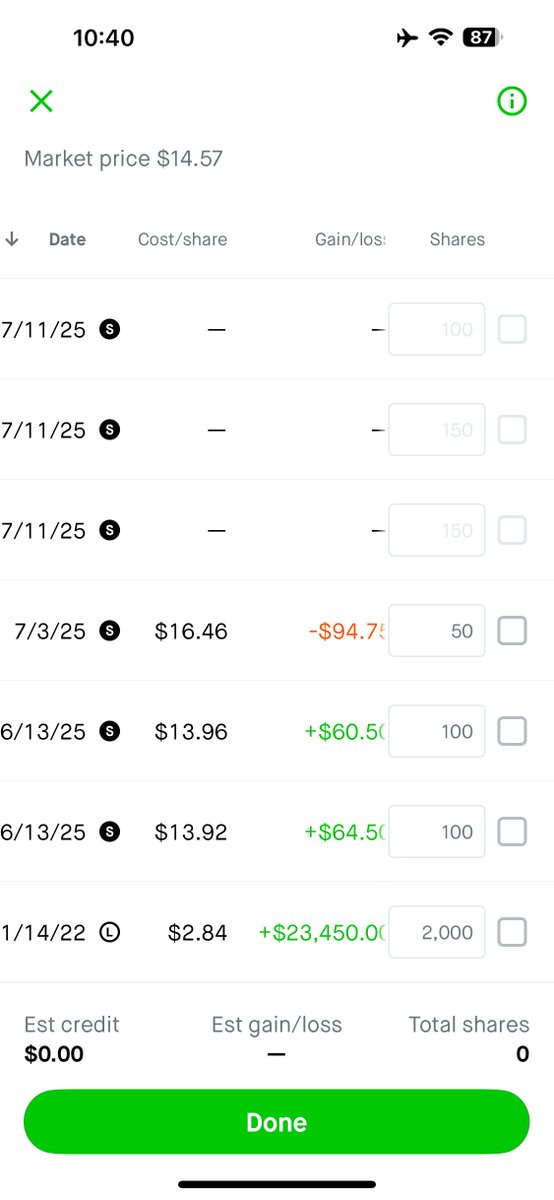

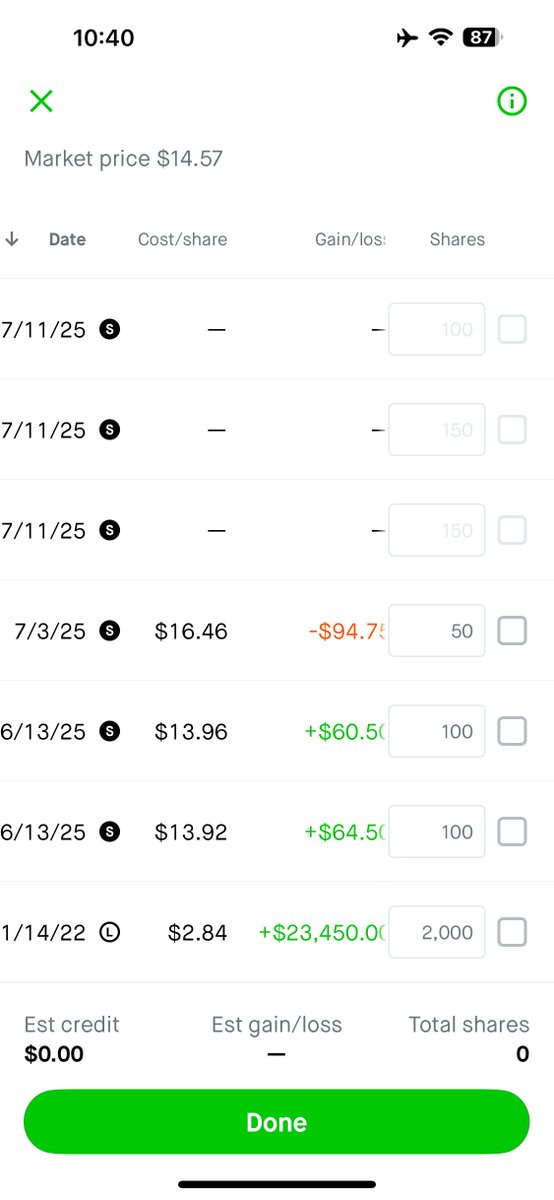

Am I nibbling on $OSCR today? Yes, but as I have repeatedly said - back when price was $20s - I really don't feel too comfortable adding above $12/$13.

Even at those prices, not comfortable because of the retail overhang.

That doesn't mean I predict it's going to those prices or lower. Rather, I predict it could and the odds are higher than most people realize.

As ugly as small caps $CNC and $MOH are, I am slightly more comfortable with them simply because while they have real risk of another leg down, they don't have additional risk of leg down from retail chasers bailing. They are 4x and 3x larger than $OSCR respectively. The retail concentration in Oscar is very high and an added risk, which cuts both ways.

XXXXXX engagements

Related Topics oscar unitedhealth group $moh $oscr $unh stocks healthcare $cnc molina healthcare inc