[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Tanaka [@Tanaka_L2](/creator/twitter/Tanaka_L2) on x 55.2K followers Created: 2025-07-11 09:54:14 UTC I’ve been watching @SeiNetwork quietly stack wins but the Circle integration might be the most telling one yet. So I can’t help but speak up my personal research today. 🔻 In a space flooded with narratives, real adoption is hard to fake. And Sei is showing real usage: ▫️ 1.6M daily txs, up from ~600K six months ago ▫️ $665M TVL (ATH) ▫️ $292M stablecoin cap with 84%+ in USDC That last stat is important. Because now, USDC will be natively integrated on @SeiNetwork and @circle just added 6.25M $SEI to its balance sheet. I believe @circle is betting on Sei becoming a core #DeFi rail because Circle focuses on bridging $80T TradFi market with DeFi ecosystem. 🔻 Why does this matter? – Native $USDC means faster, cheaper, safer settlements – CCTP V2 unlocks seamless cross-chain liquidity – Sub-400ms finality supports high-frequency use cases – Institutions get real UX + real performance You don’t need speculative liquidity when you’ve got real flow. Last week alone, stablecoin supply on $SEI grew 23%. And the flywheel is clear: → Sei growth → More DeFi/Gaming protocols → USDC utility → Circle alignment → SEI holder value accrues 🔻 Also worth noting: – 765K daily active wallets ATH (+74% MoM) – TVL growth XX% in last XX days, XXX% since April There’s a reason why Circle made this move, they see what’s coming. If $SEI becomes the execution layer for institutional DeFi and high-frequency flows, this USDC integration is just the beginning. And I think they’re early, not late. So I’m officially joining $SEI eco.  XXXXX engagements  **Related Topics** [$292m](/topic/$292m) [tvl](/topic/tvl) [$665m](/topic/$665m) [sei](/topic/sei) [adoption](/topic/adoption) [narratives](/topic/narratives) [stack](/topic/stack) [coins stablecoin](/topic/coins-stablecoin) [Post Link](https://x.com/Tanaka_L2/status/1943609768649937055)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Tanaka @Tanaka_L2 on x 55.2K followers

Created: 2025-07-11 09:54:14 UTC

Tanaka @Tanaka_L2 on x 55.2K followers

Created: 2025-07-11 09:54:14 UTC

I’ve been watching @SeiNetwork quietly stack wins but the Circle integration might be the most telling one yet.

So I can’t help but speak up my personal research today.

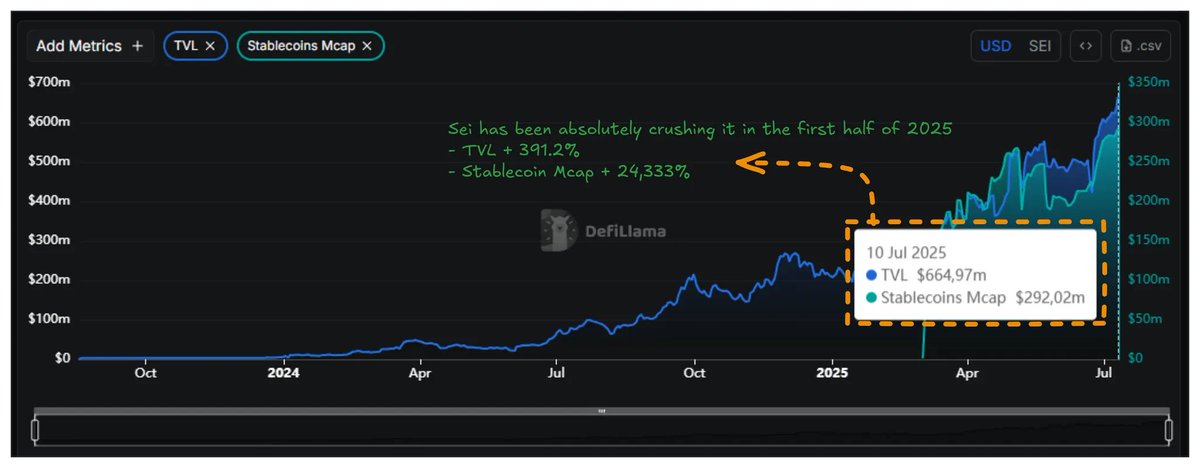

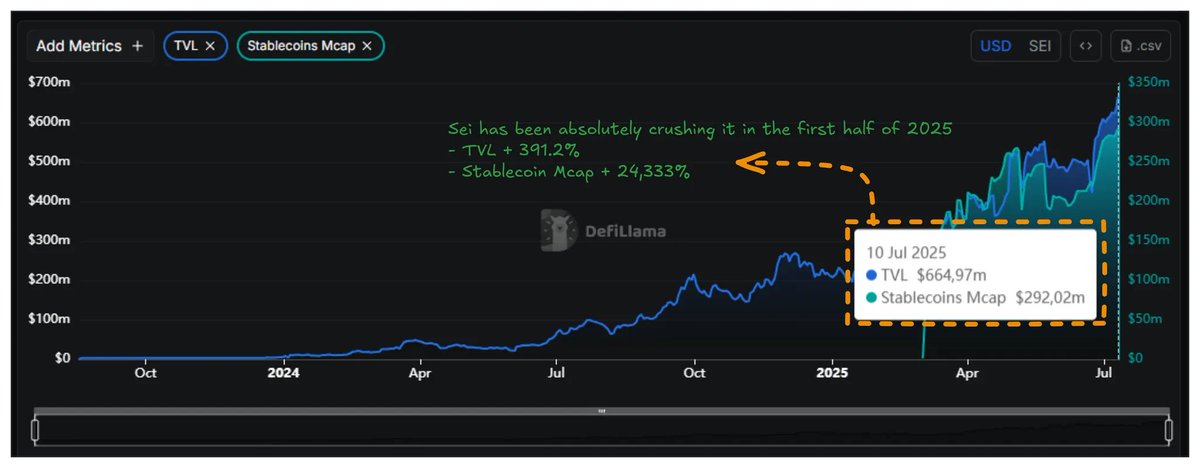

🔻 In a space flooded with narratives, real adoption is hard to fake. And Sei is showing real usage:

▫️ 1.6M daily txs, up from ~600K six months ago

▫️ $665M TVL (ATH)

▫️ $292M stablecoin cap with 84%+ in USDC That last stat is important. Because now, USDC will be natively integrated on @SeiNetwork and @circle just added 6.25M $SEI to its balance sheet.

I believe @circle is betting on Sei becoming a core #DeFi rail because Circle focuses on bridging $80T TradFi market with DeFi ecosystem. 🔻 Why does this matter?

– Native $USDC means faster, cheaper, safer settlements

– CCTP V2 unlocks seamless cross-chain liquidity

– Sub-400ms finality supports high-frequency use cases

– Institutions get real UX + real performance

You don’t need speculative liquidity when you’ve got real flow.

Last week alone, stablecoin supply on $SEI grew 23%.

And the flywheel is clear:

→ Sei growth → More DeFi/Gaming protocols → USDC utility → Circle alignment → SEI holder value accrues

🔻 Also worth noting:

– 765K daily active wallets ATH (+74% MoM)

– TVL growth XX% in last XX days, XXX% since April

There’s a reason why Circle made this move, they see what’s coming.

If $SEI becomes the execution layer for institutional DeFi and high-frequency flows, this USDC integration is just the beginning.

And I think they’re early, not late. So I’m officially joining $SEI eco.

XXXXX engagements

Related Topics $292m tvl $665m sei adoption narratives stack coins stablecoin