[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Eli5DeFi [@eli5_defi](/creator/twitter/eli5_defi) on x 38K followers Created: 2025-07-11 08:57:06 UTC ➥ Where To Park Your Stablecoins? With $BTC seemingly on a fast track to $XXXXXXX (God willing), many friends often ask where they should park their stablecoins. In this risk-on market, making profits is easy, but preserving them is the real challenge. I have several recommendations, but @SiloFinance is always at the top of my list. Why? It supports a hands-off approach through managed vaults, operates across multiple chains, offers isolated markets for those who prefer active management, and provides solid APR rates. Today I'm highlighting several managed vaults by @varlamorecap, @mevcapital, and @apostroxyz to get you started with Silo: ➠ Varlamore Falcon: ~31% APR on @ethereum using @FalconStable ➠ Varlamore USDC Growth: ~20% APR on @arbitrum ➠ MEV USDC: ~15% APR on @avax ➠ Apostro USDC: XXXX% APR on @SonicLabs (Silo Points and Sonic Points included) Simply deposit your funds, and watch them accrue yield. Obviously, there are more sophisticated strategies involving looping that you can use with Silo to optimize your returns, but let's save that for the next post. 😉  XXXXX engagements  **Related Topics** [$btc](/topic/$btc) [stablecoins](/topic/stablecoins) [bitcoin](/topic/bitcoin) [coins layer 1](/topic/coins-layer-1) [coins bitcoin ecosystem](/topic/coins-bitcoin-ecosystem) [coins pow](/topic/coins-pow) [Post Link](https://x.com/eli5_defi/status/1943595393302016145)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Eli5DeFi @eli5_defi on x 38K followers

Created: 2025-07-11 08:57:06 UTC

Eli5DeFi @eli5_defi on x 38K followers

Created: 2025-07-11 08:57:06 UTC

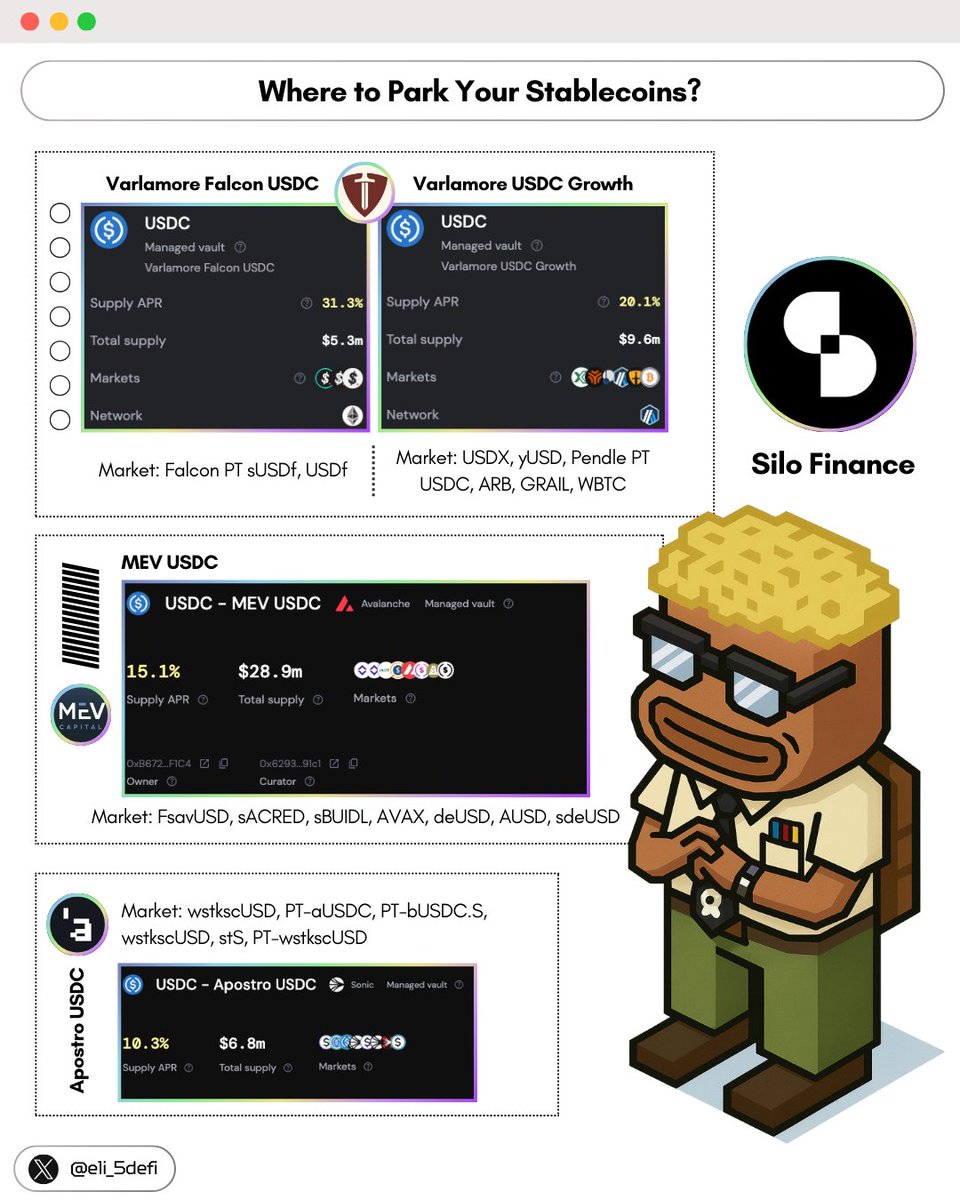

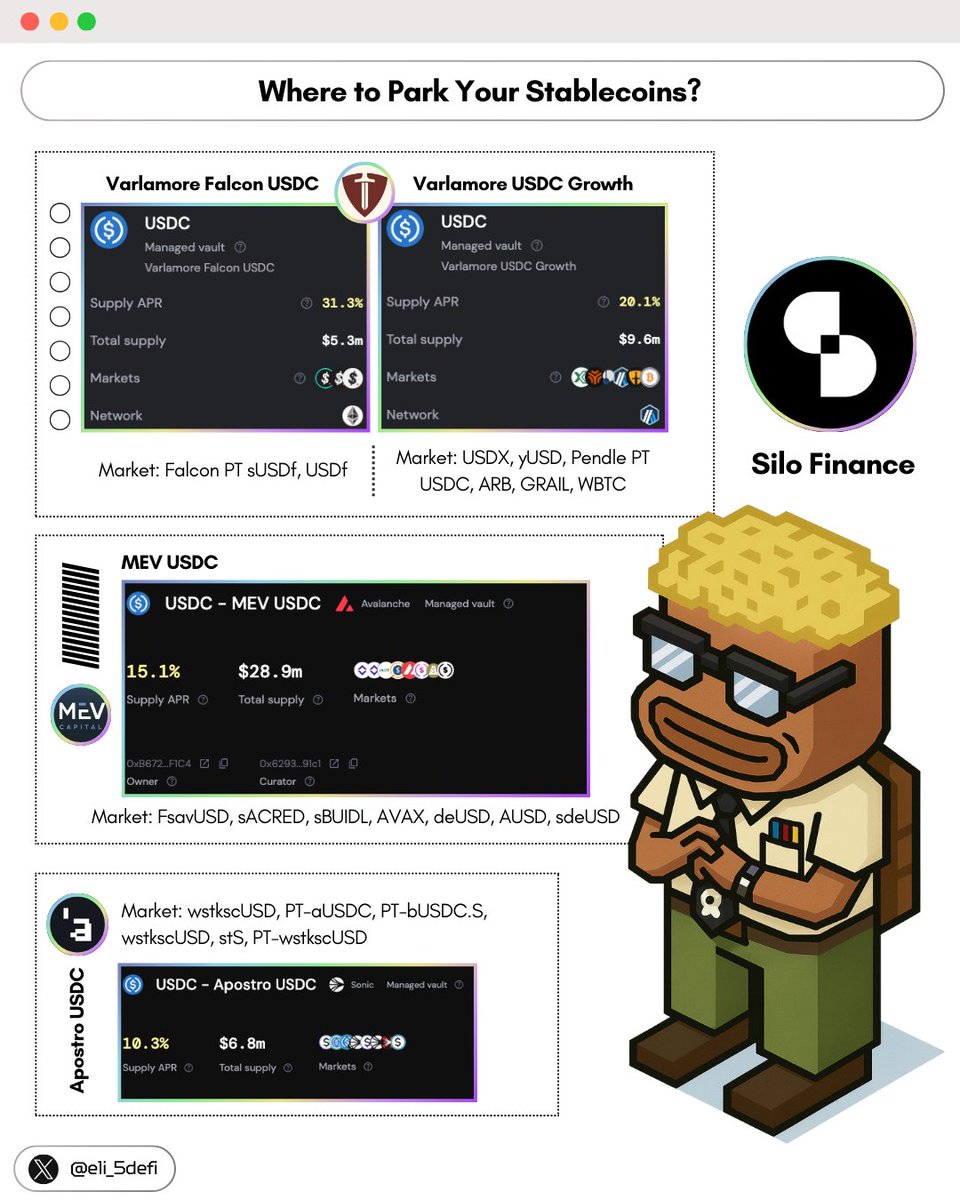

➥ Where To Park Your Stablecoins?

With $BTC seemingly on a fast track to $XXXXXXX (God willing), many friends often ask where they should park their stablecoins.

In this risk-on market, making profits is easy, but preserving them is the real challenge.

I have several recommendations, but @SiloFinance is always at the top of my list.

Why? It supports a hands-off approach through managed vaults, operates across multiple chains, offers isolated markets for those who prefer active management, and provides solid APR rates.

Today I'm highlighting several managed vaults by @varlamorecap, @mevcapital, and @apostroxyz to get you started with Silo:

➠ Varlamore Falcon: ~31% APR on @ethereum using @FalconStable ➠ Varlamore USDC Growth: ~20% APR on @arbitrum ➠ MEV USDC: ~15% APR on @avax ➠ Apostro USDC: XXXX% APR on @SonicLabs (Silo Points and Sonic Points included)

Simply deposit your funds, and watch them accrue yield.

Obviously, there are more sophisticated strategies involving looping that you can use with Silo to optimize your returns, but let's save that for the next post. 😉

XXXXX engagements

Related Topics $btc stablecoins bitcoin coins layer 1 coins bitcoin ecosystem coins pow