[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Profit Pathway [@RoadToReturns](/creator/twitter/RoadToReturns) on x 1405 followers Created: 2025-07-10 02:05:58 UTC July 09, 2025 $CPNG, $AMD, $CRM, $APP, $CUK, $MGNI, $SNOW, $HPE, $CRWV, $ZS ☀️ Market Summary US stocks rose on Wednesday as Nvidia (NVDA) became the first company ever to briefly cross the $X trillion market cap, fueling gains across major indices despite renewed trade tensions. Markets pushed higher even as President Trump announced new tariffs on several countries, keeping trade risks alive. 🌐 Trade Tensions in Focus: President Trump unveiled a fresh batch of tariff letters targeting countries such as the Philippines, Algeria, Iraq, and Libya with rates of 20%-30%, effective August X. The administration also threatened XX% tariffs on copper imports and hinted at XXX% tariffs on pharmaceuticals. German automakers Mercedes-Benz and Porsche reported sharp declines in U.S. sales as existing auto tariffs take a toll. 💵 Interest Rates & Fed Update: Fed Minutes: Only "a couple" of Fed officials supported an immediate rate cut, with most signaling that cuts later this year remain possible. Market odds continue to favor the first rate cut by September. The 10-Year Treasury Yield held steady as markets digest both trade risks and Fed uncertainty. Index Performance : $SPY: XXXX% | $QQQ: XXXX% | $IWM XXXX% 📅 Key Events This Week (July 8–12) 🔑 Economic: Thursday: Weekly Jobless Claims FOMC Minutes (released Wednesday): Confirmed a cautious but dovish tilt. 💰 Earnings Thursday, July XX (Before Open): $DAL (Delta Airlines) reports. Watch for consumer and travel demand trends. 🌟 Market Breadth & Technicals Momentum remains constructive with broad participation: 📷 🚀 Stocks on Radar Here are some setups I’m monitoring: $CPNG, $AMD, $CRM, $APP, $CUK, $MGNI, $SNOW, $HPE, $CRWV, $ZS 📝 Final Thoughts Markets continue to climb a wall of worry, with strong breadth, healthy technicals, and resilient price action across major indices. The brief surge of Nvidia past the $X trillion mark underscores the strength of leadership in tech, while broad participation supports the rally beyond just mega-caps. Trade tensions and geopolitical risks remain potential headwinds, but so far, markets are looking through them, focused instead on the Fed’s dovish tilt and the prospect of rate cuts later this year. With earnings season kicking off and key economic data ahead, near-term volatility is possible—especially with some indices slightly extended—but the prevailing trend favors upside continuation. For now, the strategy remains: respect the uptrend, stay selective, and be prepared for pauses or shakeouts along the way.  XXX engagements  **Related Topics** [countries](/topic/countries) [tariffs](/topic/tariffs) [donald trump](/topic/donald-trump) [nvda](/topic/nvda) [stocks](/topic/stocks) [market cap](/topic/market-cap) [$hpe](/topic/$hpe) [$snow](/topic/$snow) [Post Link](https://x.com/RoadToReturns/status/1943129541527962028)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Profit Pathway @RoadToReturns on x 1405 followers

Created: 2025-07-10 02:05:58 UTC

Profit Pathway @RoadToReturns on x 1405 followers

Created: 2025-07-10 02:05:58 UTC

July 09, 2025

$CPNG, $AMD, $CRM, $APP, $CUK, $MGNI, $SNOW, $HPE, $CRWV, $ZS

☀️ Market Summary

US stocks rose on Wednesday as Nvidia (NVDA) became the first company ever to briefly cross the $X trillion market cap, fueling gains across major indices despite renewed trade tensions.

Markets pushed higher even as President Trump announced new tariffs on several countries, keeping trade risks alive.

🌐 Trade Tensions in Focus:

President Trump unveiled a fresh batch of tariff letters targeting countries such as the Philippines, Algeria, Iraq, and Libya with rates of 20%-30%, effective August X. The administration also threatened XX% tariffs on copper imports and hinted at XXX% tariffs on pharmaceuticals.

German automakers Mercedes-Benz and Porsche reported sharp declines in U.S. sales as existing auto tariffs take a toll.

💵 Interest Rates & Fed Update:

Fed Minutes: Only "a couple" of Fed officials supported an immediate rate cut, with most signaling that cuts later this year remain possible.

Market odds continue to favor the first rate cut by September.

The 10-Year Treasury Yield held steady as markets digest both trade risks and Fed uncertainty.

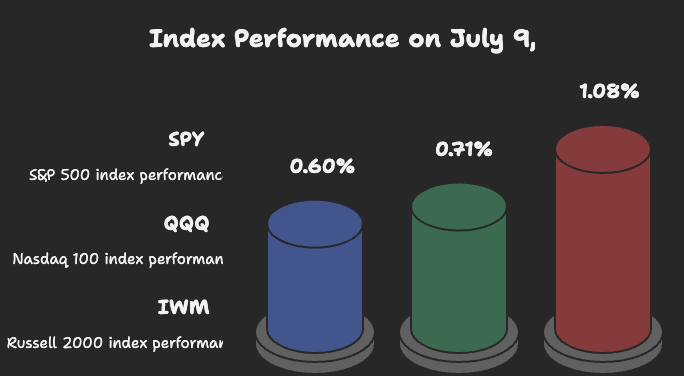

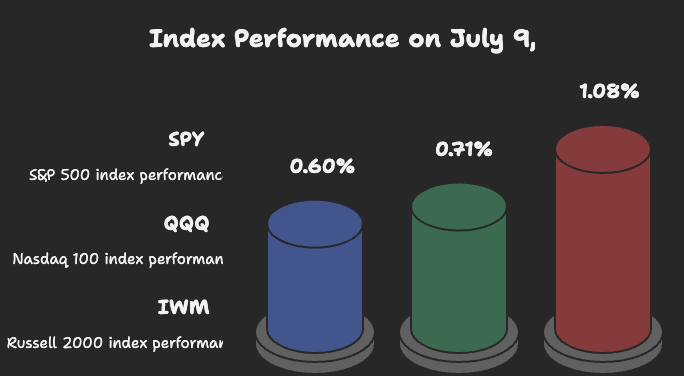

Index Performance :

$SPY: XXXX% | $QQQ: XXXX% | $IWM XXXX% 📅 Key Events This Week (July 8–12) 🔑 Economic:

Thursday: Weekly Jobless Claims

FOMC Minutes (released Wednesday): Confirmed a cautious but dovish tilt.

💰 Earnings

Thursday, July XX (Before Open): $DAL (Delta Airlines) reports. Watch for consumer and travel demand trends.

🌟 Market Breadth & Technicals

Momentum remains constructive with broad participation:

📷

🚀 Stocks on Radar

Here are some setups I’m monitoring:

$CPNG, $AMD, $CRM, $APP, $CUK, $MGNI, $SNOW, $HPE, $CRWV, $ZS

📝 Final Thoughts

Markets continue to climb a wall of worry, with strong breadth, healthy technicals, and resilient price action across major indices. The brief surge of Nvidia past the $X trillion mark underscores the strength of leadership in tech, while broad participation supports the rally beyond just mega-caps.

Trade tensions and geopolitical risks remain potential headwinds, but so far, markets are looking through them, focused instead on the Fed’s dovish tilt and the prospect of rate cuts later this year. With earnings season kicking off and key economic data ahead, near-term volatility is possible—especially with some indices slightly extended—but the prevailing trend favors upside continuation.

For now, the strategy remains: respect the uptrend, stay selective, and be prepared for pauses or shakeouts along the way.

XXX engagements

Related Topics countries tariffs donald trump nvda stocks market cap $hpe $snow