[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  0xfrosch ⛓️ [@0xFrosch](/creator/twitter/0xFrosch) on x 1540 followers Created: 2025-07-10 02:05:28 UTC lvlUSD isn’t your typical stablecoin. it’s built on top of battle-tested protocols — specifically, receipt tokens from aave, like aUSDC and aUSDT. what does that mean in practice? it’s actually easy to understand how @levelusd works but — okay, let’s break it down. ◽️what are receipt tokens? when you deposit stablecoins into aave, you receive interest-bearing tokens in return — like aUSDC or aUSDT. these act as receipts that accrue yield over time and can be used across defi. ◽️lvlUSD’s backing right now, lvlUSD is XXXX% backed by USDC deposited in aave, meaning the majority of its reserves are held as aUSDC, not idle USDC. that’s a big deal: lvlUSD’s backing base is already productive. ◽️minting options: more than just USDC/USDT thanks to this integration, lvlUSD can be minted not just with raw stablecoins (USDC, USDT), but also directly with aUSDC and aUSDT. this makes lvlUSD uniquely composable and aligned with onchain credit rails. ◽️why it matters most stablecoins sit idle. lvlUSD flips that by integrating deeply with aave, turning yield-bearing collateral into stablecoin backing. this supports capital efficiency, organic yield, and scalable growth — all without compromising stability. 🔄 leveling up stablecoin design by backing lvlUSD with aTokens, @levelusd creates a stablecoin that’s both secure and productive — one that evolves with defi itself. stable by name, composable by nature. that’s what lvlUSD is. glevel 🆙  XXX engagements  **Related Topics** [adoption](/topic/adoption) [cryptos](/topic/cryptos) [stablecoins](/topic/stablecoins) [coins stablecoin](/topic/coins-stablecoin) [lvlusd](/topic/lvlusd) [Post Link](https://x.com/0xFrosch/status/1943129414101012613)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

0xfrosch ⛓️ @0xFrosch on x 1540 followers

Created: 2025-07-10 02:05:28 UTC

0xfrosch ⛓️ @0xFrosch on x 1540 followers

Created: 2025-07-10 02:05:28 UTC

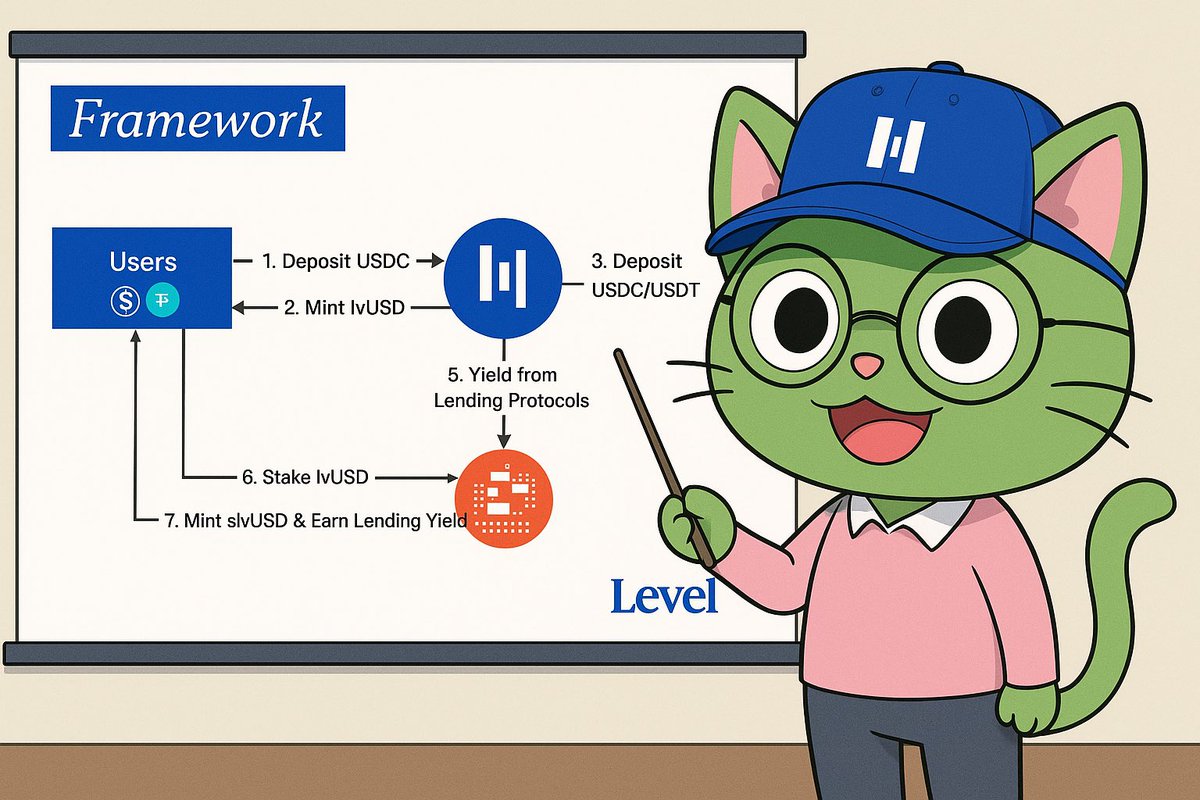

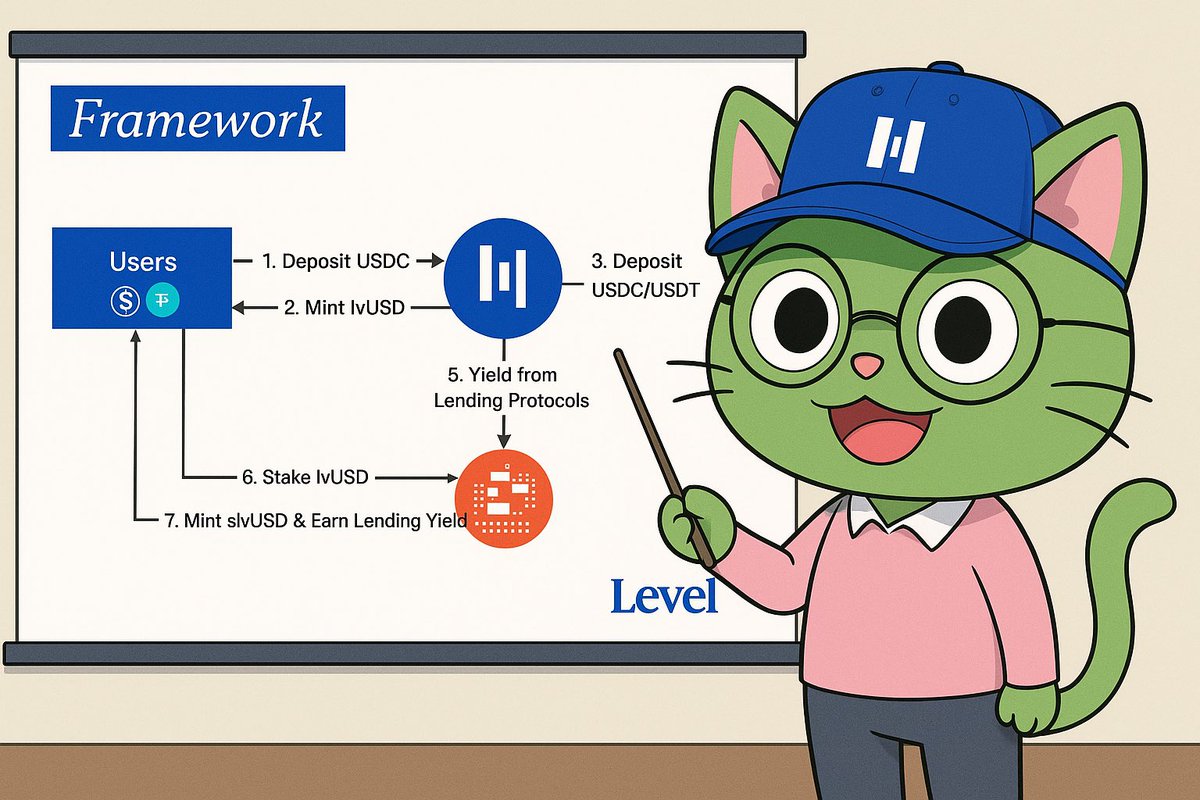

lvlUSD isn’t your typical stablecoin. it’s built on top of battle-tested protocols — specifically, receipt tokens from aave, like aUSDC and aUSDT.

what does that mean in practice? it’s actually easy to understand how @levelusd works but — okay, let’s break it down.

◽️what are receipt tokens? when you deposit stablecoins into aave, you receive interest-bearing tokens in return — like aUSDC or aUSDT. these act as receipts that accrue yield over time and can be used across defi.

◽️lvlUSD’s backing right now, lvlUSD is XXXX% backed by USDC deposited in aave, meaning the majority of its reserves are held as aUSDC, not idle USDC.

that’s a big deal: lvlUSD’s backing base is already productive.

◽️minting options: more than just USDC/USDT thanks to this integration, lvlUSD can be minted not just with raw stablecoins (USDC, USDT), but also directly with aUSDC and aUSDT.

this makes lvlUSD uniquely composable and aligned with onchain credit rails.

◽️why it matters most stablecoins sit idle. lvlUSD flips that by integrating deeply with aave, turning yield-bearing collateral into stablecoin backing.

this supports capital efficiency, organic yield, and scalable growth — all without compromising stability.

🔄 leveling up stablecoin design by backing lvlUSD with aTokens, @levelusd creates a stablecoin that’s both secure and productive — one that evolves with defi itself.

stable by name, composable by nature. that’s what lvlUSD is.

glevel 🆙

XXX engagements

Related Topics adoption cryptos stablecoins coins stablecoin lvlusd