[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  folva [@incryptfol](/creator/twitter/incryptfol) on x XX followers Created: 2025-07-09 23:36:30 UTC 2/ $4B FDV is this a lot or not? to judge and not just blindly bash @a1lon9, let’s take a clear-headed look at the project’s metrics: Annual revenue: $374.97M (fees = revenue); Monthly DEX volume: $2.936B; Quarterly revenue growth: • Q1 2024: $2.45M; • Q2 2024: $47.9M; • Q3 2024: $63.53M; • Q4 2024: $207.32M; • Q1 2025: $252.66M; alright, since we’re at it, let’s calculate the P/E ratio and compare it with other companies already in the market. • Conservative P/E 15x: $374M × XX = $5.6B FDV; • Standard P/E 20-25x: $374M × 20-25 = $7.5-9.4B FDV; • Growth company P/E 30-40x: $374M × 30-40 = $11.2-15B FDV. and the last boring bullshit (probably not) is comparing it to the big boys: • Coinbase (2023): Revenue $3.1B, Market Cap $13B (P/E ~4.2x); • Robinhood (2023): Revenue $1.9B, Market Cap $8.5B (P/E ~4.5x). i dare say, based on my observations, that for fast-growing fintech, P/E 10-20x is standard.  XX engagements  **Related Topics** [$25266m](/topic/$25266m) [$20732m](/topic/$20732m) [$6353m](/topic/$6353m) [$479m](/topic/$479m) [$245m](/topic/$245m) [$2936b](/topic/$2936b) [$37497m](/topic/$37497m) [quarterly earnings](/topic/quarterly-earnings) [Post Link](https://x.com/incryptfol/status/1943091925721964701)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

folva @incryptfol on x XX followers

Created: 2025-07-09 23:36:30 UTC

folva @incryptfol on x XX followers

Created: 2025-07-09 23:36:30 UTC

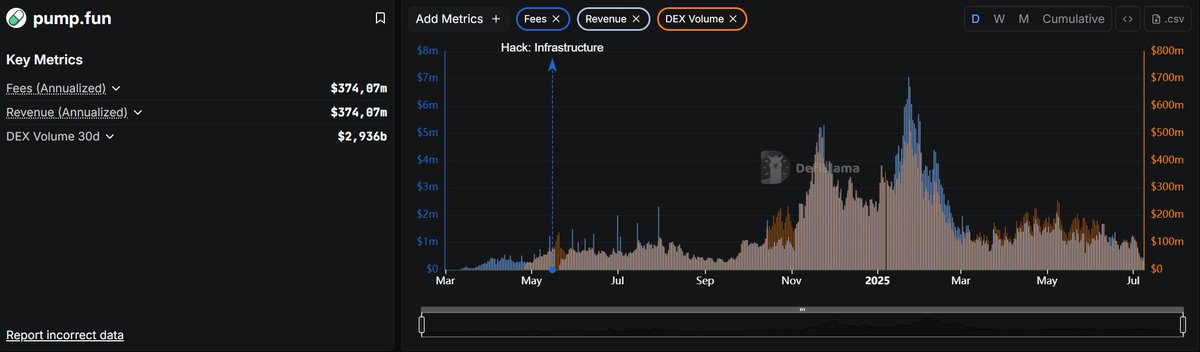

2/ $4B FDV is this a lot or not?

to judge and not just blindly bash @a1lon9, let’s take a clear-headed look at the project’s metrics:

Annual revenue: $374.97M (fees = revenue);

Monthly DEX volume: $2.936B;

Quarterly revenue growth:

• Q1 2024: $2.45M; • Q2 2024: $47.9M; • Q3 2024: $63.53M; • Q4 2024: $207.32M; • Q1 2025: $252.66M;

alright, since we’re at it, let’s calculate the P/E ratio and compare it with other companies already in the market.

• Conservative P/E 15x: $374M × XX = $5.6B FDV;

• Standard P/E 20-25x: $374M × 20-25 = $7.5-9.4B FDV;

• Growth company P/E 30-40x: $374M × 30-40 = $11.2-15B FDV.

and the last boring bullshit (probably not) is comparing it to the big boys:

• Coinbase (2023): Revenue $3.1B, Market Cap $13B (P/E ~4.2x);

• Robinhood (2023): Revenue $1.9B, Market Cap $8.5B (P/E ~4.5x).

i dare say, based on my observations, that for fast-growing fintech, P/E 10-20x is standard.

XX engagements

Related Topics $25266m $20732m $6353m $479m $245m $2936b $37497m quarterly earnings