[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Investors Compass [@selvaprathee](/creator/twitter/selvaprathee) on x 11.5K followers Created: 2025-07-09 20:23:24 UTC Blue Jet Healthcare – The Next-Gen CDMO Ascent - Forget FY25 numbers. Let’s talk strategic roadmap, growth flywheels, and how Blue Jet is positioning to become a core play in India's pharma CDMO ascent. - Here’s the investor’s lens on what really matters 1⃣ The Business Is Changing – From Bulk to Bespoke - Blue Jet isn’t just a manufacturer of intermediates. It’s building a precision-engineered CDMO platform for chronic therapies and radiology molecules. ▪️ From volume sweeteners & legacy CMIs ➡️ To patent-protected intermediates, NCEs, GLP-1s ▪️ From India exporter ➡️ To global innovator partner ▪️ From fixed-capacity business ➡️ To modular, scalable, multi-client asset-light CDMO - They’re playing the chemistry + compliance + client trust game. Not the generics game. 2⃣ Growth Vectors – Three Strategic Pillars Here’s the core growth map Blue Jet is executing: X. CV Blockbuster Intermediate (PI/API) ▪️Sole supplier to a US + EU innovator ▪️60%+ YoY Rx growth → Patent valid till 2040 ▪️Scalable, high-margin, price-inelastic X. Contrast Media NCE Ramp-Up ▪️Gadopiclenol (MRI) & Iodinated (X-ray) molecules now live ▪️Commercial supplies started Q4FY25 ▪️FY27: Full ramp, strong capacity readiness X. CDMO Pipeline Transition ▪️20+ new molecules under development ▪️30% already in late Phase X or commercial ▪️Focus: GLP-1s, oncology, cardio, CNS ➡️ Being built to replace Chinese suppliers, this is durable demand 3⃣ Execution Engine – Capacity Is Ahead of Demand Here’s why execution risk is low: ▪️Ambernath (Unit-2): Running at ~65% utilization ▪️Mahad (Unit-3): KSM backward integration → H2FY26 MPP with XX GMP reactors → H2FY27 ▪️Dahej (GIDC): Land secured. Scalable pipeline buffer ▪️De-bottlenecking headroom: 20%+ capacity upscaling in 8-9 weeks - CAPEX = ₹300 Cr | R&D = ₹40 Cr | CWIP already progressing ➡️ Blue Jet isn’t building blind, it’s building to contracts and RFPs already in play 4⃣ Strategic Positioning – Where Others Can’t Compete Blue Jet operates in low-competition, high-barrier zones: ▪️Regulatory complexity ▪️Customer-specific validations ▪️Global CDMO shift away from China ▪️Long-term relationships (4-26 years) ▪️Early-mover advantage in GLP-1 intermediates, peptide chemistry ➡️ It's not just about “molecules,” it’s about invisible moats process integration, customer IP lock-ins, audit trails. 5⃣ What Should Investors Track in FY26-FY27 ? Execution markers: ▪️Validation of Mahad KSM unit (H2FY26) ▪️Commercial traction from gadopiclenol, iodinated NCE ▪️Conversion of XX CDMO projects → commercial scale ▪️Progress on MPP commissioning + Dahej ramp plan ▪️QIP/fundraise clarity (₹1,500 Cr approved) Strategic metrics: ▪️Client stickiness ▪️Supply chain stability post-China+1 ▪️Margin durability (currently XXXX% EBITDA) ▪️Sustained high ROCE >30% Risks to watch: ▪️Contrast Media: any new destocking/inventory overhang ▪️Working capital tightness in scale-up phase ▪️Delay in new capacity utilization 🧭 The Investors Compass – Why This Matters Long-Term - Blue Jet is not a valuation bet. - It’s a visibility + stickiness + margin resilience bet. ▪️No generics exposure ▪️Zero debt, strong cash, high asset turns ▪️Rare mix of CDMO tailwinds + operating leverage ▪️Future-ready capacity + customer lock-ins - It’s building the TSMC of niche pharma intermediates, not chasing the commoditized API crowd. No Buy/Sell recommendation #StocksInFocus #StocksToWatch #bluejet #Bluejet #CDMO #pharmastocks #Pharma  XXXXXX engagements  **Related Topics** [india](/topic/india) [coins healthcare](/topic/coins-healthcare) [Post Link](https://x.com/selvaprathee/status/1943043331317207208)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Investors Compass @selvaprathee on x 11.5K followers

Created: 2025-07-09 20:23:24 UTC

Investors Compass @selvaprathee on x 11.5K followers

Created: 2025-07-09 20:23:24 UTC

Blue Jet Healthcare – The Next-Gen CDMO Ascent

- Forget FY25 numbers. Let’s talk strategic roadmap, growth flywheels, and how Blue Jet is positioning to become a core play in India's pharma CDMO ascent.

- Here’s the investor’s lens on what really matters

1⃣ The Business Is Changing – From Bulk to Bespoke

- Blue Jet isn’t just a manufacturer of intermediates. It’s building a precision-engineered CDMO platform for chronic therapies and radiology molecules. ▪️ From volume sweeteners & legacy CMIs ➡️ To patent-protected intermediates, NCEs, GLP-1s ▪️ From India exporter ➡️ To global innovator partner ▪️ From fixed-capacity business ➡️ To modular, scalable, multi-client asset-light CDMO

- They’re playing the chemistry + compliance + client trust game. Not the generics game.

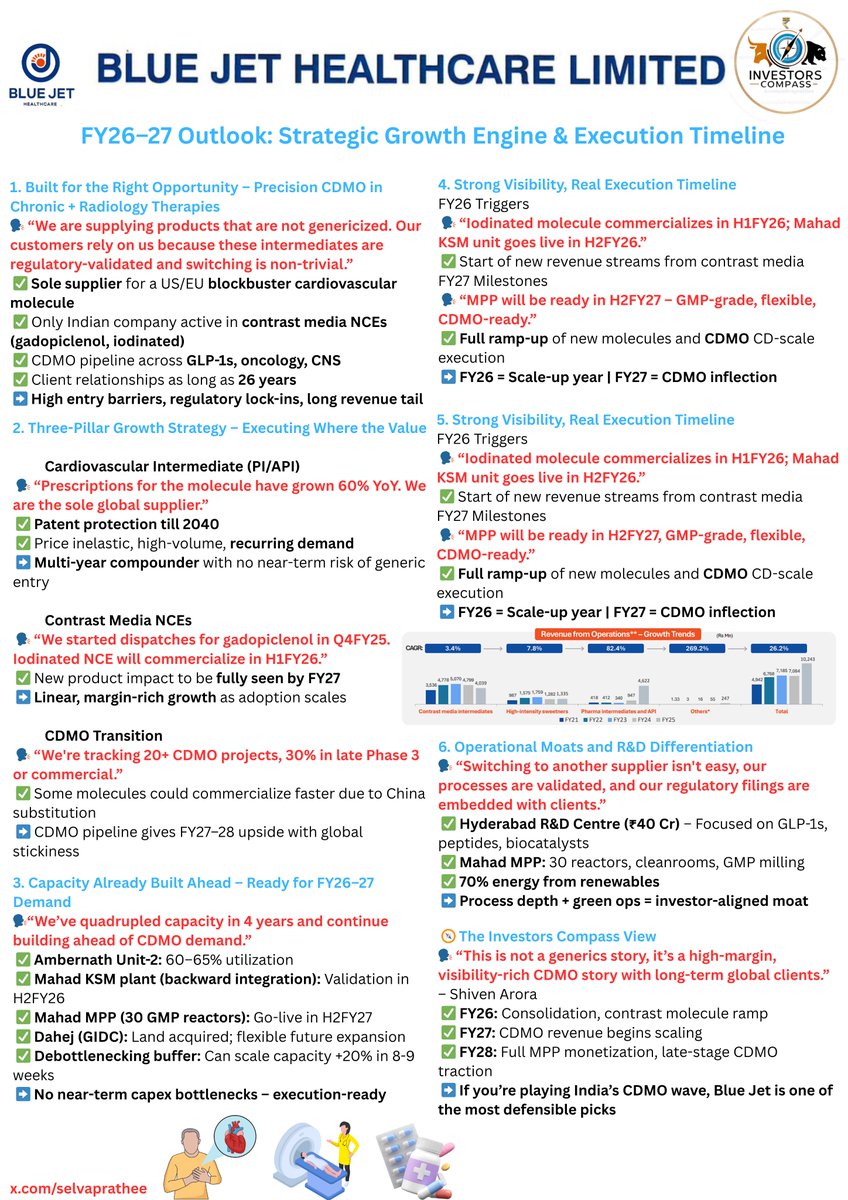

2⃣ Growth Vectors – Three Strategic Pillars Here’s the core growth map Blue Jet is executing: X. CV Blockbuster Intermediate (PI/API) ▪️Sole supplier to a US + EU innovator ▪️60%+ YoY Rx growth → Patent valid till 2040 ▪️Scalable, high-margin, price-inelastic X. Contrast Media NCE Ramp-Up ▪️Gadopiclenol (MRI) & Iodinated (X-ray) molecules now live ▪️Commercial supplies started Q4FY25 ▪️FY27: Full ramp, strong capacity readiness X. CDMO Pipeline Transition ▪️20+ new molecules under development ▪️30% already in late Phase X or commercial ▪️Focus: GLP-1s, oncology, cardio, CNS ➡️ Being built to replace Chinese suppliers, this is durable demand

3⃣ Execution Engine – Capacity Is Ahead of Demand Here’s why execution risk is low: ▪️Ambernath (Unit-2): Running at ~65% utilization ▪️Mahad (Unit-3): KSM backward integration → H2FY26 MPP with XX GMP reactors → H2FY27 ▪️Dahej (GIDC): Land secured. Scalable pipeline buffer ▪️De-bottlenecking headroom: 20%+ capacity upscaling in 8-9 weeks

- CAPEX = ₹300 Cr | R&D = ₹40 Cr | CWIP already progressing ➡️ Blue Jet isn’t building blind, it’s building to contracts and RFPs already in play

4⃣ Strategic Positioning – Where Others Can’t Compete Blue Jet operates in low-competition, high-barrier zones: ▪️Regulatory complexity ▪️Customer-specific validations ▪️Global CDMO shift away from China ▪️Long-term relationships (4-26 years) ▪️Early-mover advantage in GLP-1 intermediates, peptide chemistry ➡️ It's not just about “molecules,” it’s about invisible moats process integration, customer IP lock-ins, audit trails.

5⃣ What Should Investors Track in FY26-FY27 ? Execution markers: ▪️Validation of Mahad KSM unit (H2FY26) ▪️Commercial traction from gadopiclenol, iodinated NCE ▪️Conversion of XX CDMO projects → commercial scale ▪️Progress on MPP commissioning + Dahej ramp plan ▪️QIP/fundraise clarity (₹1,500 Cr approved) Strategic metrics: ▪️Client stickiness ▪️Supply chain stability post-China+1 ▪️Margin durability (currently XXXX% EBITDA) ▪️Sustained high ROCE >30% Risks to watch: ▪️Contrast Media: any new destocking/inventory overhang ▪️Working capital tightness in scale-up phase ▪️Delay in new capacity utilization

🧭 The Investors Compass – Why This Matters Long-Term

- Blue Jet is not a valuation bet.

- It’s a visibility + stickiness + margin resilience bet. ▪️No generics exposure ▪️Zero debt, strong cash, high asset turns ▪️Rare mix of CDMO tailwinds + operating leverage ▪️Future-ready capacity + customer lock-ins

- It’s building the TSMC of niche pharma intermediates, not chasing the commoditized API crowd.

No Buy/Sell recommendation #StocksInFocus #StocksToWatch #bluejet #Bluejet #CDMO #pharmastocks #Pharma

XXXXXX engagements

Related Topics india coins healthcare