[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Say No To Trading [@SayNoToTrading](/creator/twitter/SayNoToTrading) on x 6432 followers Created: 2025-07-09 18:39:24 UTC To offset my YTD realized gains, I will need to generate some realized losses. Unlike most, I prefer to do tax loss selling by August. Out of my hundreds of positions, the ones with red lots unrealized are health insurers $UNH, $CNC, $MOH, $ELV. What I think I'm going to do over the next XX days is buy LEAPS now and then in August (31+ days after last purchase) sell any red lots on the stock I have. Will definitely do this on $CNC and $UNH high cost lots. On $MOH and $ELV maybe not, because they're not far below breakeven. If one doesn't mind tying up a lot of capital, you can buy, as an example, XX UnitedHealth calls for Dec 17, 2027 (891 days out) at $XXX strike for $164ish That equates to breakeven at $XXX. Anything above that in ~2.5 years is gains.  XXXXX engagements  **Related Topics** [moh](/topic/moh) [$moh](/topic/$moh) [positions](/topic/positions) [tax bracket](/topic/tax-bracket) [$unh](/topic/$unh) [stocks healthcare](/topic/stocks-healthcare) [$cnc](/topic/$cnc) [molina healthcare inc](/topic/molina-healthcare-inc) [Post Link](https://x.com/SayNoToTrading/status/1943017159342596582)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Say No To Trading @SayNoToTrading on x 6432 followers

Created: 2025-07-09 18:39:24 UTC

Say No To Trading @SayNoToTrading on x 6432 followers

Created: 2025-07-09 18:39:24 UTC

To offset my YTD realized gains, I will need to generate some realized losses.

Unlike most, I prefer to do tax loss selling by August.

Out of my hundreds of positions, the ones with red lots unrealized are health insurers $UNH, $CNC, $MOH, $ELV.

What I think I'm going to do over the next XX days is buy LEAPS now and then in August (31+ days after last purchase) sell any red lots on the stock I have.

Will definitely do this on $CNC and $UNH high cost lots. On $MOH and $ELV maybe not, because they're not far below breakeven.

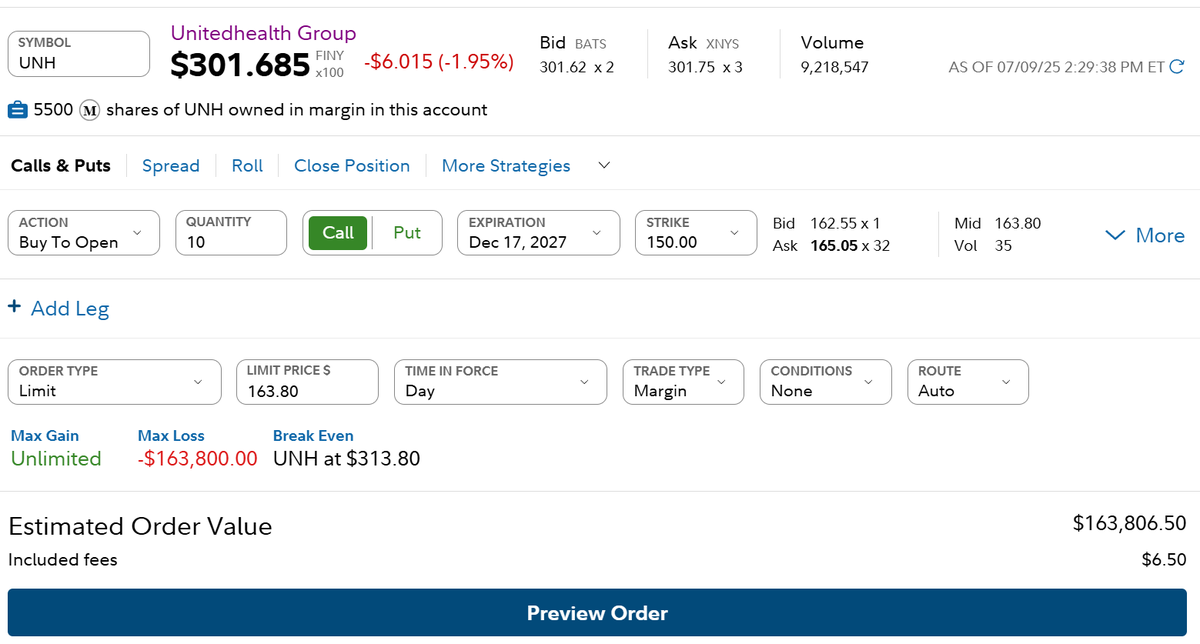

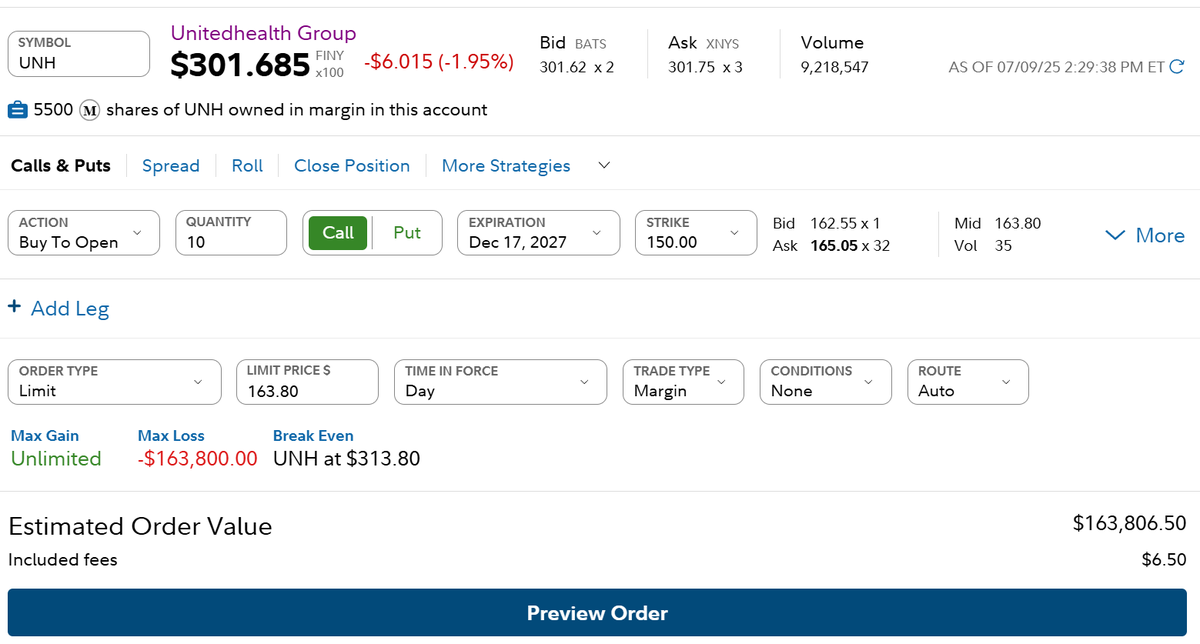

If one doesn't mind tying up a lot of capital, you can buy, as an example, XX UnitedHealth calls for Dec 17, 2027 (891 days out) at $XXX strike for $164ish

That equates to breakeven at $XXX. Anything above that in ~2.5 years is gains.

XXXXX engagements

Related Topics moh $moh positions tax bracket $unh stocks healthcare $cnc molina healthcare inc