[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Mr. P [@ProfitCircle_](/creator/twitter/ProfitCircle_) on x 2430 followers Created: 2025-07-09 18:11:53 UTC FOMC Meeting Minutes June 17–18, 2025 are out, here's summary: ⸻ 🧩 Key Policy Decision: •Fed held the federal funds rate steady at 4.25%–4.50%. •Balance sheet runoff (QT) continued; SOMA portfolio shrinking, with QT expected to end by Feb 2026. ⸻ 📉 Economic Outlook: •GDP rebounded in Q2 after a slight Q1 dip; private demand strong. •Inflation cooled but still above target — Core PCE at XXX% in May. •Unemployment steady at 4.2%; labor market solid but early signs of softening noted. ⸻ 📈 Inflation Drivers: •Tariffs seen causing short-term price bumps, but Fed expects eventual moderation. •Wages growing slower, not seen as a major inflation threat. •Geopolitical risks (e.g., Middle East) could pressure energy prices. ⸻ 💡 Key Risks & Uncertainty: •Uncertainty down from April but still high. •Risk balance: •🔺 Inflation risks skewed to the upside •🔻 Growth/labor risks skewed to the downside •Fed stressed data-driven flexibility. ⸻ 🔮 Policy Path Forward: •Most participants expect 1–2 rate cuts in 2025, depending on data (Mr.P believes no Cut in July but September and for September Cut to be 50bps) •A few open to cutting as soon as July. •A minority oppose cuts due to persistent inflation and resilient growth. ⸻ 🧠 Communication & Strategy: •Discussed upgrading SEP and using alternative scenarios to better convey risk. •Final review of their long-run policy strategy due by late summer 2025.  XXXXX engagements  **Related Topics** [inflation](/topic/inflation) [gdp](/topic/gdp) [balance sheet](/topic/balance-sheet) [fed](/topic/fed) [fomc](/topic/fomc) [Post Link](https://x.com/ProfitCircle_/status/1943010234542494042)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Mr. P @ProfitCircle_ on x 2430 followers

Created: 2025-07-09 18:11:53 UTC

Mr. P @ProfitCircle_ on x 2430 followers

Created: 2025-07-09 18:11:53 UTC

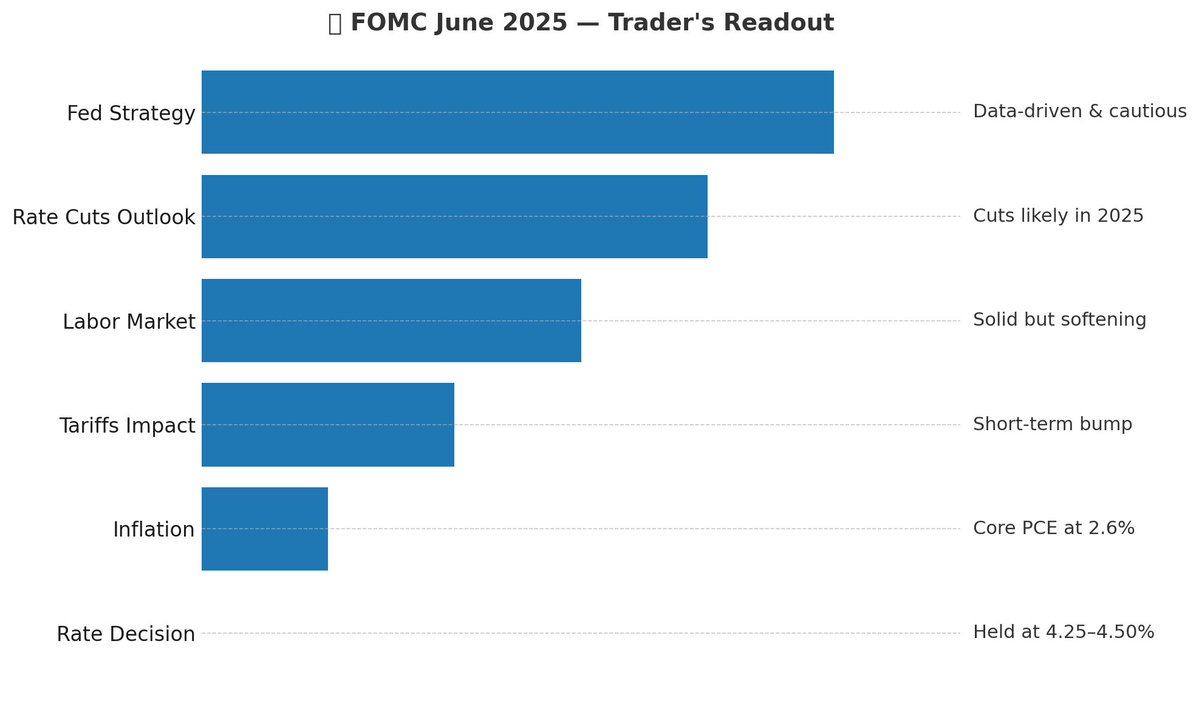

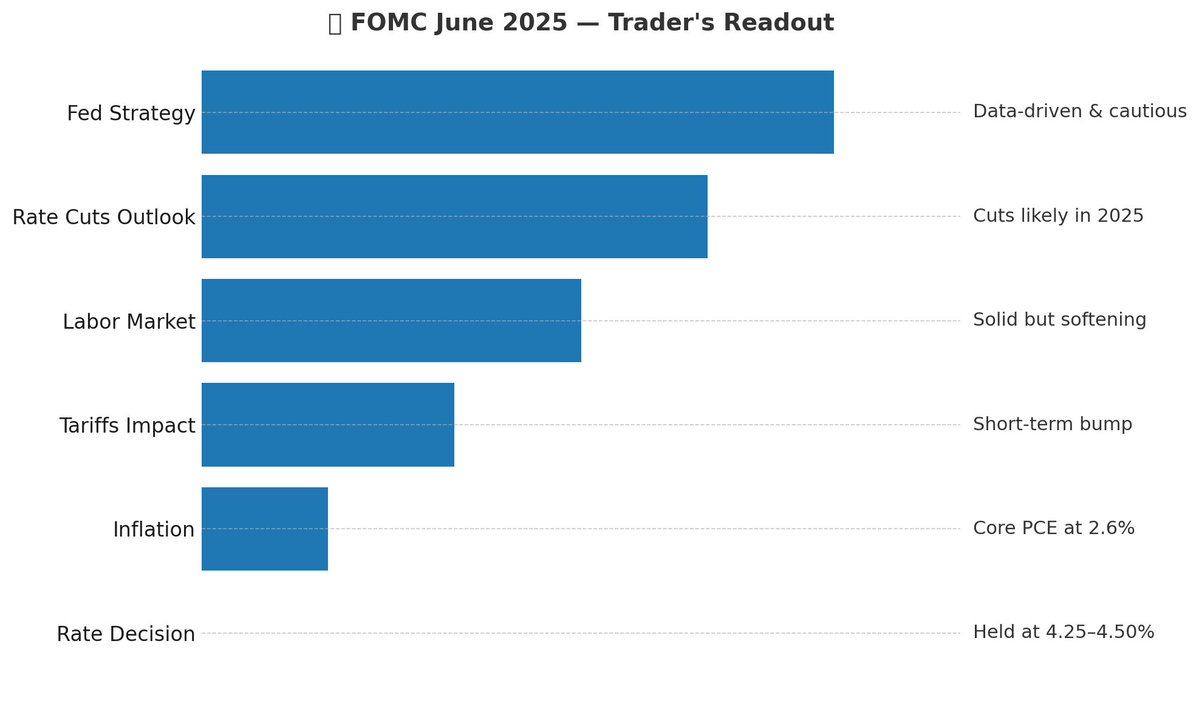

FOMC Meeting Minutes June 17–18, 2025 are out, here's summary:

⸻

🧩 Key Policy Decision: •Fed held the federal funds rate steady at 4.25%–4.50%. •Balance sheet runoff (QT) continued; SOMA portfolio shrinking, with QT expected to end by Feb 2026.

⸻

📉 Economic Outlook: •GDP rebounded in Q2 after a slight Q1 dip; private demand strong. •Inflation cooled but still above target — Core PCE at XXX% in May. •Unemployment steady at 4.2%; labor market solid but early signs of softening noted.

⸻

📈 Inflation Drivers: •Tariffs seen causing short-term price bumps, but Fed expects eventual moderation. •Wages growing slower, not seen as a major inflation threat. •Geopolitical risks (e.g., Middle East) could pressure energy prices.

⸻

💡 Key Risks & Uncertainty: •Uncertainty down from April but still high. •Risk balance: •🔺 Inflation risks skewed to the upside •🔻 Growth/labor risks skewed to the downside •Fed stressed data-driven flexibility.

⸻

🔮 Policy Path Forward: •Most participants expect 1–2 rate cuts in 2025, depending on data (Mr.P believes no Cut in July but September and for September Cut to be 50bps) •A few open to cutting as soon as July. •A minority oppose cuts due to persistent inflation and resilient growth.

⸻

🧠 Communication & Strategy: •Discussed upgrading SEP and using alternative scenarios to better convey risk. •Final review of their long-run policy strategy due by late summer 2025.

XXXXX engagements

Related Topics inflation gdp balance sheet fed fomc