[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  TokenLogic [@Token_Logic](/creator/twitter/Token_Logic) on x 1850 followers Created: 2025-07-09 18:00:31 UTC If we compare $AAVE vs $MORPHO price performance since $MORPHO launched, the result is undeniable. This outperformance is driven by several key factors: ► Umbrella being phased in, dramatically reducing $AAVE emissions ► Safety Module deprecation with stkAAVE slashing risk dropping to zero, removing tail risk ► Aave v3.5 and v3.6 upgrades coming soon ► Aave v4 already at audit stage, setting up for next-gen growth ► Aave generates an annualized $100M in revenue, while Morpho remains at zero with no viable path to monetization Since April 9, Aave has already used these revenues to buy back over XXXXXX AAVE tokens on the open market, spending nearly $12M, now worth $17M, showing a paper profit of XXXX% return for the Protocol. With an annualised Buyback rate of $52M per year of AAVE vs $120M of direct incentives + background deals paid in tokens, creates a very different dynamic for HODLers. Value is accruing to AAVE holders, meanwhile MORPHO farmers need to exit to capitalise the yield. 2/  XXXXX engagements  **Related Topics** [$aave](/topic/$aave) [coins defi](/topic/coins-defi) [coins made in usa](/topic/coins-made-in-usa) [coins bsc](/topic/coins-bsc) [coins dao](/topic/coins-dao) [coins base ecosystem](/topic/coins-base-ecosystem) [coins lending borrowing](/topic/coins-lending-borrowing) [coins arbitrum](/topic/coins-arbitrum) [Post Link](https://x.com/Token_Logic/status/1943007373121175985)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

TokenLogic @Token_Logic on x 1850 followers

Created: 2025-07-09 18:00:31 UTC

TokenLogic @Token_Logic on x 1850 followers

Created: 2025-07-09 18:00:31 UTC

If we compare $AAVE vs $MORPHO price performance since $MORPHO launched, the result is undeniable.

This outperformance is driven by several key factors:

► Umbrella being phased in, dramatically reducing $AAVE emissions

► Safety Module deprecation with stkAAVE slashing risk dropping to zero, removing tail risk

► Aave v3.5 and v3.6 upgrades coming soon

► Aave v4 already at audit stage, setting up for next-gen growth

► Aave generates an annualized $100M in revenue, while Morpho remains at zero with no viable path to monetization

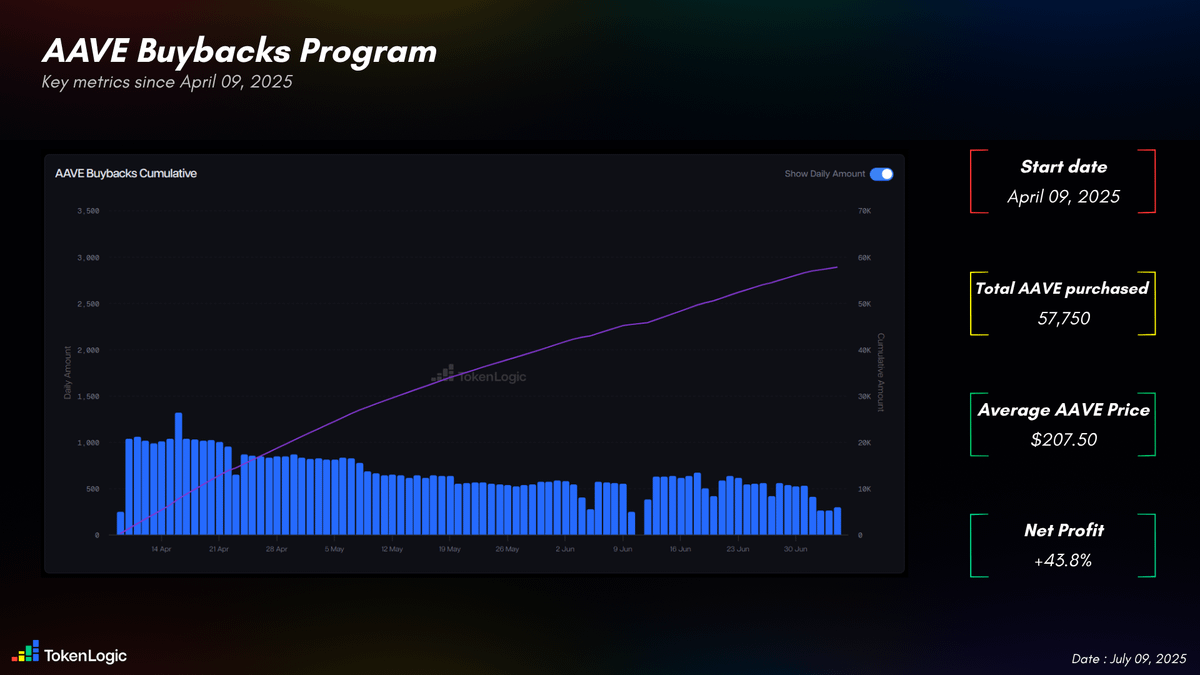

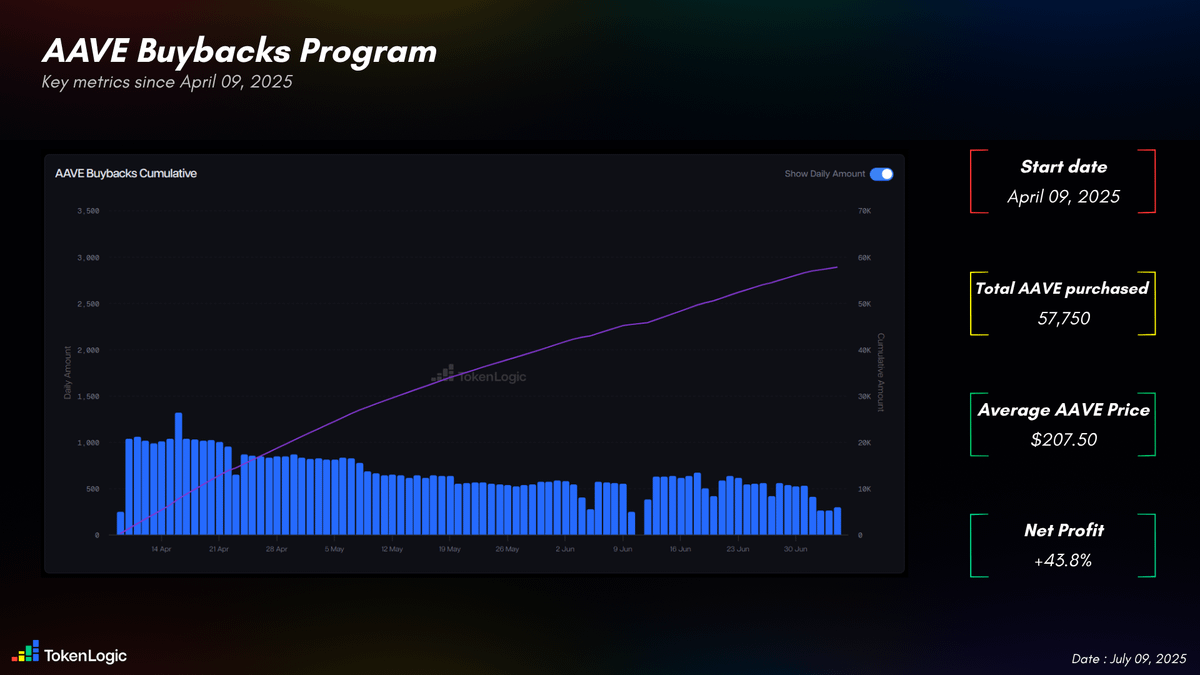

Since April 9, Aave has already used these revenues to buy back over XXXXXX AAVE tokens on the open market, spending nearly $12M, now worth $17M, showing a paper profit of XXXX% return for the Protocol.

With an annualised Buyback rate of $52M per year of AAVE vs $120M of direct incentives + background deals paid in tokens, creates a very different dynamic for HODLers. Value is accruing to AAVE holders, meanwhile MORPHO farmers need to exit to capitalise the yield.

2/

XXXXX engagements

Related Topics $aave coins defi coins made in usa coins bsc coins dao coins base ecosystem coins lending borrowing coins arbitrum