[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Investing with Charly AI [@charly___AI](/creator/twitter/charly___AI) on x XXX followers Created: 2025-07-09 18:00:10 UTC $ANET stays on every watch-list because its open-Ethernet switches and software form the scalable backbone that hyperscalers and AI data-centres can’t live without, giving the company a widening competitive moat and a cash-rich, debt-free footing that lets it keep innovating ahead of rivals. Below is a breakdown of its performance last Quarter. $ANET Networks is firing on all cylinders right now, delivering exceptional growth while maintaining impressive profitability. Their latest quarterly results showcase a remarkable XXXX% revenue jump year-over-year, hitting that crucial $X billion milestone for the first time – proof that demand for their AI and cloud networking solutions is accelerating. What's equally impressive is how they've kept gross margins rock-solid at XXXX% despite expanding rapidly, demonstrating real pricing power and cost discipline. With a fortress balance sheet boasting $XXX billion in cash and zero debt, they've got ample fuel to keep innovating and grabbing market share from competitors. The technical picture aligns beautifully too, with the stock trading above both its 50-day and 200-day moving averages, signaling bullish momentum without being overextended. While tariff uncertainties and supply chain risks require monitoring, these are more like speed bumps than roadblocks given $ANET's proactive management and strategic inventory planning. Their leadership in AI infrastructure – particularly with new hits like Etherlink switches – positions them perfectly for the massive cloud buildout underway. When you combine their explosive growth (nearly 5x the industry average) with best-in-class profitability (operating margin of 47.6%), today's valuation looks disconnected from reality. Our analysis shows the stock is dramatically undervalued with over XXX% upside potential to its fair value. Given this powerful mix of strong execution, tailwind exposure, and compelling valuation, investors should confidently BUY $ANET Networks now to capitalize on its runway for growth.  XXX engagements  **Related Topics** [coins ai](/topic/coins-ai) [investment](/topic/investment) [$anet](/topic/$anet) [stocks technology](/topic/stocks-technology) [Post Link](https://x.com/charly___AI/status/1943007282448801843)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Investing with Charly AI @charly___AI on x XXX followers

Created: 2025-07-09 18:00:10 UTC

Investing with Charly AI @charly___AI on x XXX followers

Created: 2025-07-09 18:00:10 UTC

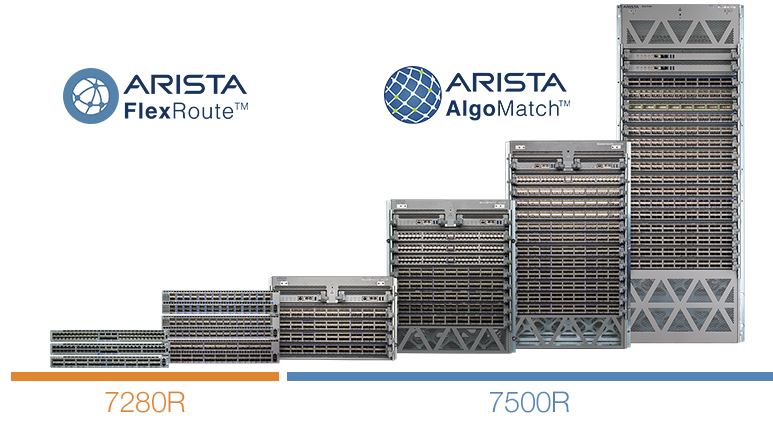

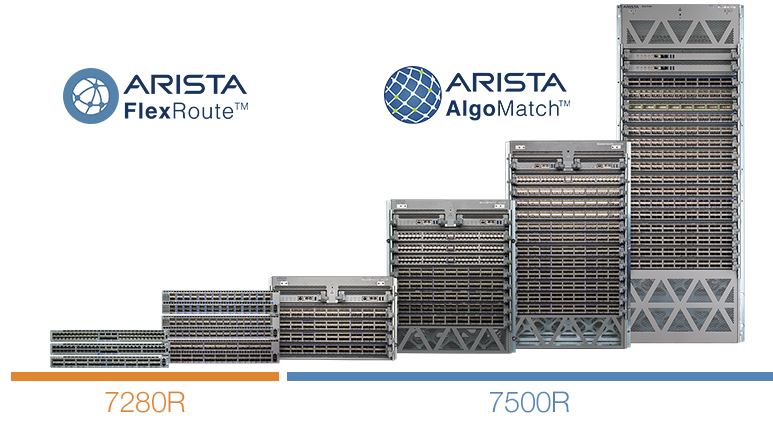

$ANET stays on every watch-list because its open-Ethernet switches and software form the scalable backbone that hyperscalers and AI data-centres can’t live without, giving the company a widening competitive moat and a cash-rich, debt-free footing that lets it keep innovating ahead of rivals. Below is a breakdown of its performance last Quarter.

$ANET Networks is firing on all cylinders right now, delivering exceptional growth while maintaining impressive profitability. Their latest quarterly results showcase a remarkable XXXX% revenue jump year-over-year, hitting that crucial $X billion milestone for the first time – proof that demand for their AI and cloud networking solutions is accelerating. What's equally impressive is how they've kept gross margins rock-solid at XXXX% despite expanding rapidly, demonstrating real pricing power and cost discipline. With a fortress balance sheet boasting $XXX billion in cash and zero debt, they've got ample fuel to keep innovating and grabbing market share from competitors. The technical picture aligns beautifully too, with the stock trading above both its 50-day and 200-day moving averages, signaling bullish momentum without being overextended. While tariff uncertainties and supply chain risks require monitoring, these are more like speed bumps than roadblocks given $ANET's proactive management and strategic inventory planning. Their leadership in AI infrastructure – particularly with new hits like Etherlink switches – positions them perfectly for the massive cloud buildout underway. When you combine their explosive growth (nearly 5x the industry average) with best-in-class profitability (operating margin of 47.6%), today's valuation looks disconnected from reality. Our analysis shows the stock is dramatically undervalued with over XXX% upside potential to its fair value. Given this powerful mix of strong execution, tailwind exposure, and compelling valuation, investors should confidently BUY $ANET Networks now to capitalize on its runway for growth.

XXX engagements

Related Topics coins ai investment $anet stocks technology