[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  #️⃣ dyor.net [@DyorNetCrypto](/creator/twitter/DyorNetCrypto) on x 84.2K followers Created: 2025-07-09 17:36:04 UTC $CATI / USDT analysis on 1d 📉 **Price Evolution and Trend Analysis** The $CATI chart exhibits a bearish trend with recent price action fluctuating around $XXXXX. The latest closing price stands at $0.0809, illustrating price compression below the key resistance zone of $XXXXXX. Although there are bullish cross signals noted, primarily from the SMA and EMA indicators, the overall trend score of -XX indicates persistent bearish pressure. ⚖️ **Trend Strength and Potential Reversal** Despite some upward momentum signs, like a Stoch RSI nearing the bullish threshold (59.78), the ADX at XXXX implies weak trend strength. This combined with the SuperTrend indicating a sell position suggests limited bullish conviction. If support around $XXXXXX holds, a breakout above the resistance level at $XXXXXX could potentially trigger a bullish reversal. 🔮 **Support and Resistance Levels** Key support is identified at $0.0713, while resistance remains anchored at $XXXXXX. A decisive break above this resistance may attract buyers, pushing towards the next target of $XXXXX. Conversely, failure to hold above the support could lead to a drop to approximately $XXXXX. 💡 **Summary and Price Target** In summary, $CATI is currently in a precarious state, showing mixed signals in a bearish context. A target price of $XXXXX is plausible if bullish momentum can be sustained. A protective stop-loss should ideally be set just below the support at $XXXXX to mitigate potential losses. Keep monitoring the market for further developments as they unfold. This content is generated by AI and does not constitute investment advice. Do your own research before investing in any asset, and only invest what you can afford to lose.  XXX engagements  **Related Topics** [cati](/topic/cati) [signals](/topic/signals) [bearish](/topic/bearish) [usdt](/topic/usdt) [$cati](/topic/$cati) [Post Link](https://x.com/DyorNetCrypto/status/1943001218403434648)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

#️⃣ dyor.net @DyorNetCrypto on x 84.2K followers

Created: 2025-07-09 17:36:04 UTC

#️⃣ dyor.net @DyorNetCrypto on x 84.2K followers

Created: 2025-07-09 17:36:04 UTC

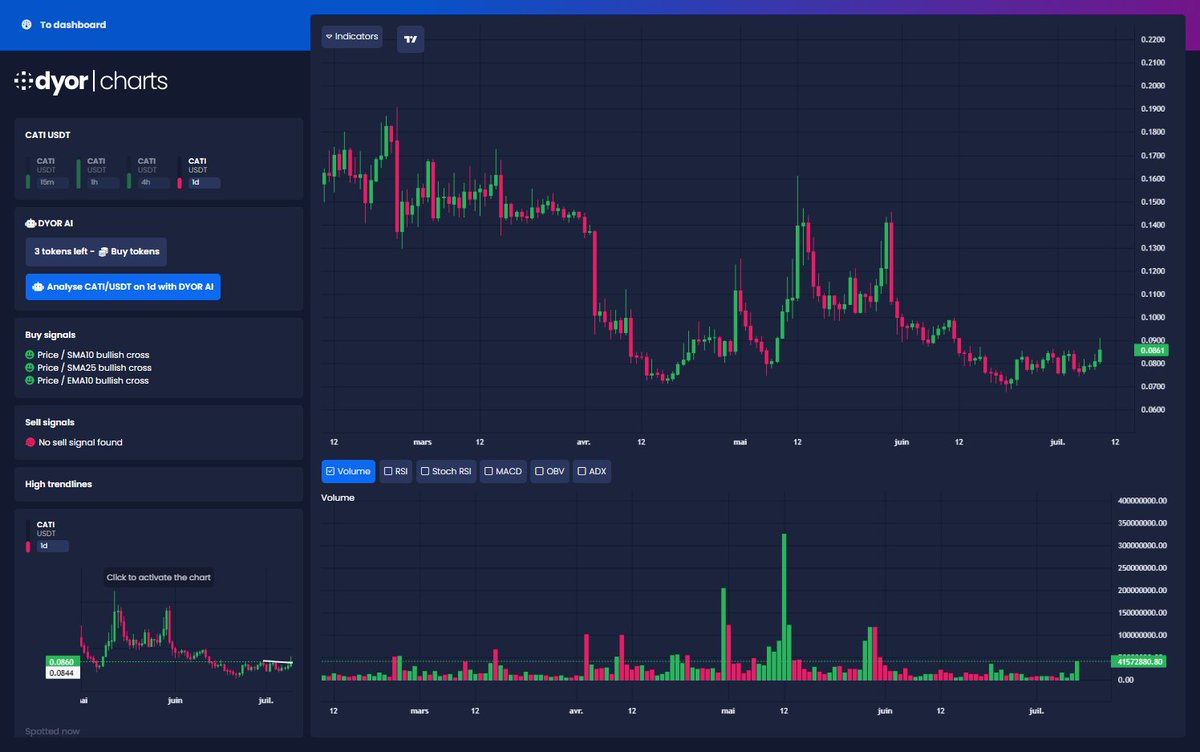

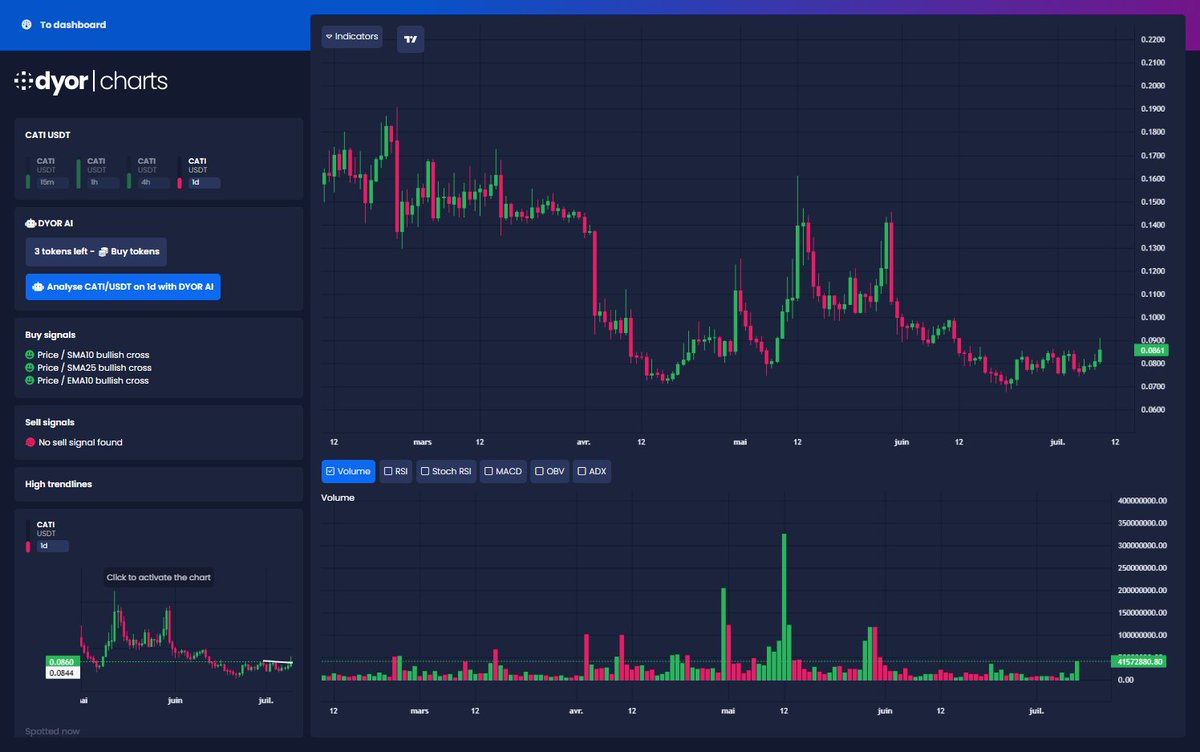

$CATI / USDT analysis on 1d

📉 Price Evolution and Trend Analysis

The $CATI chart exhibits a bearish trend with recent price action fluctuating around $XXXXX. The latest closing price stands at $0.0809, illustrating price compression below the key resistance zone of $XXXXXX. Although there are bullish cross signals noted, primarily from the SMA and EMA indicators, the overall trend score of -XX indicates persistent bearish pressure.

⚖️ Trend Strength and Potential Reversal

Despite some upward momentum signs, like a Stoch RSI nearing the bullish threshold (59.78), the ADX at XXXX implies weak trend strength. This combined with the SuperTrend indicating a sell position suggests limited bullish conviction. If support around $XXXXXX holds, a breakout above the resistance level at $XXXXXX could potentially trigger a bullish reversal.

🔮 Support and Resistance Levels

Key support is identified at $0.0713, while resistance remains anchored at $XXXXXX. A decisive break above this resistance may attract buyers, pushing towards the next target of $XXXXX. Conversely, failure to hold above the support could lead to a drop to approximately $XXXXX.

💡 Summary and Price Target

In summary, $CATI is currently in a precarious state, showing mixed signals in a bearish context. A target price of $XXXXX is plausible if bullish momentum can be sustained. A protective stop-loss should ideally be set just below the support at $XXXXX to mitigate potential losses. Keep monitoring the market for further developments as they unfold.

This content is generated by AI and does not constitute investment advice. Do your own research before investing in any asset, and only invest what you can afford to lose.

XXX engagements