[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Edward [@Defi_Edward](/creator/twitter/Defi_Edward) on x 119.1K followers Created: 2025-07-09 10:26:55 UTC It’s been a wild few days onchain... Two old wallets of $BTC and $ETH have suddenly come back to life, stirring quiet corners of the market with very loud numbers. What happens when dormant giants move? 👇 X. The XXXXX BTC Reawakening The most immediate headline comes from a Bitcoin wallet that had been silent for six years. It received XXXXX BTC in July 2019 when the asset was trading at around $9,796, totaling roughly $XXXX million. On July 8, 2025, that same wallet transferred the entire stash, now worth around $XXX million at a price above $XXXXXXX. That’s a XXXXX% gain on paper. X. Ethereum’s Genesis Memory While Bitcoin's whale was quiet for six years, Ethereum’s participant came out of a deeper slumber. A wallet tied to the 2015 ICO transferred out all XXXXX ETH it had received at launch for just $XXX. At today’s prices, that ETH is worth about $XXXX million. This follows a pattern we've seen before: old ETH whales occasionally waking to rebalance, take profits, or move assets into new contracts or custodians. X. The $8.6B Unknown Far more puzzling was last week’s movement of XXXXXX BTC from eight Satoshi-era wallets. Coins that had not moved in XX years. On-chain analysts like Coinbase’s Conor Grogan raised alarms about the nature of the move. A small Bitcoin Cash transaction sent just before the main transfer looked like a private key test. But what complicates the story is that other BCH wallets tied to the same legacy stash remain untouched. If it was a security compromise, why weren’t those drained too? If it was the original owner, why now, and why in this specific way? But the symmetry with the Bitcoin movement is hard to ignore. X. What the Data Suggests In total, we’ve seen over $XX billion in old assets shift onchain in under a week. Notably, these aren’t rug pulls, scams, or celebrity wallets but long-dormant balances associated with early protocol activity. These events serve as high-resolution snapshots of crypto’s generational turnover. They expose the tension between historical ownership and current market structure. X. Reading the Signals These movements represent potential liquidity entering (or exiting) the system after years of inactivity. A XXXXX BTC move or XXXXX ETH may not break markets today, but they highlight how dormant capital can become active supply without warning. Oh, and did I mention that the new ETH wallet also contains $XX worth of a memecoin called Gensler (GENSLR)?! So what’s the signal here: rotation, reflection, or reckoning?  XXXXXX engagements  **Related Topics** [btc eth](/topic/btc-eth) [$eth](/topic/$eth) [$btc](/topic/$btc) [coins wallets](/topic/coins-wallets) [onchain](/topic/onchain) [bitcoin](/topic/bitcoin) [coins layer 1](/topic/coins-layer-1) [coins bitcoin ecosystem](/topic/coins-bitcoin-ecosystem) [Post Link](https://x.com/Defi_Edward/status/1942893221475914104)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Edward @Defi_Edward on x 119.1K followers

Created: 2025-07-09 10:26:55 UTC

Edward @Defi_Edward on x 119.1K followers

Created: 2025-07-09 10:26:55 UTC

It’s been a wild few days onchain...

Two old wallets of $BTC and $ETH have suddenly come back to life, stirring quiet corners of the market with very loud numbers.

What happens when dormant giants move? 👇 X. The XXXXX BTC Reawakening The most immediate headline comes from a Bitcoin wallet that had been silent for six years.

It received XXXXX BTC in July 2019 when the asset was trading at around $9,796, totaling roughly $XXXX million.

On July 8, 2025, that same wallet transferred the entire stash, now worth around $XXX million at a price above $XXXXXXX.

That’s a XXXXX% gain on paper.

X. Ethereum’s Genesis Memory While Bitcoin's whale was quiet for six years, Ethereum’s participant came out of a deeper slumber.

A wallet tied to the 2015 ICO transferred out all XXXXX ETH it had received at launch for just $XXX.

At today’s prices, that ETH is worth about $XXXX million.

This follows a pattern we've seen before: old ETH whales occasionally waking to rebalance, take profits, or move assets into new contracts or custodians. X. The $8.6B Unknown Far more puzzling was last week’s movement of XXXXXX BTC from eight Satoshi-era wallets. Coins that had not moved in XX years.

On-chain analysts like Coinbase’s Conor Grogan raised alarms about the nature of the move.

A small Bitcoin Cash transaction sent just before the main transfer looked like a private key test.

But what complicates the story is that other BCH wallets tied to the same legacy stash remain untouched.

If it was a security compromise, why weren’t those drained too? If it was the original owner, why now, and why in this specific way? But the symmetry with the Bitcoin movement is hard to ignore.

X. What the Data Suggests In total, we’ve seen over $XX billion in old assets shift onchain in under a week.

Notably, these aren’t rug pulls, scams, or celebrity wallets but long-dormant balances associated with early protocol activity.

These events serve as high-resolution snapshots of crypto’s generational turnover. They expose the tension between historical ownership and current market structure.

X. Reading the Signals These movements represent potential liquidity entering (or exiting) the system after years of inactivity.

A XXXXX BTC move or XXXXX ETH may not break markets today, but they highlight how dormant capital can become active supply without warning.

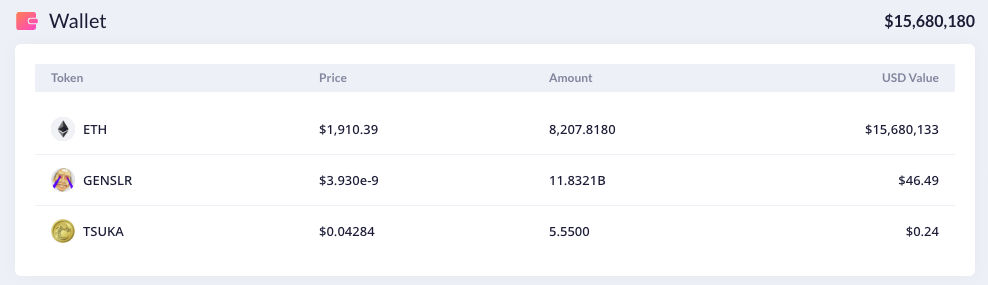

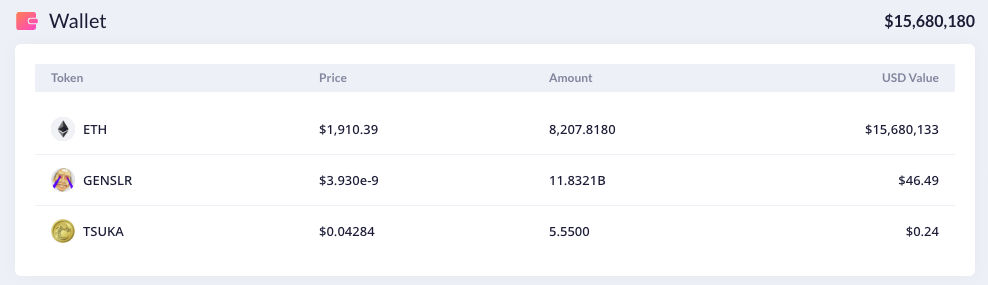

Oh, and did I mention that the new ETH wallet also contains $XX worth of a memecoin called Gensler (GENSLR)?!

So what’s the signal here: rotation, reflection, or reckoning?

XXXXXX engagements

Related Topics btc eth $eth $btc coins wallets onchain bitcoin coins layer 1 coins bitcoin ecosystem