[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  LunarCrush Social Analytics [@LunarCrush](/creator/twitter/LunarCrush) on x 310.1K followers Created: 2025-07-09 02:42:00 UTC Has the growth in M2 money supply impacted social interest in Bitcoin? Let's look at the data using the LunarCrush MCP server within @AnthropicAI's Claude. The Great Monetary Expansion From 2020 to 2025, M2 money supply exploded from $15.4T to $22.1T — the largest monetary expansion in modern history. Yet Bitcoin social chatter followed its own chaotic rhythm, completely disconnected from this unprecedented liquidity injection. Social Volatility vs Monetary Stability While M2 grew predictably at ~3-4% annually post-crisis, Bitcoin mentions swung wildly from XXXXX to XXXXXXX daily — an XXXXXX% range. Social sentiment operates in a universe entirely separate from traditional monetary policy. Election Chaos Theory November 2024's election created the perfect storm: 278K daily mentions as Bitcoin hit new highs. Meanwhile, M2 continued its steady climb, proving that crypto social energy comes from cultural moments, not monetary metrics. The Maturation Signal By 2025, Bitcoin mentions stabilized around 100-200K daily despite continued M2 growth. This suggests the crypto market is evolving from pure speculation to something resembling institutional adoption — less social noise, more real utility.  XXXXX engagements  **Related Topics** [$221t](/topic/$221t) [$154t](/topic/$154t) [central bank actions](/topic/central-bank-actions) [money](/topic/money) [coins analytics](/topic/coins-analytics) [lunarcrush](/topic/lunarcrush) [bitcoin](/topic/bitcoin) [coins layer 1](/topic/coins-layer-1) [Post Link](https://x.com/LunarCrush/status/1942776219793252811)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

LunarCrush Social Analytics @LunarCrush on x 310.1K followers

Created: 2025-07-09 02:42:00 UTC

LunarCrush Social Analytics @LunarCrush on x 310.1K followers

Created: 2025-07-09 02:42:00 UTC

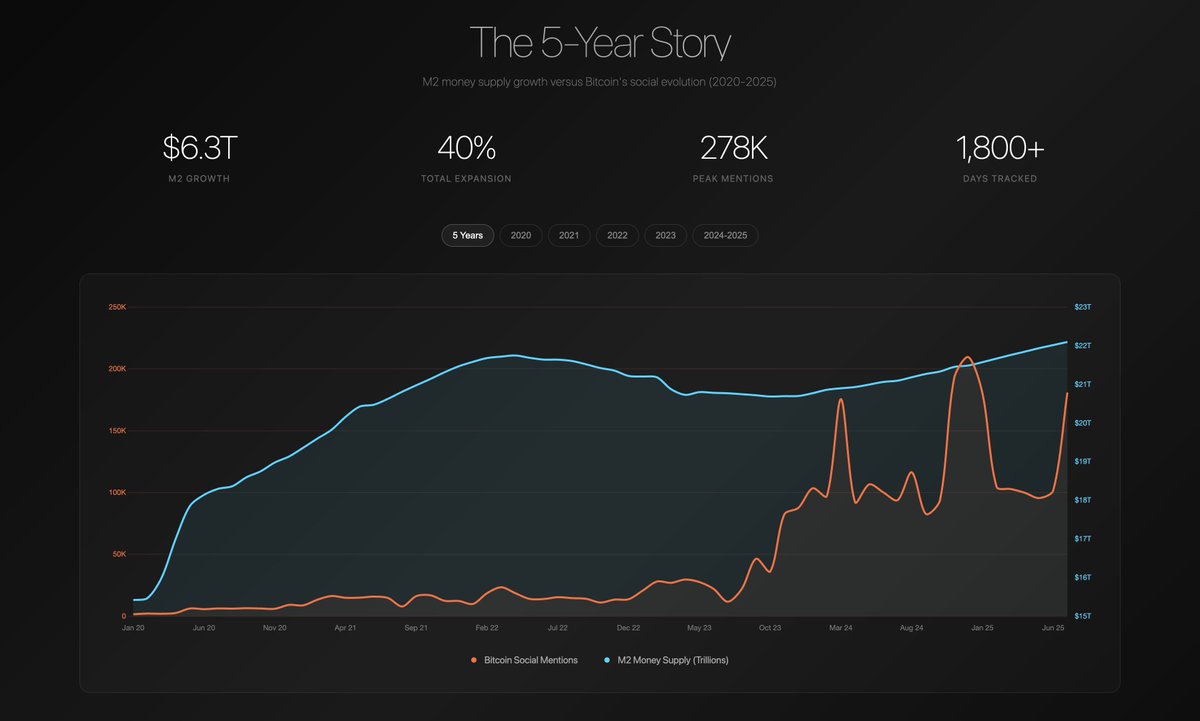

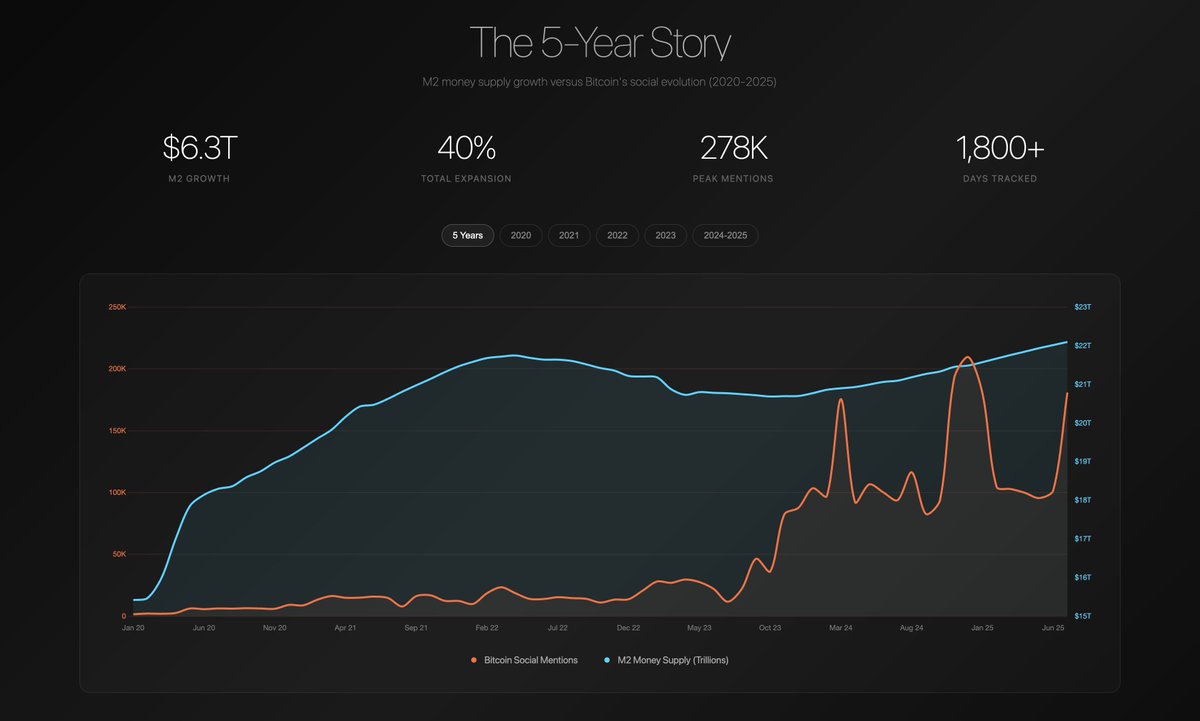

Has the growth in M2 money supply impacted social interest in Bitcoin?

Let's look at the data using the LunarCrush MCP server within @AnthropicAI's Claude.

The Great Monetary Expansion From 2020 to 2025, M2 money supply exploded from $15.4T to $22.1T — the largest monetary expansion in modern history. Yet Bitcoin social chatter followed its own chaotic rhythm, completely disconnected from this unprecedented liquidity injection.

Social Volatility vs Monetary Stability While M2 grew predictably at ~3-4% annually post-crisis, Bitcoin mentions swung wildly from XXXXX to XXXXXXX daily — an XXXXXX% range. Social sentiment operates in a universe entirely separate from traditional monetary policy.

Election Chaos Theory November 2024's election created the perfect storm: 278K daily mentions as Bitcoin hit new highs. Meanwhile, M2 continued its steady climb, proving that crypto social energy comes from cultural moments, not monetary metrics.

The Maturation Signal By 2025, Bitcoin mentions stabilized around 100-200K daily despite continued M2 growth. This suggests the crypto market is evolving from pure speculation to something resembling institutional adoption — less social noise, more real utility.

XXXXX engagements

Related Topics $221t $154t central bank actions money coins analytics lunarcrush bitcoin coins layer 1