[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Say No To Trading [@SayNoToTrading](/creator/twitter/SayNoToTrading) on x 6305 followers Created: 2025-07-08 22:31:51 UTC After I wrote about $FICO this morning, I did decide to nibble X shares as it approached $XXXXX. Almost got the bottom, but not quite. These X are subject to selling since they are not lowest cost. But we warned, REAL RISKS with FICO and it is not the strong monopoly everyone has been brainwashed by Dev Kantesaria to believe. He's just talking his book. VantageScore was considered a joke XX years ago but not anymore. When VantageScore XXX came out in 2013, they switched to a XXX to XXX range, to mimic $FICO for apples-to-apples score numbers. But the formula was way off, so an XXX FICO was way different than an XXX Vantage. However, they kept iterating the scoring and today, VantageScore XXX and XXX seriously competes with FICO. Arguments about FICO scores being low cost relative to price of a mortgage totally miss the point. For starters, it's more than everyone on X says. Potentially $140–$200 in 2025 for joint (spouses) doing a tri-merge report. You may be doing this with multiple lenders, too. Secondly, VantageScore is jointly owned by Equifax $EFX, Experian $EXPGY $EXPGF $EXPN, and TransUnion $TRU. Think about it... right now, $FICO pays the X credit bureaus for reports, puts that data through a fancy algo, then spits out a score. VantageScore can be priced nearly free, because anything is icing on the cake. They're still selling the reports (same as what they do to FICO) but now, rather than FICO making all the money off the formula layered on their data, the X agencies can do that themselves. Kind of like Zelle, owned by participating banks, ended up hurting $PYPL Venmo and $XYZ Cash App. Equifax, Experian, and TransUnion can and likely will do the same over time.  XXXXXX engagements  **Related Topics** [monopoly](/topic/monopoly) [stocks](/topic/stocks) [$fico](/topic/$fico) [fair isaac corp](/topic/fair-isaac-corp) [stocks technology](/topic/stocks-technology) [Post Link](https://x.com/SayNoToTrading/status/1942713266054295859)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Say No To Trading @SayNoToTrading on x 6305 followers

Created: 2025-07-08 22:31:51 UTC

Say No To Trading @SayNoToTrading on x 6305 followers

Created: 2025-07-08 22:31:51 UTC

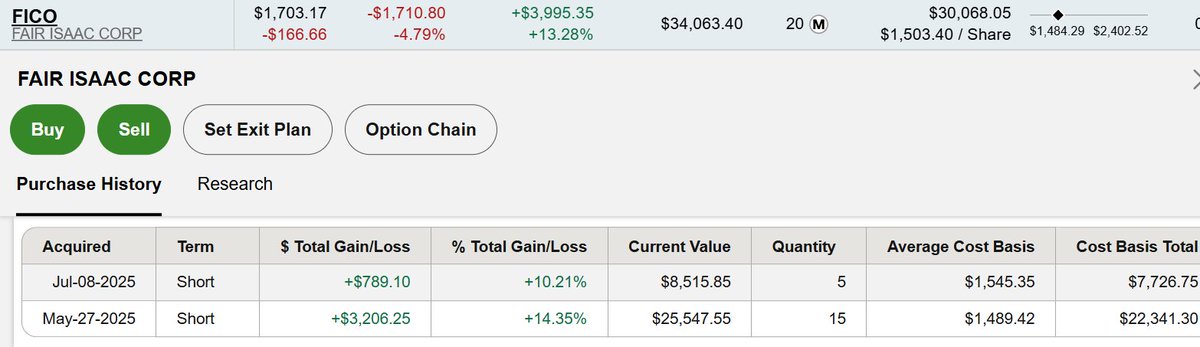

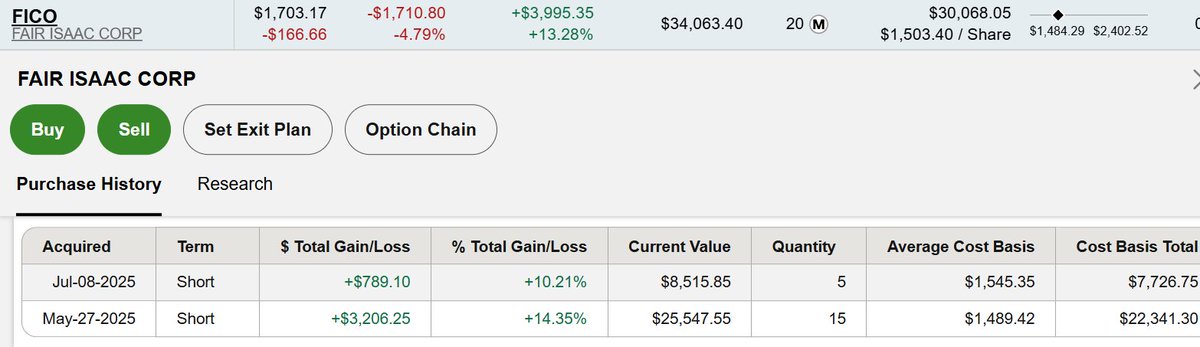

After I wrote about $FICO this morning, I did decide to nibble X shares as it approached $XXXXX. Almost got the bottom, but not quite.

These X are subject to selling since they are not lowest cost.

But we warned, REAL RISKS with FICO and it is not the strong monopoly everyone has been brainwashed by Dev Kantesaria to believe. He's just talking his book.

VantageScore was considered a joke XX years ago but not anymore.

When VantageScore XXX came out in 2013, they switched to a XXX to XXX range, to mimic $FICO for apples-to-apples score numbers.

But the formula was way off, so an XXX FICO was way different than an XXX Vantage.

However, they kept iterating the scoring and today, VantageScore XXX and XXX seriously competes with FICO.

Arguments about FICO scores being low cost relative to price of a mortgage totally miss the point.

For starters, it's more than everyone on X says.

Potentially $140–$200 in 2025 for joint (spouses) doing a tri-merge report. You may be doing this with multiple lenders, too.

Secondly, VantageScore is jointly owned by Equifax $EFX, Experian $EXPGY $EXPGF $EXPN, and TransUnion $TRU.

Think about it... right now, $FICO pays the X credit bureaus for reports, puts that data through a fancy algo, then spits out a score.

VantageScore can be priced nearly free, because anything is icing on the cake.

They're still selling the reports (same as what they do to FICO) but now, rather than FICO making all the money off the formula layered on their data, the X agencies can do that themselves.

Kind of like Zelle, owned by participating banks, ended up hurting $PYPL Venmo and $XYZ Cash App. Equifax, Experian, and TransUnion can and likely will do the same over time.

XXXXXX engagements

Related Topics monopoly stocks $fico fair isaac corp stocks technology