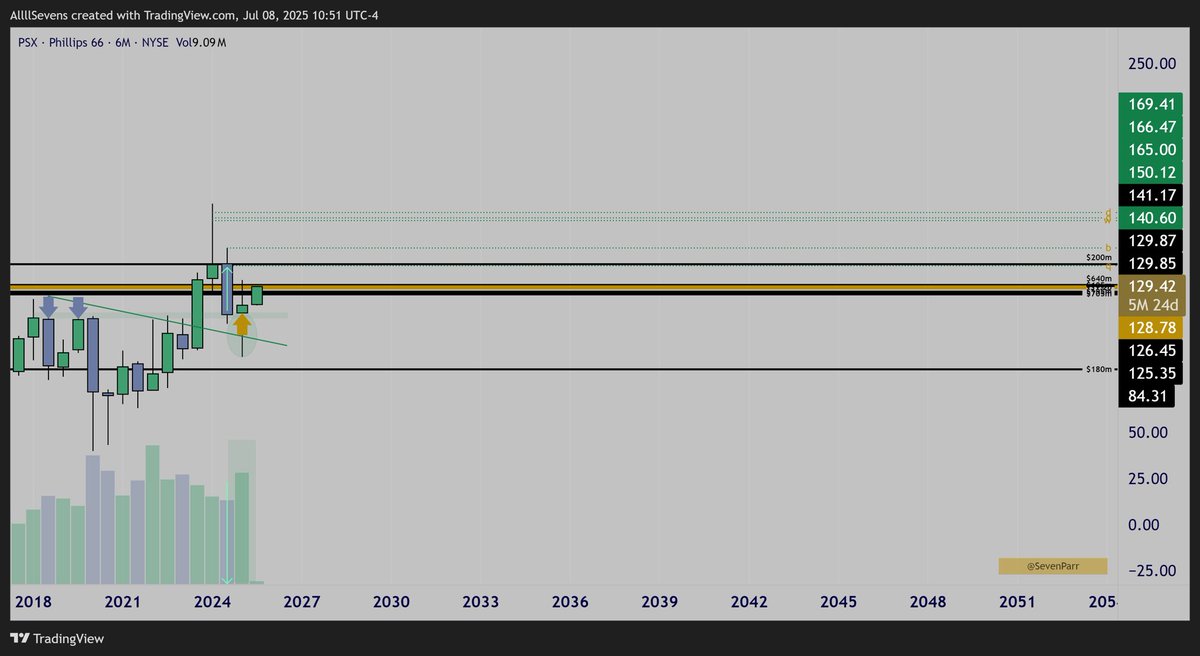

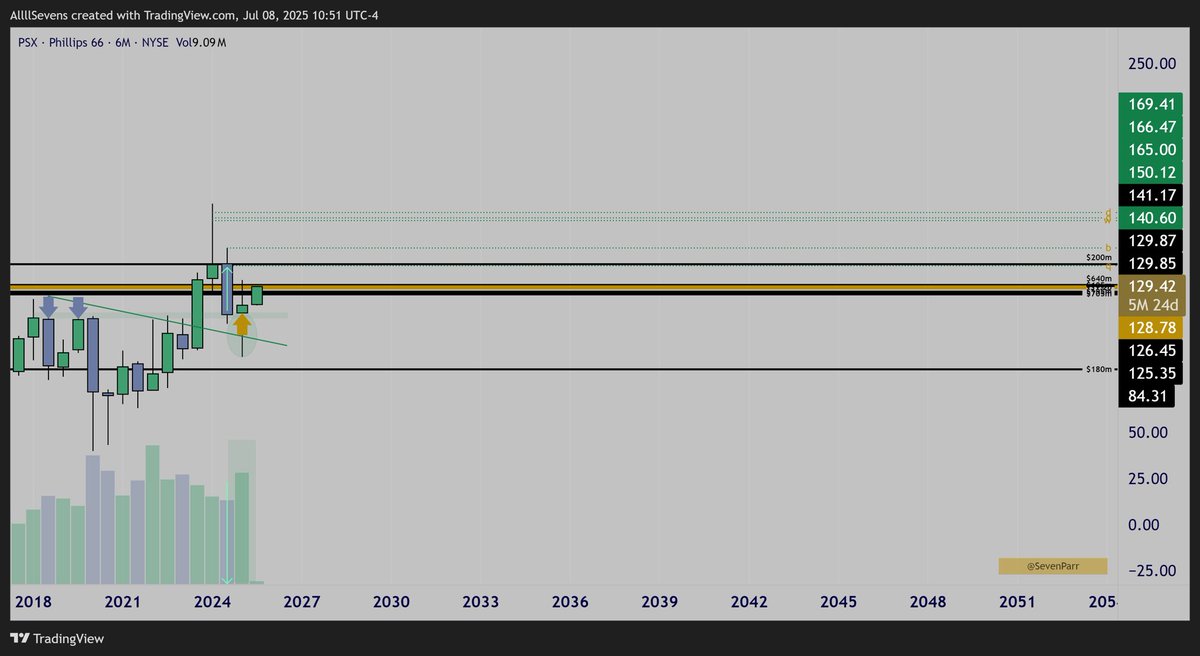

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Seven [@SevenParr](/creator/twitter/SevenParr) on x 7914 followers Created: 2025-07-08 15:15:53 UTC The stock has pulled back on anomalous volume since the 2024 highs ( very aggressive selling with very little volume ) Meanwhile, it saw its largest dark pool transactions on record… Signaling that these institutions clearly did not participate in the sell-off but are rather trying to put in a floor, and continuing to build their long term position. The last two quarters (6 month candle) displays this pattern best The decreased volume sell-off last summer on an increased spread candle is an extreme anomaly. This is why I think the stock is cheap today. Last candle shows increased volume buyers stepping in, accumulating these dark pools + bouncing from a prior double top - now acting as support Overall this stock has been relatively sideways for quite some time. I think this type of compression paired with its largest institutional transactions on record and that active “discount” from last summer, there’s a great long-term opportunity here, even at $XXX Btw that’s incredible you got in in the $50’s. Respect. There was definitely better times to buy this, but I do believe institutional investors are actively adding some of their larger size ever to this stock (long-term) so I am also buying.  XXX engagements  **Related Topics** [candle](/topic/candle) [Post Link](https://x.com/SevenParr/status/1942603553429721361)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Seven @SevenParr on x 7914 followers

Created: 2025-07-08 15:15:53 UTC

Seven @SevenParr on x 7914 followers

Created: 2025-07-08 15:15:53 UTC

The stock has pulled back on anomalous volume since the 2024 highs ( very aggressive selling with very little volume )

Meanwhile, it saw its largest dark pool transactions on record… Signaling that these institutions clearly did not participate in the sell-off but are rather trying to put in a floor, and continuing to build their long term position.

The last two quarters (6 month candle) displays this pattern best

The decreased volume sell-off last summer on an increased spread candle is an extreme anomaly. This is why I think the stock is cheap today. Last candle shows increased volume buyers stepping in, accumulating these dark pools + bouncing from a prior double top - now acting as support

Overall this stock has been relatively sideways for quite some time. I think this type of compression paired with its largest institutional transactions on record and that active “discount” from last summer, there’s a great long-term opportunity here, even at $XXX

Btw that’s incredible you got in in the $50’s. Respect. There was definitely better times to buy this, but I do believe institutional investors are actively adding some of their larger size ever to this stock (long-term) so I am also buying.

XXX engagements

Related Topics candle