[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Cheek Analytics🍑🪙 [@CheekAnalytics](/creator/twitter/CheekAnalytics) on x 2918 followers Created: 2025-07-08 13:37:40 UTC Liquidity comparison: $SATFI vs $DEGE – $SATFI at 1.1M MC has 627K liquidity, with 259K in real money inside the pool (wBTC). – $DEGE at 19.59M MC had similar 617K liquidity and 259K real money inside the pool (in SOL). Why does this matter? Because in the long term, coins with better liquidity setups win, and holders as well. Sure, low-liquidity coins can pump hard, but when sellers wake up, it’s GG. Especially with bundled coins like $DEGE. I still don’t get why all launchpads default to super-low liquidity settings. Is it intentional? More pumps = more hype = more users for the launchpad? Maybe. But at the end of the day, retail gets dumped on. Only snipers and early farmers win, scooping up 20–30% supply for a few grand, as shown in my countless analyses. So basically, understand it this way: If the dev of bundled $DEGE decides to market sell his entire bag, the maximum he can extract is $259K. That’s the real pooled value in the LP, not the fake MC you see on screen. Always look at real liquidity, not just the market cap. SATFI is the future of how launchpads will look; it's just a matter of time.  XXXXX engagements  **Related Topics** [cpg7gjcjcdzghe5ej6loal4xqztnfewexxmtkyjaovaf](/topic/cpg7gjcjcdzghe5ej6loal4xqztnfewexxmtkyjaovaf) [holders](/topic/holders) [coins](/topic/coins) [sol](/topic/sol) [wbtc](/topic/wbtc) [money](/topic/money) [$satfi](/topic/$satfi) [coins analytics](/topic/coins-analytics) [Post Link](https://x.com/CheekAnalytics/status/1942578836601717021)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Cheek Analytics🍑🪙 @CheekAnalytics on x 2918 followers

Created: 2025-07-08 13:37:40 UTC

Cheek Analytics🍑🪙 @CheekAnalytics on x 2918 followers

Created: 2025-07-08 13:37:40 UTC

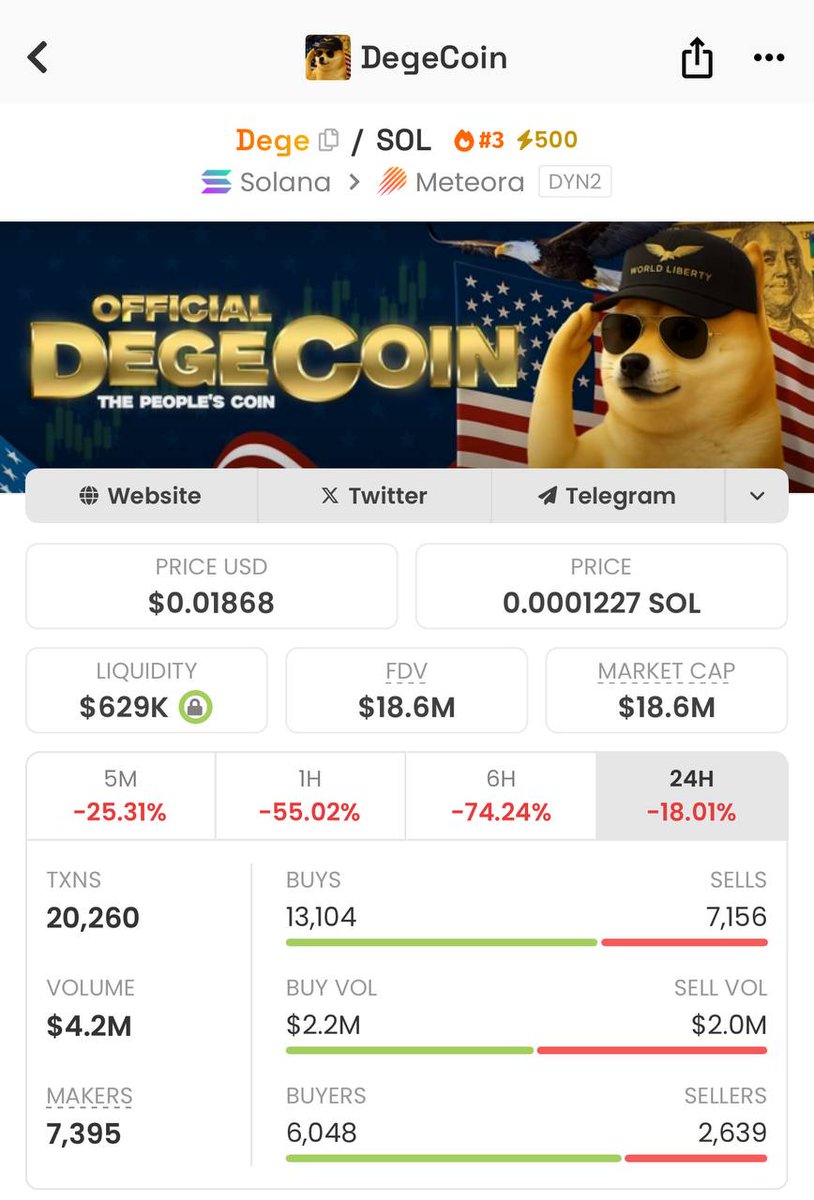

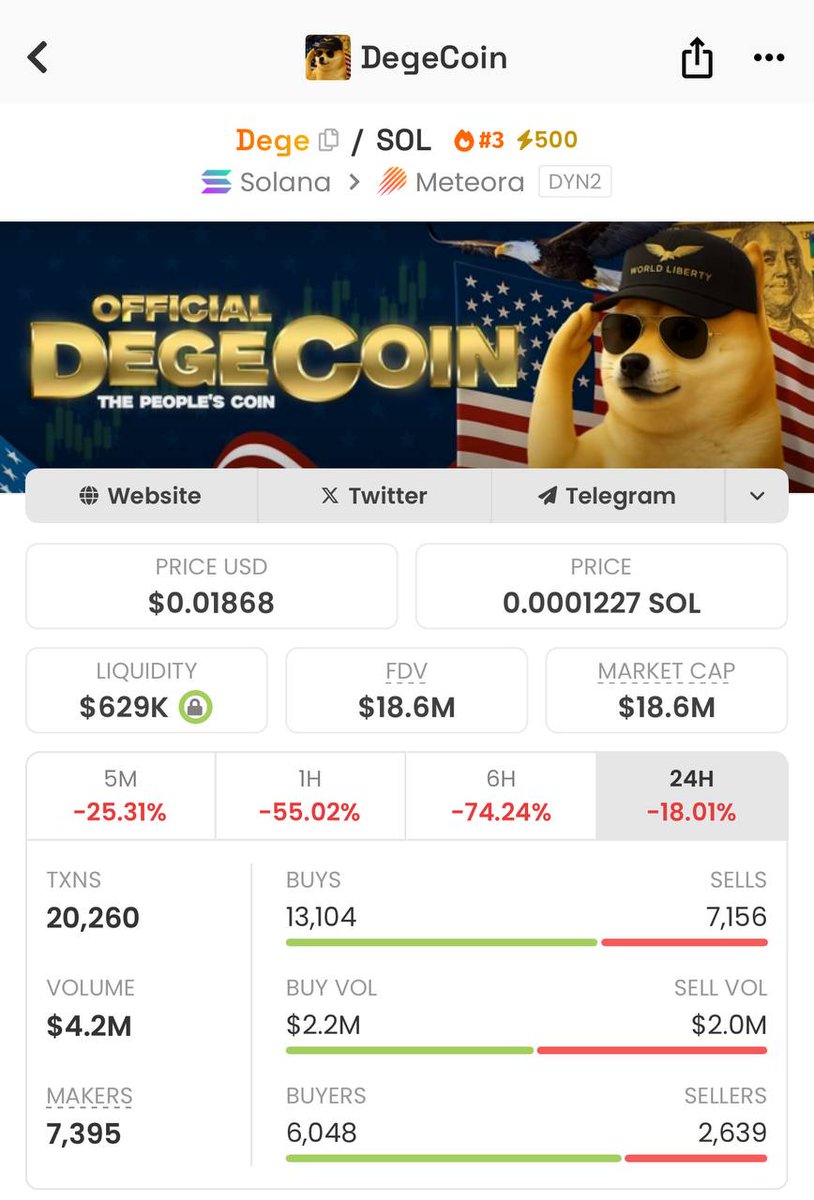

Liquidity comparison: $SATFI vs $DEGE

– $SATFI at 1.1M MC has 627K liquidity, with 259K in real money inside the pool (wBTC). – $DEGE at 19.59M MC had similar 617K liquidity and 259K real money inside the pool (in SOL).

Why does this matter? Because in the long term, coins with better liquidity setups win, and holders as well. Sure, low-liquidity coins can pump hard, but when sellers wake up, it’s GG. Especially with bundled coins like $DEGE.

I still don’t get why all launchpads default to super-low liquidity settings. Is it intentional? More pumps = more hype = more users for the launchpad? Maybe. But at the end of the day, retail gets dumped on. Only snipers and early farmers win, scooping up 20–30% supply for a few grand, as shown in my countless analyses.

So basically, understand it this way:

If the dev of bundled $DEGE decides to market sell his entire bag, the maximum he can extract is $259K. That’s the real pooled value in the LP, not the fake MC you see on screen. Always look at real liquidity, not just the market cap.

SATFI is the future of how launchpads will look; it's just a matter of time.

XXXXX engagements

Related Topics cpg7gjcjcdzghe5ej6loal4xqztnfewexxmtkyjaovaf holders coins sol wbtc money $satfi coins analytics