[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Swingly [@SwinglyHQ](/creator/twitter/SwinglyHQ) on x 1373 followers Created: 2025-07-08 13:20:00 UTC $APP: Base-Building Just Below Trigger • $APP was one of the first tech leaders to break out in April, and after a healthy pullback in early June, it's now tightening into a textbook setup. • We're seeing a clean volatility contraction pattern (VCP) forming just below the 10, 20, and 50-day EMAs, with the stock coiling along its point of control (POC) near $XXX. • What makes this even more compelling is the low-volume shelf up to $XXX (as shown on the VRVP), which could act as an air pocket if $APP breaks through the $352–$356 zone. • That range also aligns with dense resistance on the weekly chart, adding significance to a potential breakout. • The rising 10- and 20-week EMAs are holding perfectly, and the weekly pattern is now showing clear signs of institutional accumulation. • If $APP clears $353–$356 on strong volume, we could see fast movement toward the $XXX zone. This is a high-quality setup to keep on top of your watchlist today.  XXX engagements  **Related Topics** [poc](/topic/poc) [economic downturn](/topic/economic-downturn) [volatility](/topic/volatility) [$app](/topic/$app) [applovin](/topic/applovin) [stocks technology](/topic/stocks-technology) [Post Link](https://x.com/SwinglyHQ/status/1942574390643941431)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Swingly @SwinglyHQ on x 1373 followers

Created: 2025-07-08 13:20:00 UTC

Swingly @SwinglyHQ on x 1373 followers

Created: 2025-07-08 13:20:00 UTC

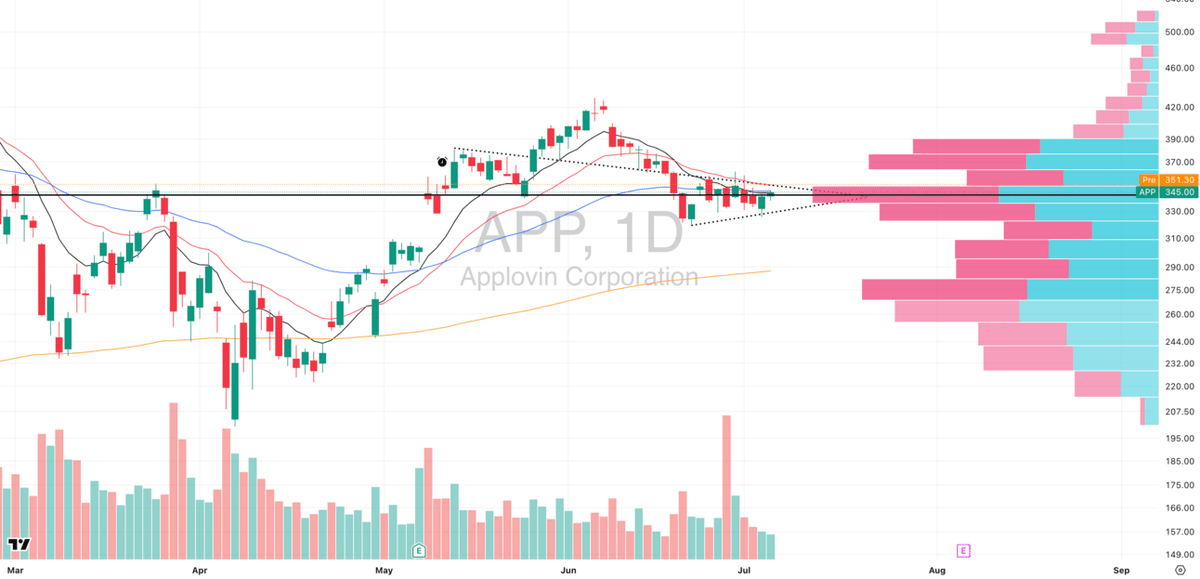

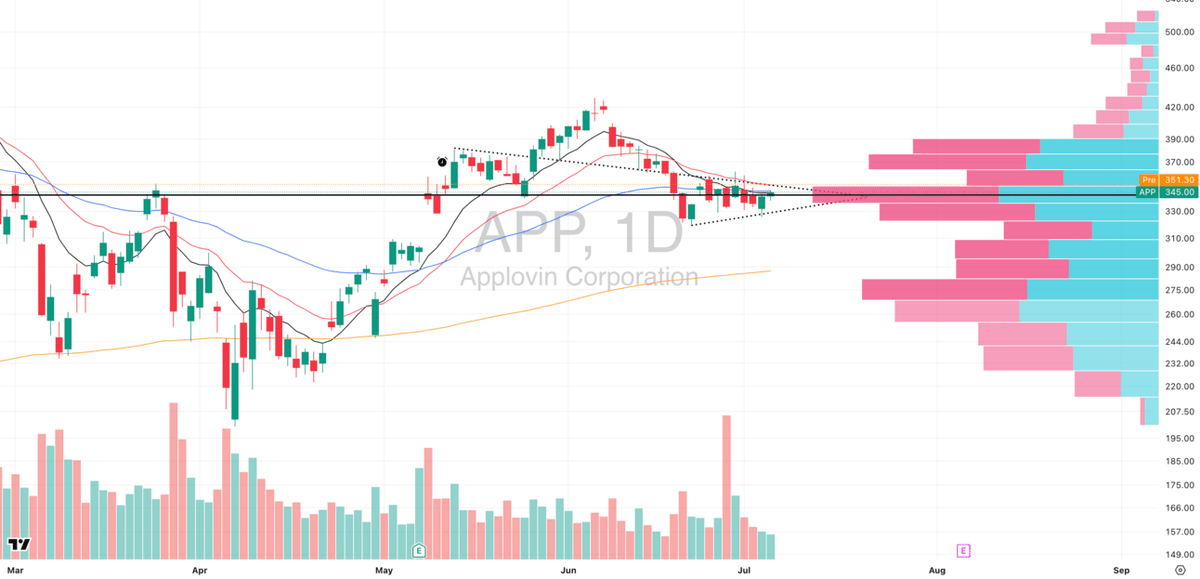

$APP: Base-Building Just Below Trigger

• $APP was one of the first tech leaders to break out in April, and after a healthy pullback in early June, it's now tightening into a textbook setup.

• We're seeing a clean volatility contraction pattern (VCP) forming just below the 10, 20, and 50-day EMAs, with the stock coiling along its point of control (POC) near $XXX.

• What makes this even more compelling is the low-volume shelf up to $XXX (as shown on the VRVP), which could act as an air pocket if $APP breaks through the $352–$356 zone.

• That range also aligns with dense resistance on the weekly chart, adding significance to a potential breakout.

• The rising 10- and 20-week EMAs are holding perfectly, and the weekly pattern is now showing clear signs of institutional accumulation.

• If $APP clears $353–$356 on strong volume, we could see fast movement toward the $XXX zone. This is a high-quality setup to keep on top of your watchlist today.

XXX engagements

Related Topics poc economic downturn volatility $app applovin stocks technology