[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Restructuring__ [@Restructuring__](/creator/twitter/Restructuring__) on x 38.6K followers Created: 2025-07-06 18:18:43 UTC Pari Passu Newsletter - Deep Dive I just crossed 35k followers, so it’s a good time to re-introduce myself - Here’s my story 👇👇 (and entire growth timeline) I fell in love with restructuring my freshman year I read Moyer and was hooked - I knew this was what I was meant to do After graduation, I started as a restructuring and special situations analyst at PJT / Houlihan / Evercore During my time there, I would get tens, if not hundreds, of emails from students interested in chatting. After doing a few calls, I realized I was wasting time and that I should share my passion for the field in a way that could impact more students. In addition, I hated the fact that no one on Instagram talked about restructuring (LOL), so I thought I should just do it. Fill the gap, I started in January 2022. Post advanced restructuring on an image-based platform. Want to guess how that worked? Pretty poorly. I posted 3-4x posts per week, and after a year, I had less than XXXXX followers. Not bad, but I realized the social media game was not easy. This said, what really bothered me was that memes used to do better than my advanced educational posts. Message received, I should change things up. High of my XXXXX subscribers, I started Pari Passu, my restructuring newsletter in January 2023. The first email went out to XXX subscribers. After XX editions, I crossed XXXXX subscribers. I felt cool. After XX editions, I crossed XXXXX subscribers. I felt so cool. At the end of the first year (2023), I had XXXXX subscribers. I was blown away, but things were just getting hot. By May 2024, I had doubled, XXXXX subscribers. By November, I doubled again, crossing XXXXXX subscribers and posting our 100th edition, Pluralsight deep dive - awesome piece. We ended our second year at XXXXXX subscribers. Growth was outstanding, but I realized something had to change. After my two years in banking, I moved to private equity, and I felt that the newsletter should include more non-restructuring content. My thinking was something along the lines of “That is what I do in my main job, therefore I should change what I write about.” Over 2024, I realized that the write-ups I was really excited about were all restructuring-focused, and this is what makes Pari Passu different. The world does not really need another company deep-dives newsletter. In 2025, I have been focused: restructuring only. Our content has never been better, our growth has continued (23,000 subscribers today), but our open rate has skyrocketed (63%) and so has our paid conversion. Our readers include every influential investor in the distressed space. To give you an idea, two of our avid readers include the Head of Restructuring at Elliott and the founder of Canyon Partners. I sincerely believe our content is unmatched, the explanation of complex restructuring topics is what makes us stand out, and I do not care if our TAM is too small. Everyone should understand credit and restructuring. Currently, our ecosystem includes the Pari Passu Newsletter and our Social Media accounts (e.g., Instagram, X, LinkedIn). In the newsletter, you can expect 5,000+ words writeups which fit three buckets: 1) Transaction Deep Dives: Talen, Thrasio, BurgerFi, GrafTech, SmileDirectClub - these writeups in which we provide a comprehensive overview on the business, what went wrong, and how the restructuring unfolded 2) Technical Case Studies: Double and Triple Dips, Disqualified Lender List, Section 363, Equitable Subordination, Unions and Chapter XX - these are writeups in which we explain a restructuring-related technical topic that is essential to understand to navigate the current world; these writeups are divided into a purely technical first half and a second half covering a case study 3) Tactical Analyses (Premium subscribers only): Hunter-gatherer LMT and analysis of the Ardagh-Apollo deal, Zips Car Wash - a Quick Private Credit Chapter 11, First HVAC Roll-Up to File for Chapter XX - these are writeups about developing transactions and trends that everyone should be following (publishing Saks later this week) On our social media platforms, you can expect: - Me sharing my experience as Private Equity associate - Short-form restructuring content and news coverage - Private equity transaction summaries - Podcast summaries - Research article summaries and many other educational topics Interested in joining me and learning advanced restructuring and private equity lessons? Follow me here and subscribe to our Pari Passu Newsletter (15% off our premium plans for July 4th expires tonight)  XXXXXX engagements  **Related Topics** [chapter 11](/topic/chapter-11) [Post Link](https://x.com/Restructuring__/status/1941924787573735676)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Restructuring__ @Restructuring__ on x 38.6K followers

Created: 2025-07-06 18:18:43 UTC

Restructuring__ @Restructuring__ on x 38.6K followers

Created: 2025-07-06 18:18:43 UTC

Pari Passu Newsletter - Deep Dive

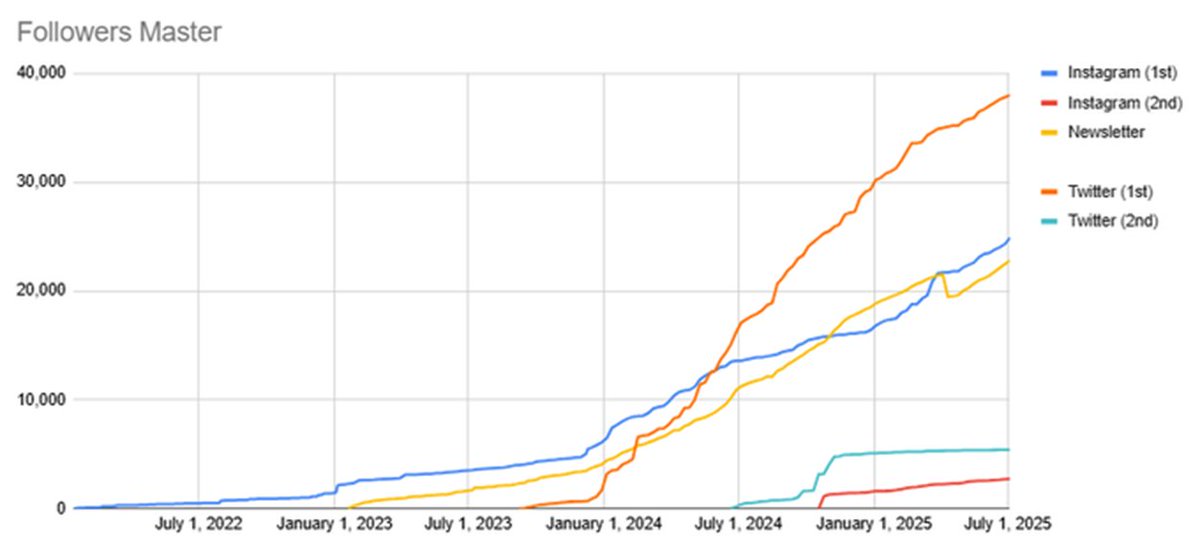

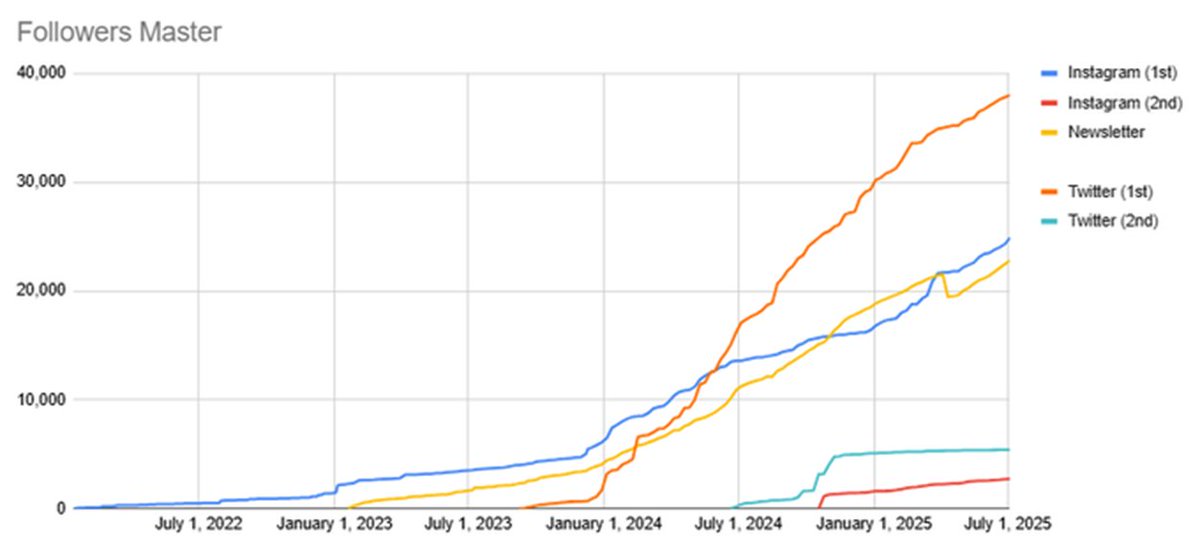

I just crossed 35k followers, so it’s a good time to re-introduce myself - Here’s my story 👇👇 (and entire growth timeline)

I fell in love with restructuring my freshman year

I read Moyer and was hooked - I knew this was what I was meant to do

After graduation, I started as a restructuring and special situations analyst at PJT / Houlihan / Evercore

During my time there, I would get tens, if not hundreds, of emails from students interested in chatting. After doing a few calls, I realized I was wasting time and that I should share my passion for the field in a way that could impact more students.

In addition, I hated the fact that no one on Instagram talked about restructuring (LOL), so I thought I should just do it. Fill the gap, I started in January 2022. Post advanced restructuring on an image-based platform. Want to guess how that worked?

Pretty poorly. I posted 3-4x posts per week, and after a year, I had less than XXXXX followers. Not bad, but I realized the social media game was not easy.

This said, what really bothered me was that memes used to do better than my advanced educational posts. Message received, I should change things up.

High of my XXXXX subscribers, I started Pari Passu, my restructuring newsletter in January 2023.

The first email went out to XXX subscribers.

After XX editions, I crossed XXXXX subscribers. I felt cool.

After XX editions, I crossed XXXXX subscribers. I felt so cool.

At the end of the first year (2023), I had XXXXX subscribers. I was blown away, but things were just getting hot.

By May 2024, I had doubled, XXXXX subscribers.

By November, I doubled again, crossing XXXXXX subscribers and posting our 100th edition, Pluralsight deep dive - awesome piece.

We ended our second year at XXXXXX subscribers. Growth was outstanding, but I realized something had to change.

After my two years in banking, I moved to private equity, and I felt that the newsletter should include more non-restructuring content. My thinking was something along the lines of “That is what I do in my main job, therefore I should change what I write about.”

Over 2024, I realized that the write-ups I was really excited about were all restructuring-focused, and this is what makes Pari Passu different. The world does not really need another company deep-dives newsletter.

In 2025, I have been focused: restructuring only.

Our content has never been better, our growth has continued (23,000 subscribers today), but our open rate has skyrocketed (63%) and so has our paid conversion.

Our readers include every influential investor in the distressed space. To give you an idea, two of our avid readers include the Head of Restructuring at Elliott and the founder of Canyon Partners.

I sincerely believe our content is unmatched, the explanation of complex restructuring topics is what makes us stand out, and I do not care if our TAM is too small.

Everyone should understand credit and restructuring.

Currently, our ecosystem includes the Pari Passu Newsletter and our Social Media accounts (e.g., Instagram, X, LinkedIn).

In the newsletter, you can expect 5,000+ words writeups which fit three buckets:

Transaction Deep Dives: Talen, Thrasio, BurgerFi, GrafTech, SmileDirectClub - these writeups in which we provide a comprehensive overview on the business, what went wrong, and how the restructuring unfolded

Technical Case Studies: Double and Triple Dips, Disqualified Lender List, Section 363, Equitable Subordination, Unions and Chapter XX - these are writeups in which we explain a restructuring-related technical topic that is essential to understand to navigate the current world; these writeups are divided into a purely technical first half and a second half covering a case study

Tactical Analyses (Premium subscribers only): Hunter-gatherer LMT and analysis of the Ardagh-Apollo deal, Zips Car Wash - a Quick Private Credit Chapter 11, First HVAC Roll-Up to File for Chapter XX - these are writeups about developing transactions and trends that everyone should be following (publishing Saks later this week)

On our social media platforms, you can expect:

- Me sharing my experience as Private Equity associate

- Short-form restructuring content and news coverage - Private equity transaction summaries

- Podcast summaries

- Research article summaries and many other educational topics

Interested in joining me and learning advanced restructuring and private equity lessons?

Follow me here and subscribe to our Pari Passu Newsletter (15% off our premium plans for July 4th expires tonight)

XXXXXX engagements

Related Topics chapter 11