[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Anthony Sandford [@AnthonySandford](/creator/twitter/AnthonySandford) on x 29.3K followers Created: 2025-07-06 16:49:02 UTC Unusual Flow of the Week: $LVS 7/3 45C @ $XXXX → $XXXX = XXXXX% All flow is courtesy of @unusual_whales 🐳 and found on the platform. - We had an unusual trade come in on 6/30 for XXXXXX contracts at an average fill of $0.24, totaling $362K in premium on the 7/3 $LVS 45C. This was also the biggest spike in net call premium on $LVS over the last XX days. Looking at the raw flow feed, we can see this came in as "repeated hits with ascending fill", which just means our spot price was increasing — visible under the "Spot" column — going from $XXXX to $XXXX. We also saw IV% increasing. These are all clues that these were likely buys. - All of the open interest carried over into 7/1 as well. $LVS gapped up on 7/1 and finished +8.89% on news that Macau’s Gaming Inspection and Coordination Bureau reported gaming revenue growth soared XX% in June. - On 7/1, XXXXXX contracts traded, and on 7/2, XXXXX contracts were closed. We know for sure this whale closed about half of their position. With total volume matching the original whale's entry size, I’d make an educated guess that the whale closed XX% and passed the rest to another party — half the OI remained into the end of the week. - These contracts ran from an average of $XXXX to a high of $XXXX — a XXXXX% move. It looks like our whale exited around $XXXX for XXXXXX% and $XXXX for 945.83%.  XXXXXX engagements  **Related Topics** [$362k](/topic/$362k) [$lvs](/topic/$lvs) [las vegas sands corp](/topic/las-vegas-sands-corp) [stocks consumer cyclical](/topic/stocks-consumer-cyclical) [Post Link](https://x.com/AnthonySandford/status/1941902220850614382)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Anthony Sandford @AnthonySandford on x 29.3K followers

Created: 2025-07-06 16:49:02 UTC

Anthony Sandford @AnthonySandford on x 29.3K followers

Created: 2025-07-06 16:49:02 UTC

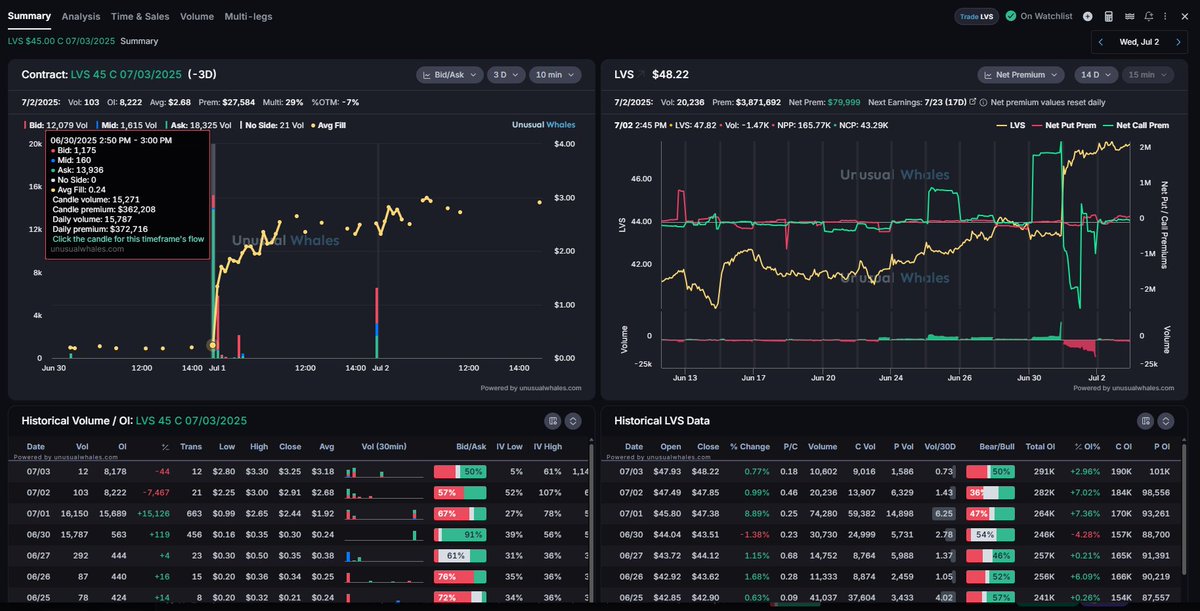

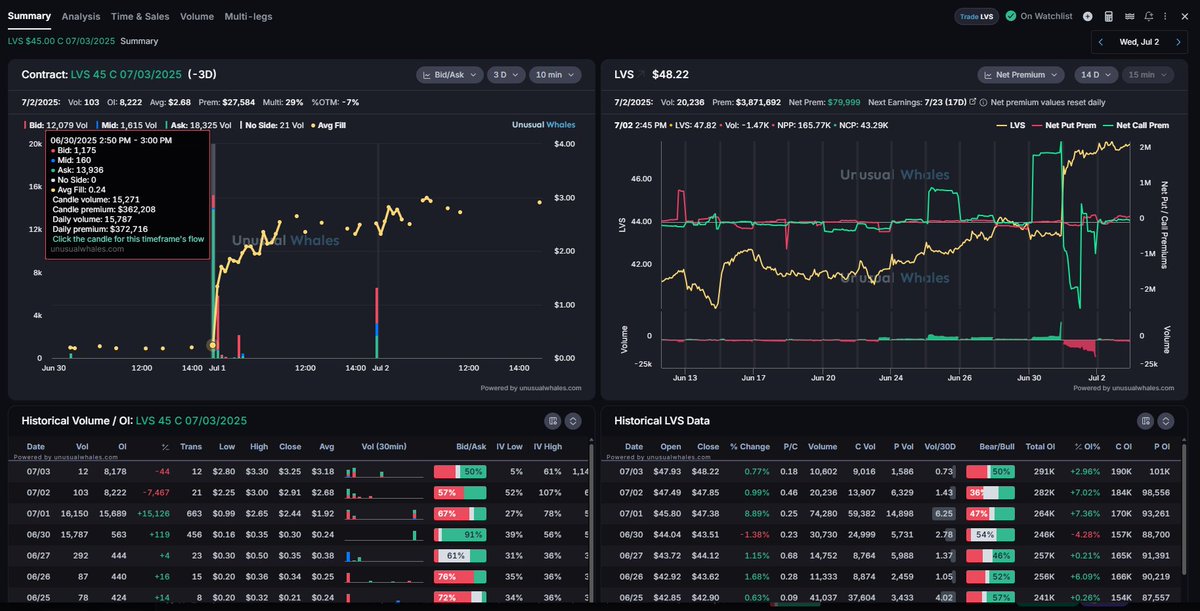

Unusual Flow of the Week: $LVS 7/3 45C @ $XXXX → $XXXX = XXXXX%

All flow is courtesy of @unusual_whales 🐳 and found on the platform.

We had an unusual trade come in on 6/30 for XXXXXX contracts at an average fill of $0.24, totaling $362K in premium on the 7/3 $LVS 45C. This was also the biggest spike in net call premium on $LVS over the last XX days. Looking at the raw flow feed, we can see this came in as "repeated hits with ascending fill", which just means our spot price was increasing — visible under the "Spot" column — going from $XXXX to $XXXX. We also saw IV% increasing. These are all clues that these were likely buys.

All of the open interest carried over into 7/1 as well. $LVS gapped up on 7/1 and finished +8.89% on news that Macau’s Gaming Inspection and Coordination Bureau reported gaming revenue growth soared XX% in June.

On 7/1, XXXXXX contracts traded, and on 7/2, XXXXX contracts were closed. We know for sure this whale closed about half of their position. With total volume matching the original whale's entry size, I’d make an educated guess that the whale closed XX% and passed the rest to another party — half the OI remained into the end of the week.

These contracts ran from an average of $XXXX to a high of $XXXX — a XXXXX% move. It looks like our whale exited around $XXXX for XXXXXX% and $XXXX for 945.83%.

XXXXXX engagements

Related Topics $362k $lvs las vegas sands corp stocks consumer cyclical